3 Factors Causing the 50% Drop in Solana (SOL) Price from All-Time Highs

Jakarta, Pintu News – Solana is one of the cryptocurrencies that has great potential, but has recently experienced a significant price drop. Solana’s price has dropped by almost 50% since reaching its highest price of $295 (IDR 4,819,350) on January 19. This price drop is also recorded as the largest monthly decline since November 2022, which coincided with the collapse of the FTX exchange.

Some of the technical and fundamental factors that influenced Solana’s price drop have caught the attention of many crypto market participants. Here are the three main reasons that led to the Solana price drop.

1. Decrease in Total Value Locked (TVL)

One of the main reasons behind Solana’s price drop is the decrease in Total Value Locked (TVL) in its ecosystem. TVL reflects the amount of assets locked in a decentralized application (dApp) on the blockchain. In January 2023, Solana’s TVL reached a record high of $10 billion. However, after reaching this figure, the TVL began to decline, and is currently only around $7.13 billion (IDR116,000,000,000).

This decline was mainly due to a sharp drop in major DeFi platforms such as Raydium, which recorded a 60% decline in just under a month. Other platforms such as Jupiter DEX and Kamino Lending also saw significant declines.

Data from DefiLlama shows that Solana’s on-chain transaction volume, which previously reached $97 billion (Rp1,586,010,000,000,000) in the second week of January, is now only around $7 billion (Rp114,310,000,000,000) per week. This decline reflects reduced trust in the Solana ecosystem, which has a direct impact on transaction activity and network usage.

Also Read: Ethereum (ETH) continues to slump, is there any hope of recovery? This is the analysis! (2/25/25)

2. Liquidity Shift to Ethereum (ETH) and Arbitrum

In addition to the drop in TVL, liquidity that was previously on the Solana network has also started to flow to other blockchains. In the last 30 days, more than $500 million has been moved by traders to other blockchains such as Ethereum , Arbitrum , and several other networks. This move indicates a significant shift in interest from users who were previously active on the Solana network.

Analysts observed that the fee burn rate at Solana also dropped to a low of just $177,000 in the past month. This suggests a decline in transaction activity and lower interest from traders. Crypto analyst Miles Deutscher stated that market participants are starting to feel “burned” after the events that affected Solana’s performance, and many are now choosing to switch to other networks that are considered more stable.

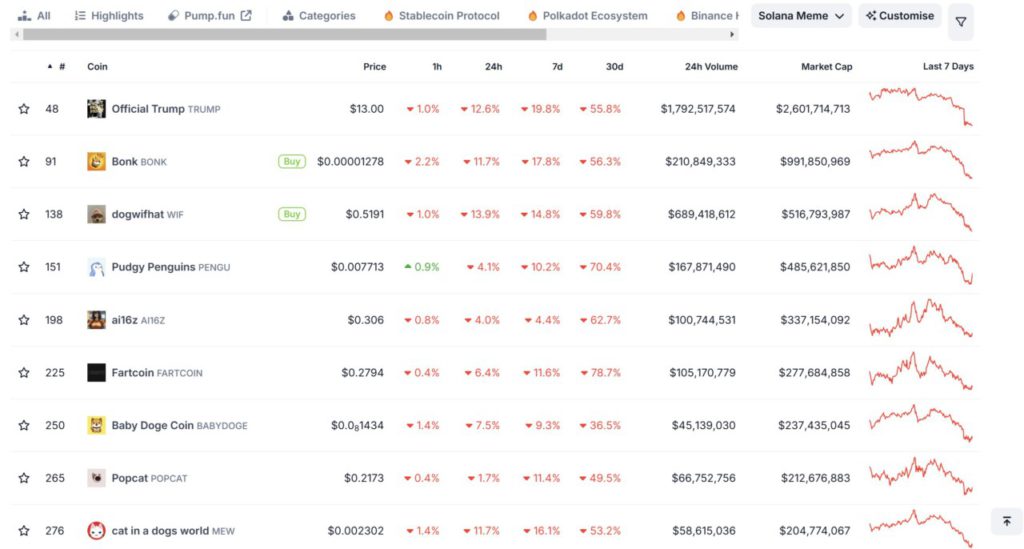

3. Solana-related Coin Meme Market Decline

Another phenomenon that has affected Solana’s price is the collapse of the meme coin market that boomed some time ago. At its peak, the market capitalization of meme coins related to Solana had reached $25 billion (Rp407,500,000,000,000,000) in December 2024. However, now the market value of the meme coin has plummeted to just $8.3 billion (IDR135 billion). Many of these meme tokens have experienced price drops of 80% to 90%.

While Solana is not a meme coin, the existence and volatility of the meme coin market has had some effect on the perception of Solana’s value. One such platform, Pump.fun, which launched around 7.5 million meme tokens, has generated $550 million in revenue, but most of this market value is now gone. These large fluctuations in the meme coin market also affected investor confidence in the Solana network and led to a further decline in the Solana price.

Conclusion

Solana’s (SOL) price drop of almost 50% from its highest peak was influenced by several technical and fundamental factors. A significant drop in Total Value Locked (TVL), liquidity migration to other blockchains, and the collapse of the Solana-related meme coin market are some of the main reasons behind the drop.

Nonetheless, Solana is still one of the blockchain projects that has great potential in the future, and these changes provide an important lesson for cryptocurrency market participants to always do their research before making investment decisions.

Also Read: What Currency Will Replace the US Dollar? Bitcoin is predicted to be one of them!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph.“3 Reasons Why Solana (SOL) Price Is Down 50% From Its All-Time High.” Accessed February 26, 2025.

- Featured Image: Euronews