Bitcoin Price Drops to $88,000 Today (2/26/25): BTC Enters Bear Market Territory!

Jakarta, Pintu News – The price of Bitcoin has experienced a significant decline since yesterday and today, February 26, 2025, fell to $88,000 level. This decline signals that Bitcoin has entered bear market territory, with a loss of more than 20% from the all-time high recorded just a month ago.

The continuous downward price movement, coupled with the massive increase in liquidation in the crypto market, has further worsened the market sentiment.

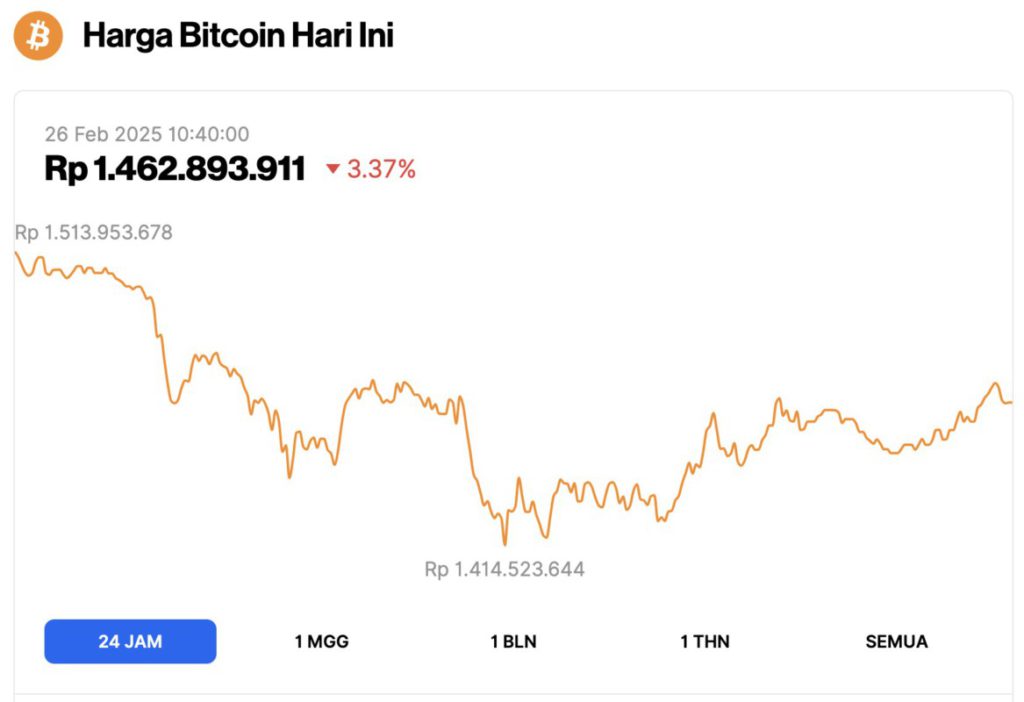

Bitcoin Price Drops 3.37% in 24 Hours

On February 26, 2025, Bitcoin (BTC) saw a decline of 3.37%, trading at $88,888, or approximately 1,462,893,911 IDR. Over the past 24 hours, Bitcoin’s price dropped from its peak of 1,513,953,678 IDR to a low of 1,414,523,644 IDR, reflecting a significant market correction.

This decrease in BTC’s price led to a 3.73% drop in Bitcoin’s market capitalization, now standing at $1.76 trillion. Despite the price decline, trading volume surged by 65% in the past 24 hours, reaching $84.43 billion, signaling a notable increase in market activity and transaction interest.

Also read: Top 5 Crypto Performers Today (2/26/25): Number 1 Altcoin Soars 31%!

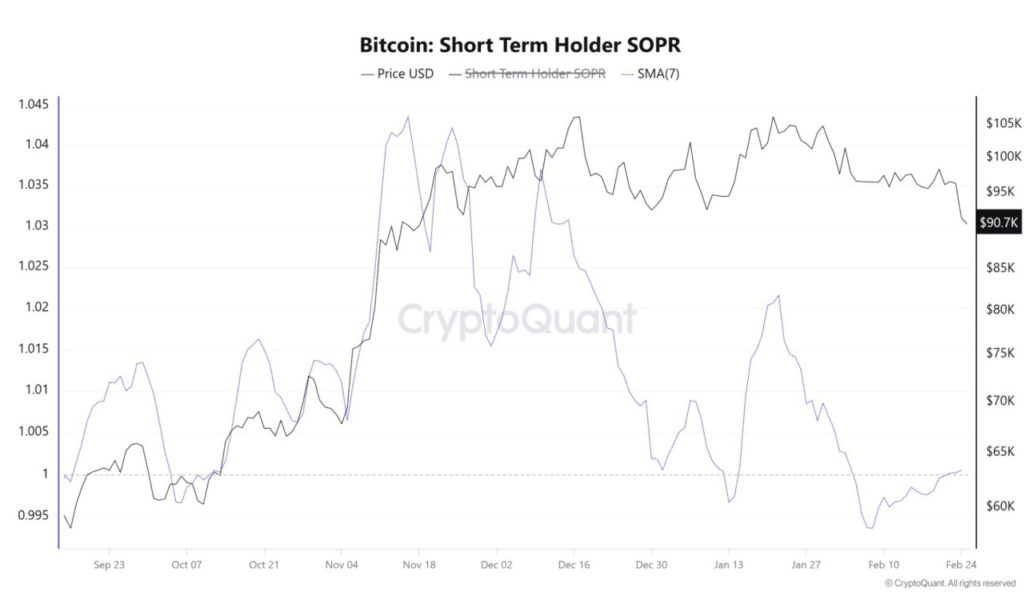

Bitcoin Investors Worry about Losses

Reporting from BeInCrypto (2/25/25), the Short-term holder (STH) Spent Output Profit Ratio (SOPR) indicator is struggling to cross the bullish limit of 1.0 again. When this indicator is above that level, it shows that STHs are still making profits and are willing to hold their assets.

However, the failure of this indicator to stay above 1.0 could signal increasing selling pressure. If SOPR remains below 1.0, more STHs are likely to sell, which could lead to further losses for Bitcoin investors.

This situation is quite worrying, as STHs are known for their fast trading behavior. When they start selling in large quantities, the price of Bitcoin can drop quickly.

SOPR’s inability to stay above the critical limit suggests that bearish sentiment may be on the rise, which could bring Bitcoin price down below $90,000 and extend the market decline.

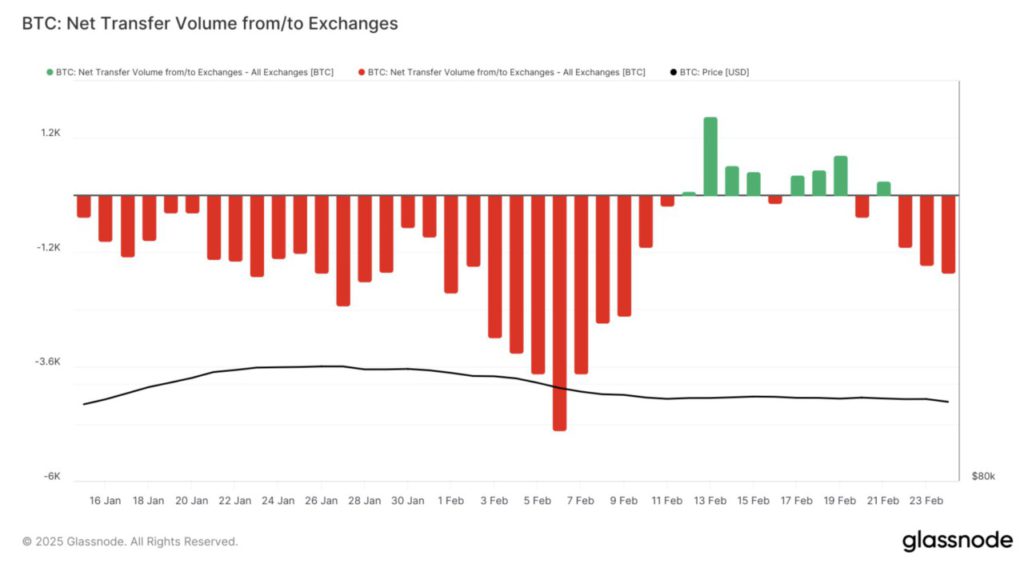

Despite Bitcoin experiencing a significant drop in the last 24 hours, net flows on exchanges show that no significant amount of BTC has left exchanges.

In the last 24 hours (2/25/25), exchanges only recorded an outflow of 157 BTC worth $14 million. This small outflow doesn’t match the fear-driven selling that usually occurs after a drastic drop like this.

The lack of large drawdowns suggests that STHs may be hesitant to sell despite the recent decline. This could signal that many investors are still holding their assets, waiting for a possible market reversal.

Also read: Pi Network Price Up 6% Today (2/26/25): Can PI Coin Reclaim the $2 Level?

Without a huge wave of selling, Bitcoin will probably find its way to recover as market conditions improve.

BTC Price Losses Enter Bear Market Territory

Meanwhile, Cointelegraph (2/25/25) reports that BTC/USD is getting closer to the $86,000 level. At its lowest level since November 13, Bitcoin is currently struggling to find support as wary traders observe the impact of the massive liquidation event.

Cross-crypto liquidations in the last 24 hours (2/25) reached nearly $1.6 billion, with crypto market sentiment quickly falling into the zone of “extreme fear.”

Bitcoin is now down 20% from its all-time high just a month ago, entering a technical bear market, as noted by financial and trading resource Barchart.

“A downward deviation below the Range Low of the ReAccumulation Range is now underway,” said renowned trader and analyst Rekt Capital.

Rekt Capital produced a weekly chart highlighting the key structures in BTC’s price movement since the end of the last macro bear market in late 2022.

Also read: The Impact of Trump’s Tariff Decision on the Market: Bitcoin Drops to Intraday Low

However, an X post in early February acknowledged some similar deviations, calling it a “huge bargaining opportunity.”

Analyzing possible market positions, another trader, TheKingfisher, predicts lower levels, approaching the previous high of $73,800 from March 2024.

“Long liquidation (bars to the LEFT of the line) is concentrated in the 68k-77k area. Short liquidation (bars on the RIGHT) increased significantly in the 103k-138k area,” he commented on the related chart.

“Imbalance favors liquidation over price. Risks: Large set of liquidation longs below price could act as support, but if it loses this support it could trigger a cascade. Target: shorts could head towards 103k area.”

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin’s Price Plummets Below $89,000, Short-Term Holder Selling Pressure May Spike. Accessed on February 26, 2025

- Cointelegraph. Bitcoin enters ‘technical bear market’ as BTC price drops 20% from all-time high. Accessed on February 26, 2025