Bitcoin Price Slumps, Internal and External Influences on Bitcoin Price (2/27/25)

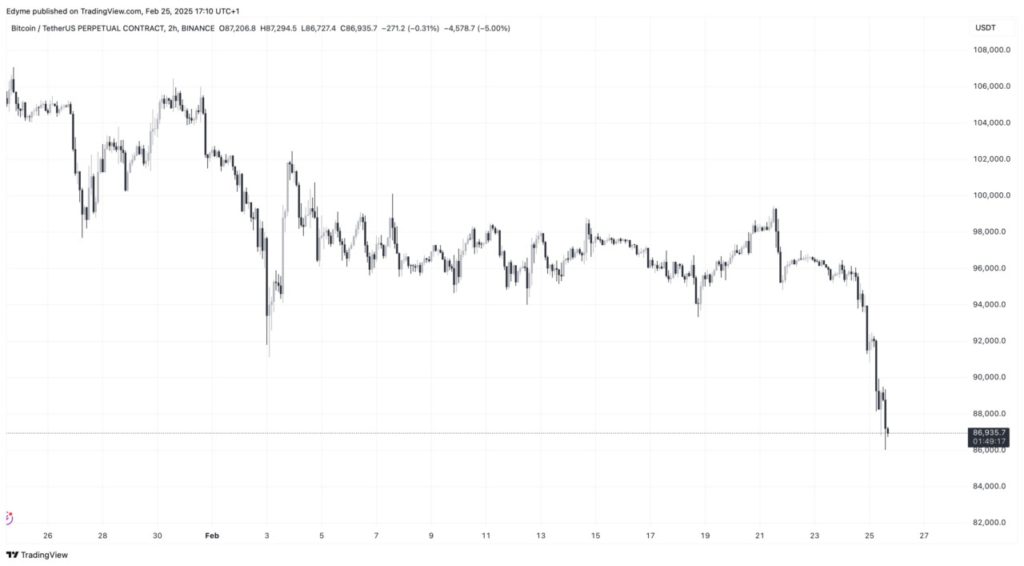

Jakarta, Pintu News – Bitcoin has recently experienced a significant price drop, falling below $90,000 and hitting a low today of $87,000. This sharp decline distances the cryptocurrency from January’s record high of over $109,000.

Internal and External Influences on Bitcoin

This decline in Bitcoin (BTC) price has been affected by a combination of internal and external pressures. Internally, hacking incidents related to Ethereum have disrupted the crypto market at large. Meanwhile, externally, continued inflation concerns and the Trump administration’s reintroduced tariff policies have put pressure on risky assets, including Bitcoin (BTC).

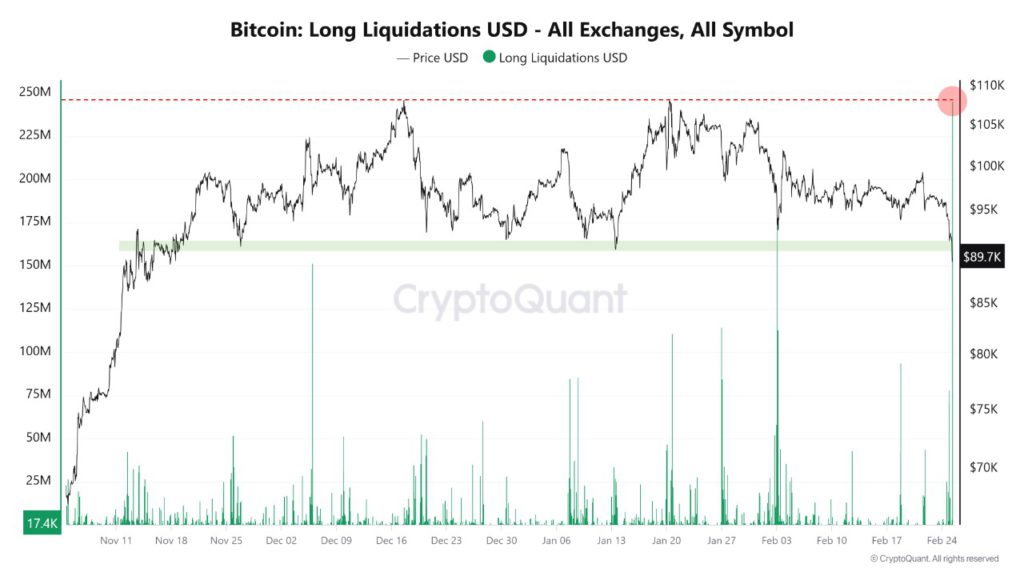

This pressure has caused Bitcoin (BTC) to fall below the critical $90,000 support level. Mac analysts highlighted two key elements that could influence Bitcoin’s (BTC) direction going forward. First, the recent liquidation of long positions reached its highest level since November, with $245 million of long positions erased. These massive liquidations often reduce the depth of the market, creating conditions that may allow for a price rebound.

Also Read: Bybit Recovers $600 Million Ethereum (ETH) After $1.5 Billion Crypto Robbery

Critical Support Levels and Stabilization Potential

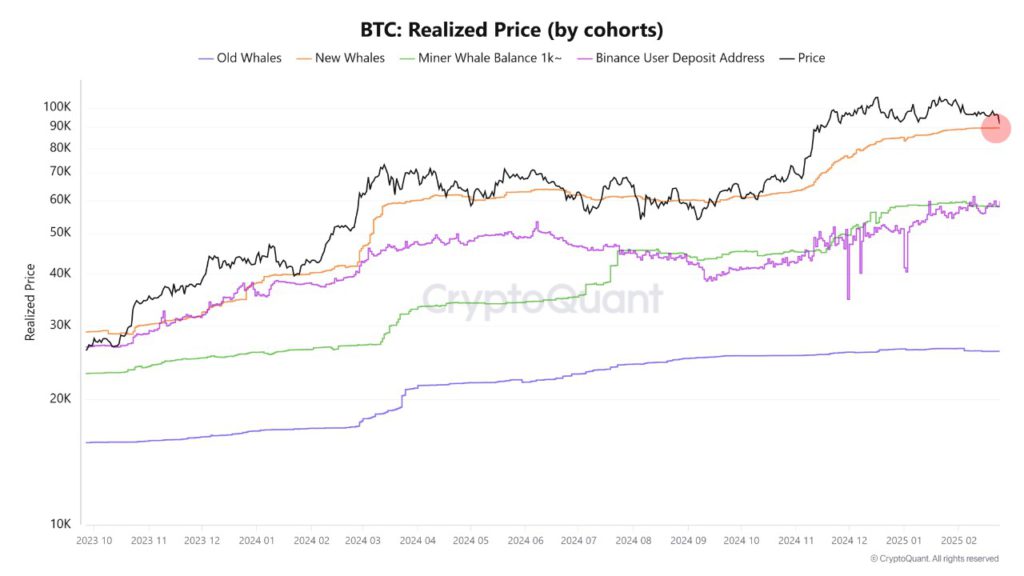

Second, the average entry price for large investors holding Bitcoin (BTC) for less than six months is around $89,600. This psychological support level could help stabilize the market if such large investors refrain from further selling. However, despite this potential support, the outlook is far from certain.

Mac warns that if the support level fails to hold, further declines could occur. In this scenario, he recommends proactive risk management strategies, including short positions in futures or partial liquidation of holdings.

Technical Outlook on Bitcoin

With Bitcoin (BTC) currently trading at $87,132, it is clear that the asset has breached the $89,600 support highlighted by Mac. Although Mac suggests that this breach could lead to further declines, another analyst, RektCapital, offers a more optimistic technical view.

According to RektCapital, the recent Bitcoin (BTC) price drop may only be a temporary setback. The analyst highlights the potential downside aberrations that often precede significant price recoveries, suggesting that a rebound may already be taking shape.

Conclusion and Next Steps

Despite significant internal and external pressures, there is still a possibility for Bitcoin (BTC) price recovery if some support conditions can be maintained. Investors and traders should stay alert to the current market dynamics and be ready to adjust their strategies according to changing market conditions.

Also Read: Uniswap Successful, SEC Case Terminated: Will UNI Surge? (2/27/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Faces Internal and External Pressure, Is a Rally Still Possible? Accessed on February 26, 2025

- Featured Image: Generated by AI