Bitcoin ETFs Record Highest Expenditures, Is this the End of the Bull Run?

Jakarta, Pintu News – The Bitcoin market in the United States experienced its highest net outflow day ever, reaching $937.78 million, as the price of Bitcoin fell below $90,000. This triggered negative sentiment among investors amid heightened macroeconomic concerns.

Check out the full news below!

Main Causes of Mass Expulsion

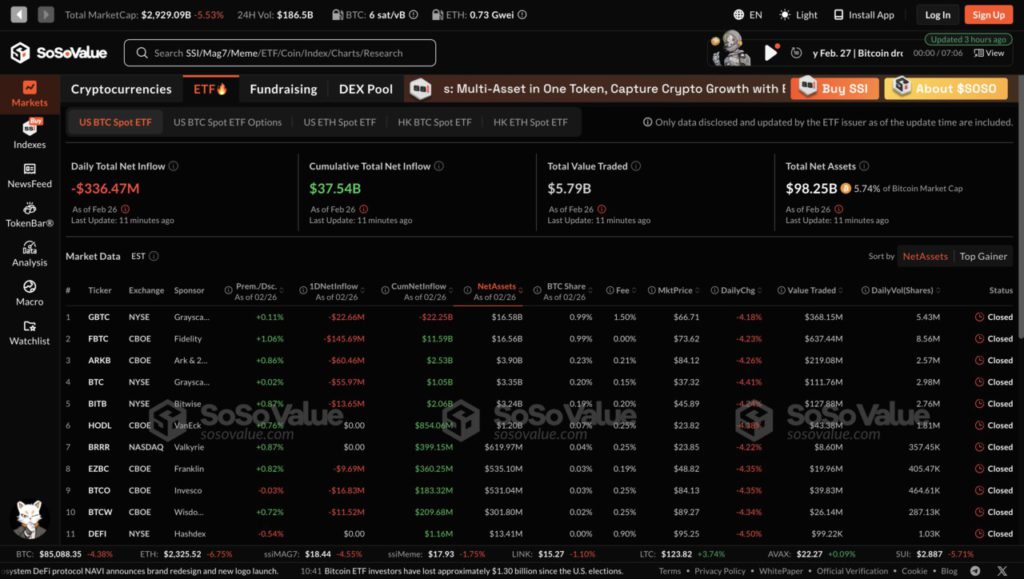

On February 25, funds listed in 12 spot Bitcoin ETFs recorded a net outflow of $937.78 million, a record high since the product’s launch.

Fidelity’s FBTC was the leader with $344.65 million in expenses, followed by BlackRock’s IBIT, which recorded a net expense of $164.37 million.

Despite the heavy selling, the spot Bitcoin ETF’s daily trading volume increased by almost 167% from the previous day, reaching $7.74 billion. Since its launch, the ETF has still recorded total net inflows of $38.08 billion.

Read also: ARK Invest Invests in Coinbase as Bitcoin Price Falls, What’s the Strategy?

Market Factors that Drive Sales

Bitcoin’s price drop below the critical $90,000 level was one of the main triggers for this sell-off. Concerns about Donald Trump’s proposed tariffs on goods from Canada and Mexico, which would take effect in March, also exacerbated the situation.

If 25% tariffs on US imports are imposed, this could lead to higher inflation and slower economic growth, which would put pressure on the Federal Reserve to respond.

Although the Fed has stated that it will only cut rates when inflation is close to its 2% target, recent data shows that inflation is moving in the opposite direction.

Read also: Pi Network (PI) Surges 75% Today (2/27/25), Can It Break $4 in March?

On-Chain Data Shows Selling Pressure Increasing

Data from Sentiment shows that more Bitcoin (BTC) is moving to exchanges, while holdings by ‘whales’ in non-stock wallets are declining.

This change suggests that large investors who previously accumulated Bitcoin are now transferring their holdings to exchanges, which often signals selling pressure.

In addition, a key metric, namely the supply of Bitcoin held by funds, also decreased, suggesting that institutional investors are reducing their Bitcoin holdings.

This aligns with net outflows on spot Bitcoin ETFs, which have experienced net outflows on 12 of the last 16 trading days, totalling around $2.41 billion since the beginning of February.

Conclusion

Despite the market decline, analyst Matt Mena of 21Shares argues that this is only a temporary adjustment, not the cycle’s end. Mena emphasized that this is a strategic entry point for investors who were hesitant to enter the market after the election. “Historically, crypto markets have punished those who hesitate during key downturns. The window for accumulation may not last long,” Mena concluded.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News. Bitcoin ETFs Log Highest Net Outflow Day Totaling $937.78M as BTC Drops Below $90K. Accessed on February 27, 2025

- Featured Image: Bitcoin News