Will the White House Crypto Summit Take Bitcoin (BTC) to New Heights?

Jakarta, Pintu News – Towards the end of the week, Bitcoin showed strong signs of recovery, fueled by anticipation of a key meeting at the White House that will discuss stablecoin regulation and Bitcoin (BTC) reserves. The event has sparked intense market speculation, with market participants awaiting policy clarity that could have a significant impact on the price of Bitcoin (BTC) and other cryptocurrencies.

Stablecoin Regulation and Bitcoin (BTC) Reserves

Although full details about the summit agenda are still not widely known, two of the main themes that will be discussed are the regulation of stablecoins and the possible establishment of a Bitcoin (BTC) reserve by the United States. This discussion is particularly important as stablecoins play a crucial role in the crypto ecosystem, providing a bridge between traditional currencies and cryptocurrencies with more guaranteed stability.

A possible announcement about Bitcoin (BTC) reserves by the US government is also attracting great attention. This could be a big step towards legitimizing Bitcoin (BTC) as a financial asset and possibly influencing monetary policy in the future. Investors and analysts alike are looking forward to the impact of this policy on global markets.

Also Read: The Future of Pi Coin (PI) in the Cryptocurrency World: Will PI Capi $5? Here’s the Technical Analysis!

Market Speculation Ahead of Summit

Ahead of the summit, the price of Bitcoin (BTC) has shown high volatility, an indication that the market is preparing for a range of possible outcomes from the meeting. These price fluctuations suggest that investors are trying to position themselves in anticipation of news from the summit.

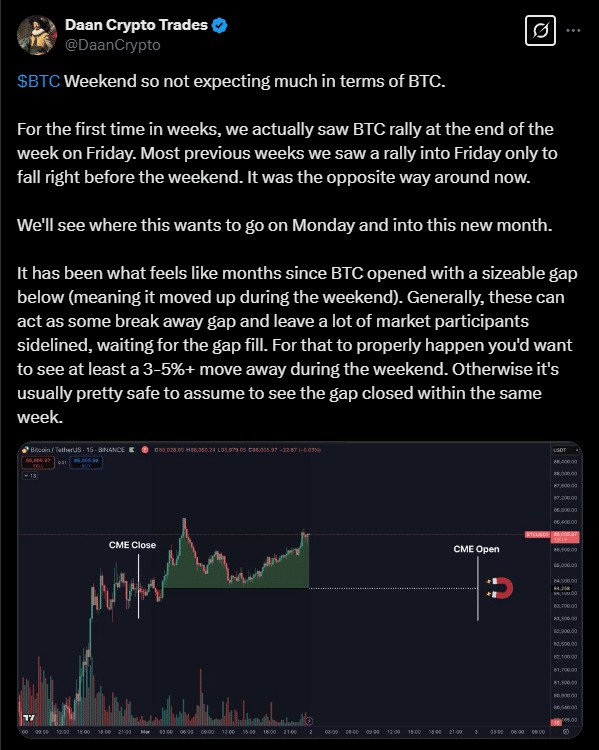

The formation of Bitcoin (BTC) price gaps over the weekend also adds complexity to market analysis. These gaps are often interpreted as important indicators by traders to gauge market sentiment and potential further price movements. This adds uncertainty but also opens up opportunities for careful traders.

Bitcoin (BTC) Outlook Post Summit

The two main scenarios faced by Bitcoin (BTC) traders are the possibility of a price break above $87,000, which is a key resistance level that has capped the recent price rise. If the current momentum holds, the chances of reaching and even surpassing that mark become more likely.

However, if the summit does not produce the expected results or results in policies that are seen negatively by the market, there is a significant downside risk. Market participants should be prepared for both possibilities and adjust their strategies according to the results that will be announced.

Conclusion

This important meeting at the White House will not only determine the future direction of crypto regulation in the United States but could also be an important catalyst for the price movements of Bitcoin (BTC) and other crypto assets. Market participants are now waiting in anticipation, ready to respond to the outcome of a meeting that could well determine market trends for months to come.

Also Read: Pi Network Price Plunges 18% After Legal Warning from Vietnam (3/2/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin’s recovery: Is the White House crypto summit driving BTC’s ahead?. Accessed on March 3, 2025

- Featured Image: PYMNTS