Bitcoin Falls Below $92,000, Bitcoin’s Short-Term Recovery (3/2/25)

Jakarta, Pintu News – Bitcoin has recently experienced a significant drop, raising concerns among short-term holders. With the current value well below short-term holders’ pain point of $92,000, many are wondering if this will trigger a wave of panic selling.

Short-Term Trader

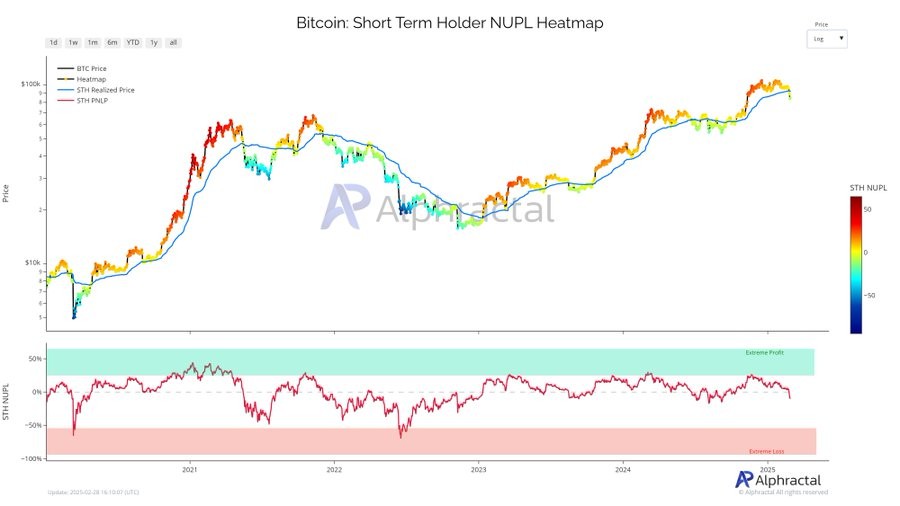

The Short-Term Holder Net Unrealized Profit/Loss (STH NUPL) indicator shows whether investors who bought Bitcoin (BTC) in the last 155 days are in a profit or loss position. Currently, Bitcoin (BTC) is well below the psychological price of $92,000, which marks a significant change in market sentiment.

This drop raises questions about the possible next actions of short-term holders. When the price of Bitcoin (BTC) dropped below $80,000, many felt anxious. However, the price recovery in the last few hours suggests that there may still be hope. The current price at $85,000 suggests a recovery, but it remains to be seen if this will continue.

Also Read: The Future of Pi Coin (PI) in the Cryptocurrency World: Will PI Capi $5? Here’s the Technical Analysis!

Bitcoin’s Short-Term Recovery

After experiencing a drastic drop, Bitcoin (BTC) managed to recover some of its value. Currently, Bitcoin (BTC) is trading at $85,000, indicating an increased accumulation post-sale. The On-Balance Volume (OBV) indicator is also showing an increase, which could be a sign that investors are starting to accumulate their assets again.

This recovery is important to restore investor confidence, especially for short-term holders. If Bitcoin (BTC) can continue to maintain this momentum and return to the $92,000 level, it could greatly change the current market dynamics. However, it remains to be seen if the OBV can continue to rise, which will be key for long-term stability.

Prospects for Short-Term Holders

The next move for Bitcoin (BTC) largely depends on its ability to break and sustain levels above $92,000. If successful, this would restore confidence among short-term holders and possibly trigger a new wave of accumulation. The Relative Strength Index (RSI) indicator is currently hovering around 55, suggesting there is still room for upside if buying pressure continues.

However, if Bitcoin (BTC) fails to break $92,000, it could reinforce the short-term downtrend and encourage more selling. Failure to overcome this level could see Bitcoin (BTC) price return to support in the range of $82,000 to $84,000 in the coming sessions.

Conclusion

By all current indicators, the Bitcoin (BTC) market is at a critical point. The recovery from the latest decline provides some hope, but short-term holders should probably still prepare for possible further fluctuations. Investment decisions should be based on an in-depth analysis of market trends and available technical indicators.

Also Read: Pi Network Price Plunges 18% After Legal Warning from Vietnam (3/2/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin drops below $1k, will holders panic sell?. Accessed on March 3, 2025

- Featured Image: Generated by AI