XRP Faces Hurdle at $2.4: Can Bulls Break Through? (4/3/25)

Jakarta, Pintu News – Ripple has shown significant strength compared to Ethereum , which is the altcoin with the largest market capitalization. Data from CoinMarketCap shows that in the past 24 hours, Ripple (XRP) has seen a gain of 5.57%, while Ethereum (ETH) has only gained 2.25%. Despite facing a bearish structure, Ripple (XRP) is still showing recovery potential after retesting support at $2.

US Post-Election Performance Comparison

Since the United States presidential election, Ethereum (ETH) has erased all of its gains, while Ripple (XRP) still recorded a gain of 351% from its low point on November 4. This shows the resilience of Ripple (XRP) in the face of unfavorable market fluctuations.

Nonetheless, Ripple (XRP) still faces a tough challenge to maintain its positive momentum. The outperformance of Ripple (XRP) over Ethereum (ETH) in recent months has caught the attention of investors and market analysts. The significant rise in Ripple (XRP) compared to Ethereum (ETH) suggests potential that may not have been fully tapped.

Also Read: The Future of Pi Coin (PI) in the Cryptocurrency World: Will PI Capi $5? Here’s the Technical Analysis!

Technical Analysis and Key Levels

Ripple (XRP) has formed several trading ranges in recent months, with each range being shorter than the previous. The latest range formed has reversed the bullish movement and dropped below the low of the range, which is at the 78.6% Fibonacci retracement level of the rally that peaked at $3.4.

Although the price has retracement almost all the way up from the rally, the Accumulation/Distribution (A/D) indicator continues to show an uptrend. This indicates that accumulation continues despite the price retracement. The lack of selling pressure suggests that Ripple’s (XRP) recovery could be quick.

Prediction of Future Price Movements

The bearish market structure and the importance of the $2.3 resistance level make the possibility of a price increase in the short term seem unlikely. Although the Money Flow Index (MFI) indicator is at oversold levels suggesting a potential price bounce, this move may struggle to push the price past $2.3.

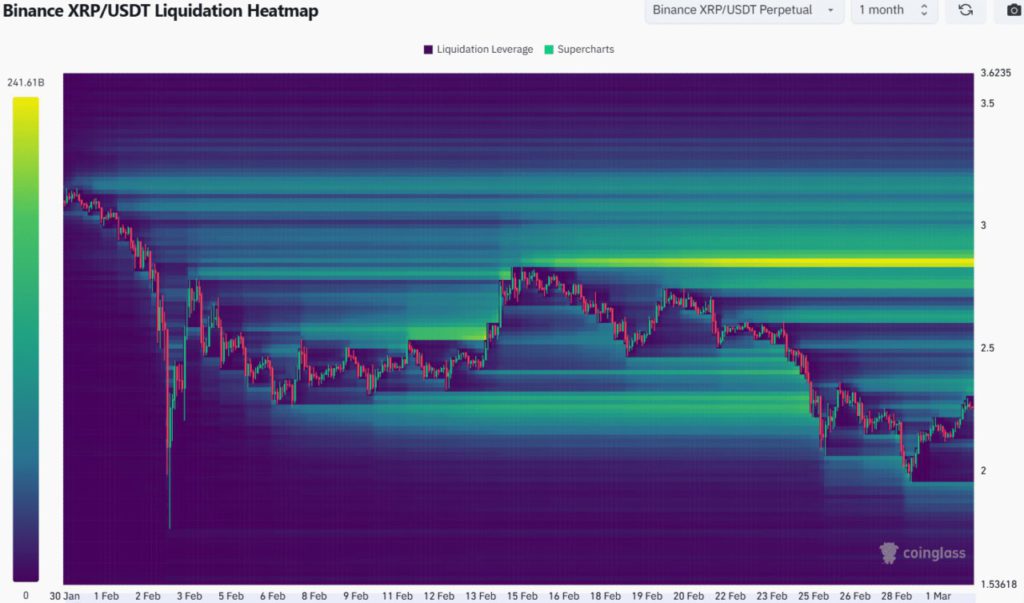

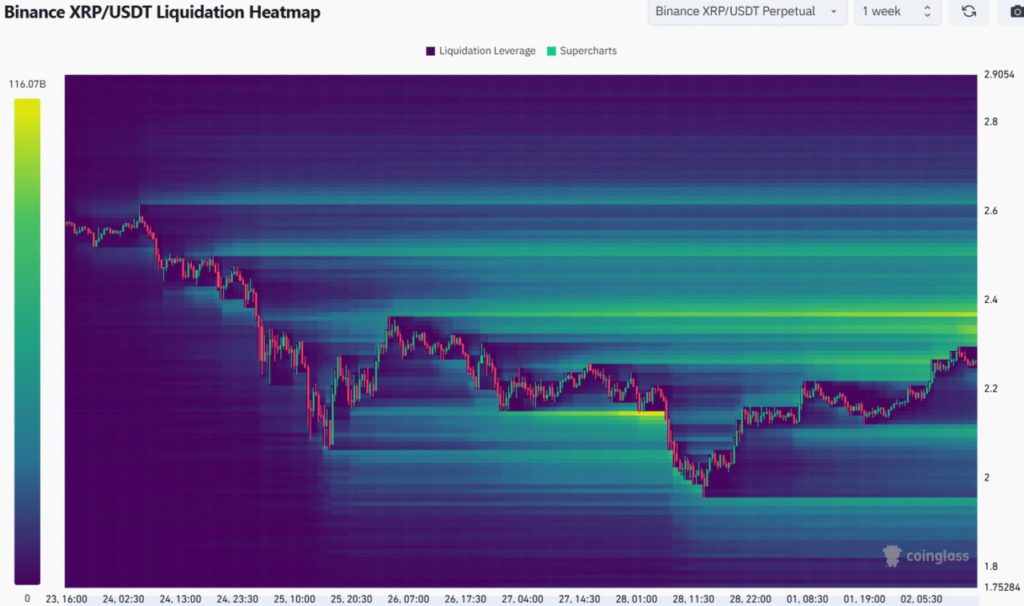

The one-month liquidation heatmap shows a large liquidity pocket at $2.84-$2.88, which is the lower high from mid-February after the retracement of the bullish range breakout. The $2.36 and $2.62 levels are also important magnetic zones that could attract prices.

Conclusion

Considering the bearish market structure and technical indicators showing low selling pressure, Ripple (XRP) may find it difficult to break the key resistance at $2.4 in the near term. However, the potential for a short-term price bounce still exists, which could provide opportunities for alert traders.

Also Read: Pi Network Price Plunges 18% After Legal Warning from Vietnam (3/2/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. XRP faces resistance at $2.4, will bulls overcome the barrier?. Accessed on March 4, 2025

- Featured Image: Generated by AI