Bitcoin Holds Steady at $87,400 Today (5/3/25) – Is a Big Move Coming for BTC?

Jakarta, Pintu News – Bitcoin price has been experiencing high volatility since last week. After plummeting from almost $100,000 to $78,200, BTC briefly surged back to $95,000 on Monday (3/3/25), before finally dropping again to $87,400 today (5/3/25).

A crypto analyst predicted that Bitcoin price will keep moving in a wide range between $70,000 and $90,000 for a while, as market uncertainty remains high.

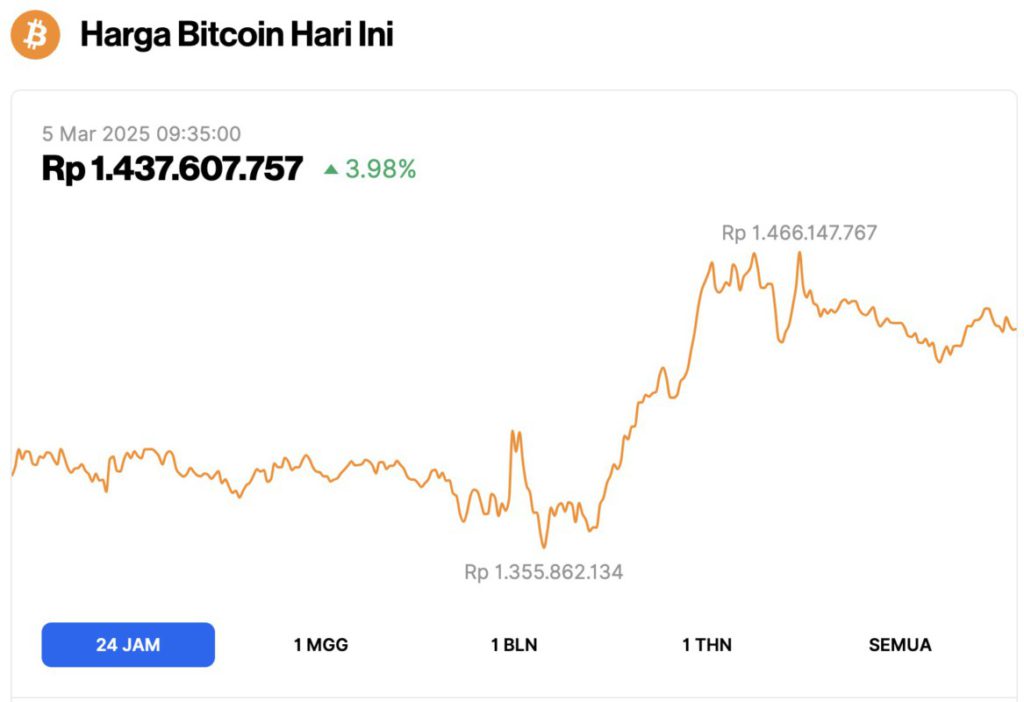

Bitcoin Price Up 3.98% in 24 Hours

On March 5, 2025, Bitcoin (BTC) was trading at $87,485, equivalent to 1,437,607,757 IDR, marking a 3.98% increase in the past 24 hours. During this period, BTC hit a low of 1,355,862,134 IDR before surging toward its daily high of 1,466,147,767 IDR.

According to CoinMarketCap, Bitcoin’s market capitalization has now risen to $1.73 trillion, with trading volume in the last 24 hours falling 13% to $61.83 billion.

Read also: 3 Latest Crypto Airdrops in March 2025!

Bitcoin Price Predicted to Stay in the $70K-$90K Range for a While

Bitcoin (BTC) and other crypto assets have many potential catalysts in the near future. Rumors are circulating that Donald Trump will use the crypto summit to propose the elimination of capital gains tax for US-origin coins.

In addition, he also hinted that the United States will establish a strategic crypto reserve. Meanwhile, the SEC has dropped various lawsuits against major companies such as Uniswap and Coinbase, giving a positive boost to the crypto industry.

In a post on X, Alphractal analysts predict that Bitcoin price will stay in the range of $70,000 to $90,000 for the time being.

This prediction is based on metrics such as open interest, number of trades, and purchase volume, which are currently within these ranges. He also predicts that there will be massive liquidation before Bitcoin experiences a more pronounced breakout.

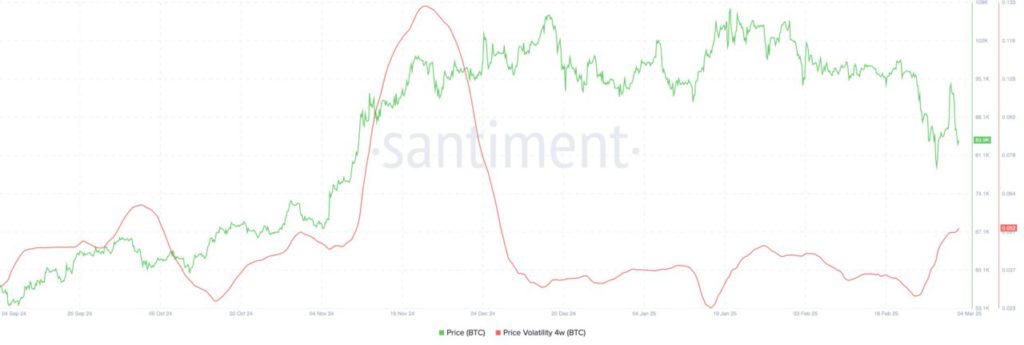

This prediction comes amid a surge in Bitcoin’s volatility. In the last ten days, Bitcoin’s average volatility has more than doubled.

Santiment data shows that Bitcoin’s volatility in a four-week period has surged to 0.052, the highest level since December 8 last year, after previously hitting a low of 0.027 last month.

The main factor behind this volatility is the trade war between the United States and its major trading partners, which impacts over $2.2 trillion worth of trade per year. Currently, the US has implemented a 25% tariff on imported goods from Canada and Mexico, which risks slowing economic growth and increasing inflation.

Read also: This Trader Cashed in $7 Million Overnight – Here’s What Happened!

Bitcoin Price Analysis: Death Cross Risk Emerges

Bitcoin (BTC) has experienced high volatility in recent days, after plummeting below the crucial support level of $89,000. This level is the neckline of a double-top pattern at $108,200, which has now turned into a strong resistance area.

Quoting Coingape’s report, Bitcoin has now fallen below the 50-day and 200-day Weighted Moving Averages (WMA) lines. With the distance between the two narrowing, there is a risk of a death cross forming – a technical signal indicating a potential further bearish trend.

In addition, the price of BTC has dropped below the 38.2% Fibonacci Retracement level. If Bitcoin drops further to break last week’s low of $78,200 (which is also the 50% Fibonacci Retracement level), then the potential for a further drop towards the 61.8% level of $71,500 is greater.

The level is still within the $70,000-$90,000 range, as predicted by Alphractal analysts.

On the other hand, if BTC manages to surge above the $95,000 resistance, then bullish momentum could be re-established, opening up the opportunity for a rise towards $100,000 or even an all-time record high price.

Potential Catalysts for Bitcoin: What Could Push BTC Up?

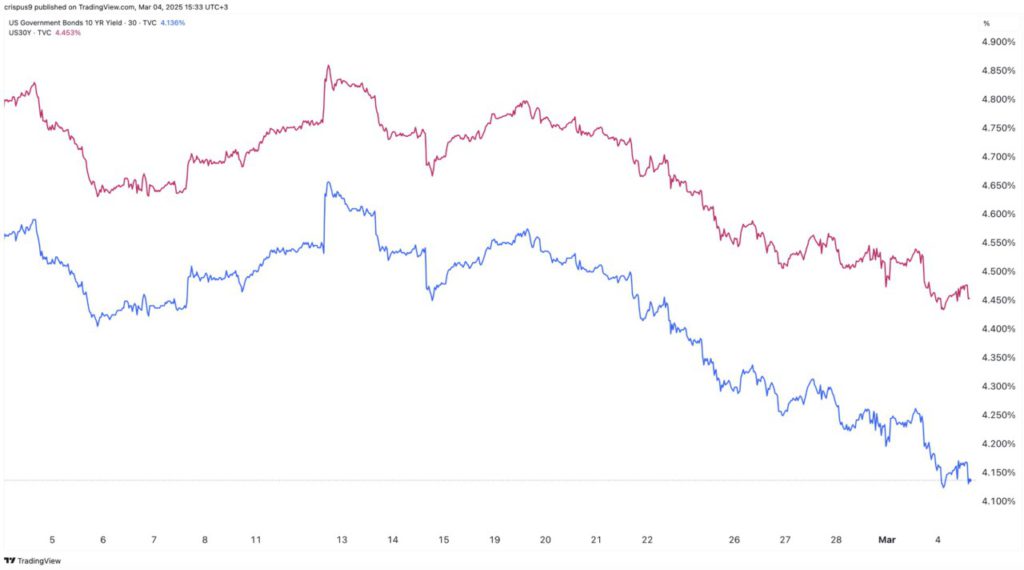

Bitcoin (BTC) has a number of positive catalysts that could potentially push its price higher in the near future. On the macroeconomic front, the chances of the Federal Reserve (Fed) cutting interest rates are growing.

Read also: Bitcoin Investments Surge as Metaplanet Inc. Expands BTC Holdings by $13.4 Million!

One indicator is that US bond yields continue to decline, with both the 10-year and 30-year bond yields reaching their lowest levels since December 6. If the Fed does cut interest rates, then liquidity in the market will increase, which could be a price hike trigger for Bitcoin.

In addition, BTC could also potentially be boosted by the US government’s plan to establish a Strategic Bitcoin Reserve (SBR). If this reserve is realized, the US government and other countries could start buying Bitcoin in bulk, which would significantly increase demand and push prices higher.

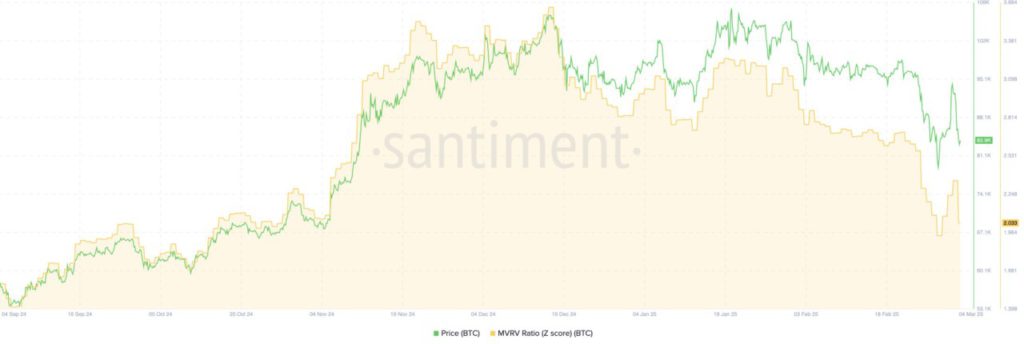

In terms of technical analysis, the MVRV-Z Score indicator shows that Bitcoin is currently undervalued, with the value dropping to level 2.

The MVRV-Z Score is an indicator that compares Bitcoin’s market value (Market Value) to its fair value (Realized Value), then calculates a Z-score to determine whether Bitcoin is overvalued or undervalued.

With a score of 2, Bitcoin is in the undervalued zone, which is often considered a buying opportunity for large investors.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Here’s Why Bitcoin Price Will Be Stuck Between $70K and $90K for a While. Accessed on March 5, 2025