Bitcoin (BTC) Strengthens Again, What Will Happen Next? (7/3/25)

Jakarta, Pintu News – Bitcoin has shown a significant recovery after its decline, with the current price sitting at $87,992, an increase of 6.9% in the last 24 hours. The dynamics of changing ownership from long-term holders to short-term holders has been a major highlight in this recent price movement.

Short Term Holders vs Long Term Holders: Market Equilibrium

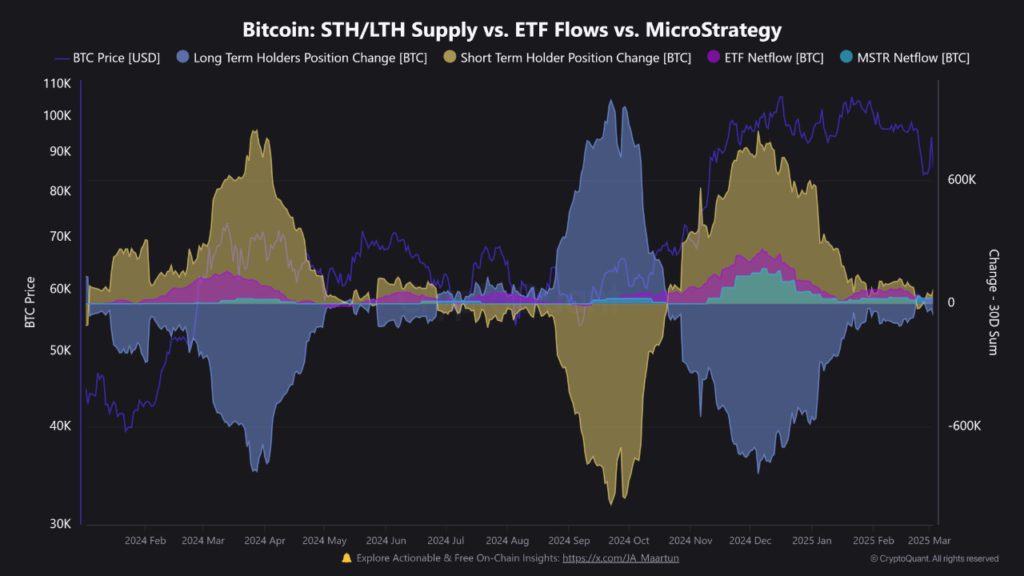

According to XBTManager, the recent highs of Bitcoin (BTC) have triggered an increase in supply by short-term holders (STH), while supply from long-term holders (LTH) has decreased. This change usually signals a market shift, where long-term holders start selling their assets while short-term traders accumulate them.

This dynamic plays an important role in determining peak price levels, as increased activity from short-term holders indicates higher speculative interest. Analyzing who is buying and selling Bitcoin (BTC) is crucial to identifying market trends. When long-term holders sell their Bitcoin (BTC), the supply moves into the hands of short-term traders who often react more quickly to price fluctuations.

Also Read: The Burning of 20 Million SHIBs: Will Shiba Inu Prices Skyrocket? (7/3/25)

Institutional Behavior and its Impact on Markets

In addition, institutional and ETF buyers continued to accumulate Bitcoin (BTC), behaving similar to short-term holders during this phase. MicroStrategy (MSTR), a large corporate Bitcoin (BTC) investor, also followed the retail buying pattern. Although institutional inflows support Bitcoin (BTC) price, XBTManager warns that a prolonged consolidation period is possible due to liquidity demand.

Analysis suggests that once STH starts selling and LTH starts accumulating again, the market will probably stabilize, creating a more favorable environment for long positions. This signals that Bitcoin (BTC) may be in a withdrawal phase after reaching the recent ATH, leading to a potential price consolidation period.

Bitcoin (BTC) Future Outlook and Predictions

Although Bitcoin’s (BTC) supply shift is showing a cooling phase, market participants are keeping an eye out for signs of a potential trend reversal. A report from CryptoQuant highlights that real spot demand has declined, meaning that despite recent price gains, sustained upward momentum may be difficult unless demand returns.

IntoTheBlock recently revealed a spike in active Bitcoin (BTC) addresses following last week’s price drop. This increase suggests heightened on-chain activity, often seen in periods of market transition. Whether this signals a renewed accumulation phase or continued volatility remains to be seen.

Conclusion: The Future of Bitcoin (BTC) in Hand

For now, supply trends, ETF inflows, and liquidity conditions are worth monitoring to assess the next move of Bitcoin (BTC). If long-term holders re-enter the market and demand recovers, Bitcoin (BTC) may see renewed upward momentum.

Also Read: Litecoin (LTC) Hit a Record High, Will the Price Surge? (7/3/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Short-Term Holders Dominate as Bitcoin Rebounds, What’s Next. Accessed on March 6, 2025

- Featured Image: Generated by AI