Ethereum Price Crashes 6% Today (10/3/25): What Happened?

Jakarta, Pintu News – Ethereum came under intense selling pressure once again on March 10, 2025, tumbling 6% in the past 24 hours as market sentiment turned increasingly bearish.

This latest decline has pushed ETH closer to critical support levels, raising concerns among investors and traders. The broader bearish sentiment is being fueled by macroeconomic uncertainties, including the impact of the US Non-Farm Payroll report and mounting outflows from Ethereum ETFs.

With selling pressure still dominating the market, the big question remains—will ETH extend its losses, or is a rebound on the horizon?

Ethereum Price Drops 6.32% in 24 Hours

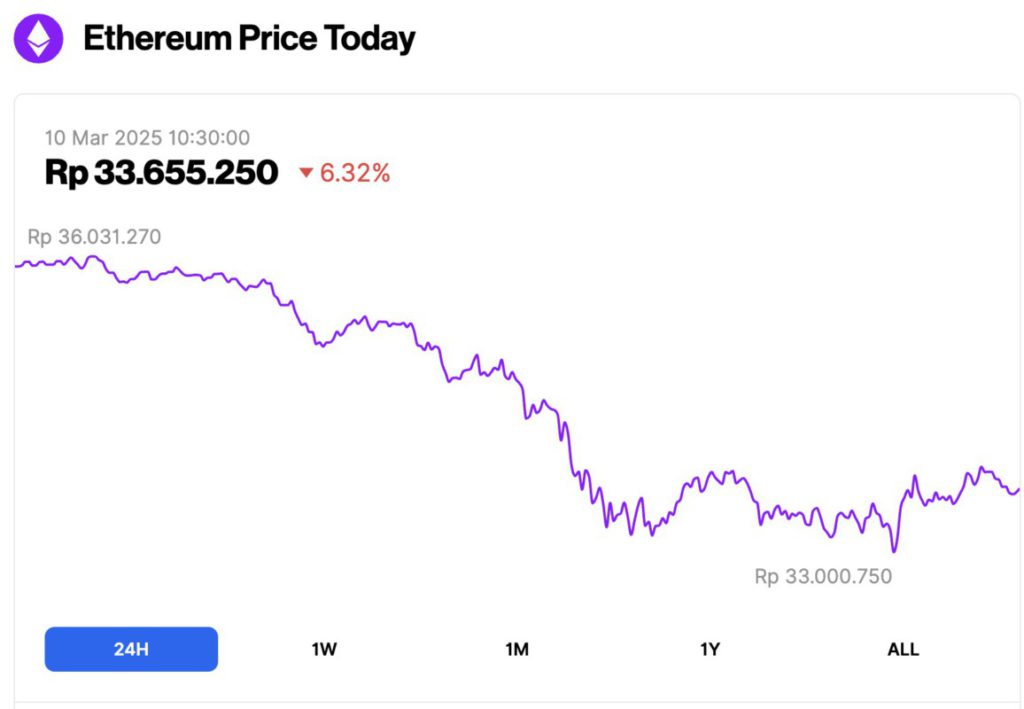

On March 10, 2025, Ethereum (ETH) saw a sharp decline, plunging 6.32% in the past 24 hours to trade around $2,056 (33,655,250 IDR). During this period, ETH briefly touched a high of 36,031,270 IDR before slipping to a low of 33,000,750 IDR, reflecting the intense selling pressure in the market.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $248.36 billion, with daily trading volume rising 103% to $20.1 billion in the last 24 hours.

Read also: These 5 Solana Meme Coins Are Making Waves in March 2025!

Ethereum (ETH) Price Falls Below $2,000 After US NFP Report Triggers Bearish Sentiment

Reporting from Coingape (10/3/25), Ethereum (ETH) experienced a sharp decline over the weekend, after the highly anticipated White House Crypto Summit failed to push market sentiment in a positive direction.

Instead, the latest US Non-Farm Payroll (NFP) report dominated investors’ views, with data showing a rise in unemployment and rising inflationary pressures.

As a result, the price of ETH plummeted below the psychological level of $2,000, even touching $1,998 on Binance on March 9, recording an 8% daily decline.

This correction exceeds Bitcoin’s decline of 4% over the same period, signaling that the bearish pressure on the ETH market is stronger than other crypto assets.

Selling pressure intensified as the market was concerned about the possibility of further monetary policy tightening by the Federal Reserve, following rising inflation indicators.

With investors now eagerly awaiting the latest Consumer Price Index (CPI) report, ETH prices will likely struggle to recover significantly, barring a more favorable macroeconomic shift.

Baca juga: Massive Token Unlocks Ahead! 5 Crypto to Watch in March 2025!

BlackRock ETF Leads $11 Million Outflows After US NFP Data: Ethereum Selling Pressure Increases

Amid rising unemployment and increasing inflationary pressures, institutional investors started shifting capital from crypto markets to fixed-income assets, leading to a rise in bond yields in global markets. This shift in sentiment resulted in massive outflows from Ethereum ETFs.

According to SosoValue, an on-chain analytics provider, the Ethereum ETF recorded outflows of $23 million last Friday, right after the US Non-Farm Payroll (NFP) report was released.

One of the largest liquidations was BlackRock’s iShares Ethereum ETF, which saw $11 million withdrawn in a day, making it the largest outflow among other Ethereum ETFs.

This rapid outflow from Ethereum ETFs indicates that institutional investors are starting to restructure their portfolios, anticipating further declines in the crypto market.

If this outflow trend continues in the coming week, ETH prices will likely struggle to recover significantly, and selling pressure could intensify.

Ethereum Price Prediction: Death Cross Pattern Hints at Deeper Drop to $1,850

Technical signals for Ethereum (ETH) have turned significantly bearish, with ETH prices plummeting 8.3% on March 9, testing key support around $2,000. The daily chart shows a worrying pattern, as ETH is still below major moving averages.

In addition, the formation of a Death Cross between the short-term Exponential Moving Averages (EMA) further confirms the risk of a sustained decline.

Read also: AI Cryptos to Watch: 3 Coins Set to Surge as China’s ‘Manus’ AI Gains Global Attention!

If Ethereum closes below the critical $2,000 level, selling pressure could intensify further, with the next downside target at $1,850, where market demand has previously managed to contain price declines.

The Bollinger Bands indicator shows ETH trading near the lower boundary, which usually indicates oversold conditions. However, the lack of a significant bullish reaction suggests that buying momentum is still very weak.

Also, the MACD histogram remains in the negative zone, with the signal line widening against the MACD line, confirming that the bearish pressure is still dominant and shows no sign of trend reversal yet.

Despite the possibility of a temporary rebound, ETH price recovery towards $2,250 or $2,433 is likely to face strong resistance, as sellers waiting at higher levels could potentially push the price back down.

Additionally, the high leverage in the derivatives market could exacerbate ETH’s price movements. If ETH loses its grip on the $2,000 level, then the liquidation of long positions could trigger a domino effect, potentially pushing the price deeper to $1,850 as the next major support level.

Conversely, if ETH manages to close above $2,200, the market sentiment could start to change towards a bullish retracement.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum Price Analysis: BlackRock ETF’s $11M Sell-off and US Inflation Triggers to Drive Next ETH Big Move. Accessed on March 10, 2025