Solana (SOL) Ready to Rebound to $180? Here are 4 Factors to Watch!

Jakarta, Pintu News—Solana’s price rose 17% after falling to $125 on February 28, 2025. However, SOL is still struggling to break the $180 level, which is strong resistance.

Currently, the SOL price hovers around $145, down 50% from the all-time high (ATH) of $295 on January 19, 2025.

This price drop is due to several factors, including the meme coin market correction, decreased on-chain activity, lack of interest from leveraged traders, and the dominance of MEV bots. Four main factors must be overcome to get back to the $180 level.

Could SOL be bullish again?

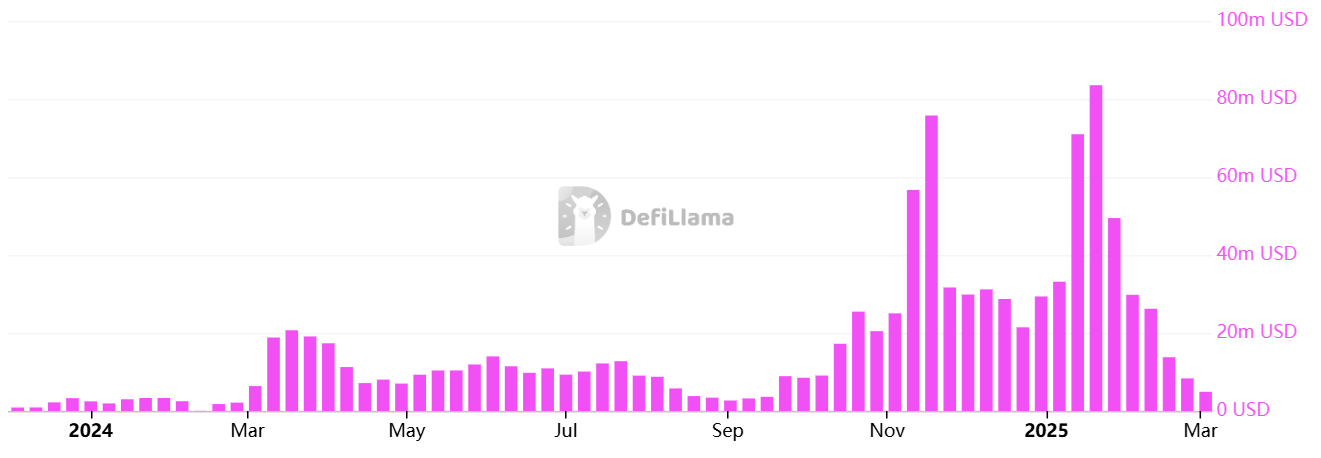

Onchain Activity Declines Drastically

One of the main causes of Solana’s (SOL) weakening price is a significant decline in on-chain activity. According to DefiLlama data, revenue from transaction fees on the Solana network fell by 73% in the past month, which indicates a decrease in user interest.

In addition, some key sectors in the Solana ecosystem have seen a decline in active users. Data from DappRadar shows that:

- Jito, Solana’s largest liquid staking protocol, lost 56% of users in the last 30 days.

- Magic Eden, the leading NFT marketplace, saw a 38% drop in the number of active users.

- Save (formerly Solend), a crypto-based lending platform, lost 42% of users in the same period.

In comparison, the number of active addresses on Base (Ethereum layer-2) only dropped by 2%, while on the Ethereum main network it dropped by 17%. This shows that the drop in activity on Solana is greater than that of other blockchains.

Read also: Survey: 50% of Women Investors Seek Long-Term Wealth from Crypto!

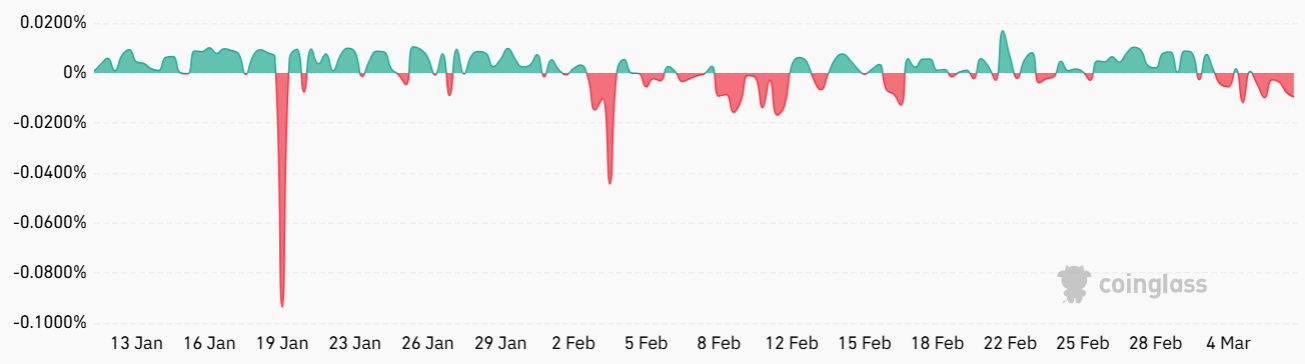

Lack of Interest from Leverage Traders

The lack of interest from leveraged traders has also been an impediment to SOL price increases. Data from CoinGlass shows that the SOL funding rate in the futures market has been negative for three consecutive days, meaning traders who open short positions (sell) have to pay a fee to maintain their position.

The SOL 8-hour funding rate currently stands at -0.01%, or approximately -0.9% per month. While this is not too significant, the lack of interest from leveraged buyers after ATH’s 52% price drop does not bode well for market sentiment.

However, it is possible that market surprises, such as the approval of the Solana ETF in the US, could trigger a short squeeze and push prices up significantly quickly.

MEV Bot Domination and Manipulative Trading Activity

Most of the transaction activity on the Solana (SOL) network is dominated by MEV (Maximum Extractable Value) bots and automated trading strategies. According to a report from arndxt_xo, around 95% of Solana’s total transaction fees come from just 1.3% of users, most of which are algorithmic traders such as Wintermute and MEV bots.

These bots often utilize a sandwich attack strategy, which is:

- Detect pending transactions in decentralized exchange (DEX).

- Conduct transactions before and after.

- Profit from price changes created by genuine transactions.

This phenomenon makes most of Solana’s price increases unsustainable as they come not from organic demand, but from speculative plays by automated traders.

Also read: Bitcoin (BTC) plummets 7% after White House Crypto Summit, investors disappointed?

Lack of Support from Big Projects Like Trump’s World Liberty Financial

One of the factors contributing to the weak SOL price is the lack of investment from large projects, such as the Donald Trump-linked World Liberty Financial (WLFI).

The project has accumulated crypto assets such as Ethereum (ETH), Wrapped Bitcoin , Tron (TRX), Chainlink , and Aave but did not purchase Solana (SOL). In fact, the Solana network is where the Official Trump (TRUMP) meme coin was launched.

Without support from large projects like this, demand for SOL from institutional investors is still not strong enough to sustain prices at $180 or higher.

Conclusion

To become bullish again and break the $180 level, Solana SOL must overcome four major challenges:

- Reinvigorate onchain activity and user attraction.

- Draw back interest from leveraged traders and large investors.

- Reduce the dominance of MEV bots for healthier market activity.

- Get support from big projects like World Liberty Financial.

If these factors can be overcome, then SOL prices have a chance to return to the $180 level or higher. However, if the bearish trend continues, the price may remain stagnant or even drop deeper before recovering.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. 4 reasons why Solana (SOL) price could rally back to $180. Accessed March 10, 2025.

- Featured Image: Zipmex