Bitcoin Headed for $75K? Key US CPI Data Could Trigger a Drop This Week!

Jakarta, Pintu News – The price of Bitcoin experienced another 4.5% decline, touching a low of $80,350 on March 10, 2025, as market sentiment remains bearish ahead of the release of US Consumer Price Index (CPI) data this week.

In the last 24 hours (10/3), the crypto market experienced a sharp decline, erasing more than $170 billion from investors’ total wealth. Analysts expect further downside potential in the next few days.

Will Bitcoin Price Plummet to $75,000?

Bitcoin is facing massive selling pressure again after experiencing strong rejection at the $92,500 level, extending the weekly loss to over 11.15%.

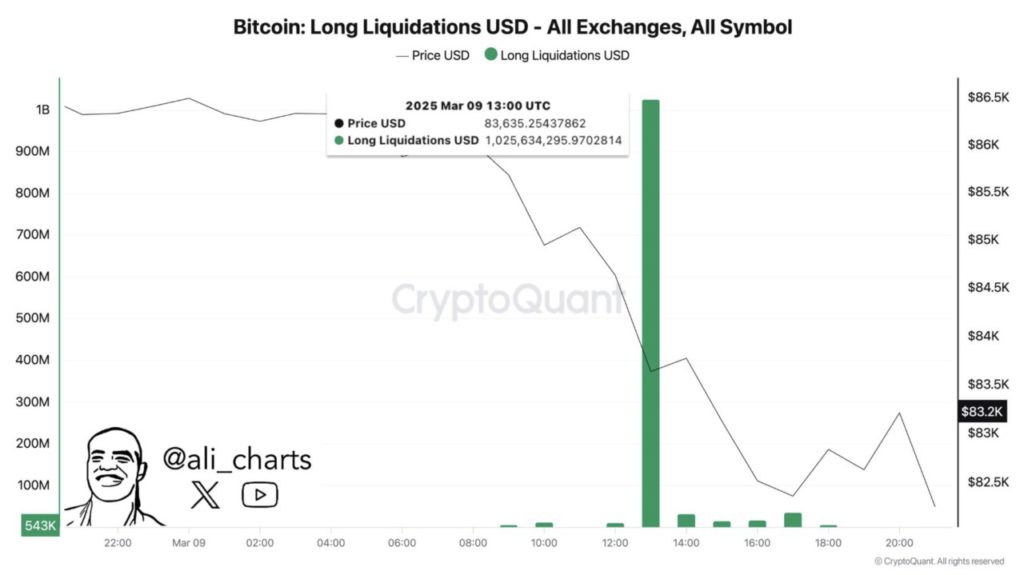

According to popular crypto analyst Ali Martinez, more than $1 billion worth of long Bitcoin (BTC) positions have been liquidated in a single day. This massive liquidation further confirms the high volatility currently rocking the crypto market.

Bitcoin is forming a bearish pennant pattern, says Peter Brandt

Veteran trader Peter Brandt revealed technical analysis showing that Bitcoin’s current price movement confirms a bearish outlook.

In his latest chart, Brandt identified three key technical developments that signaled further selling pressure:

- The market forms a double top pattern.

- The highs were again tested by the pennant pattern.

- The pennant pattern is complete, confirming the bearish trend for Bitcoin (BTC).

In his analysis, Brandt noted that Bitcoin made two peaks around $108,100 before eventually forming a bearish pennant pattern. Bitcoin had a “deep retest” around $95,321 before experiencing further breakdown.

The chart shows that Bitcoin briefly found temporary support at $81,513 after the breakdown, but the bearish pattern that has formed indicates the possibility of further declines.

Read also: Pi Network at Risk? $480 Million Pi Coin Unlock Could Send Shockwaves Through the Market!

In addition, former BitMEX CEO, Arthur Hayes, also warned that Bitcoin may still face more selling pressure. In his statement, he wrote:

“Bad start to the week. It looks like $BTC will retest $78k. If it fails to hold, $75k is the next target. Many option positions with open interest at $70-$75k. If we get into that range, volatility will increase drastically.”

Will BTC Enter a Bear Market After the Release of US CPI Data?

Some market analysts predict that Bitcoin is finally entering a bear market phase as investor sentiment deteriorates, despite the launch of the Bitcoin Strategic Reserve program.

Moreover, the initiative seems to focus solely on the acquisition of seized BTC, with no additional purchase plans in place.

On the other hand, institutional demand for Bitcoin has decreased dramatically, as seen by the largeoutflows from Bitcoin ETFs. Between March 3-7, Bitcoin exchange-traded funds (ETFs) recorded significant outflows, signaling a weakening of investor confidence in the market.

Data shows that total outflows reached $799 million, with the Fidelity Bitcoin ETF (FBTC) accounting for $201 million of the total.

Read also: Ethereum Network in Turmoil: Holesky Testnet Faces Critical Rescue Mission!

Now, attention is on the release of the US Consumer Price Index (CPI) data for February scheduled before March 12, 2025. This US inflation data is expected to show progress in efforts to curb inflation-a key factor that the Federal Reserve looks at in determining its monetary policy.

According to Bloomberg survey projections of economists, core CPI (excluding food and energy) is expected to rise by 0.3%. If the data released is higher than expectations, the crypto market, including Bitcoin, could face further pressure.

However, if inflation is under control, there is a possibility of the Fed’s policy becoming more dovish, opening up opportunities for a BTC recovery.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Price Crash to $75,000 Imminent Ahead of US CPI Data This Week? Accessed on March 11, 2025