Ethereum in Crisis? Spot ETFs Experience $455 Million Outflows!

Jakarta, Pintu News – Ethereum , the second-largest cryptocurrency, is facing a tough challenge as Wall Street investors’ interest in Ethereum-based exchange-traded funds (ETFs) declines.

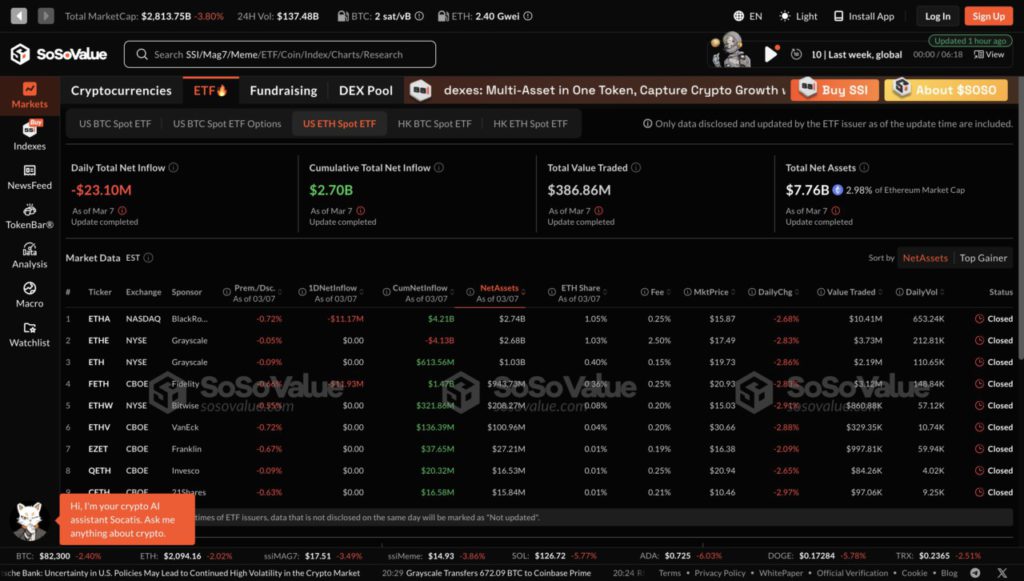

In recent weeks, $455 million has been withdrawn from Ethereum ETFs, signaling potentially bigger problems for the digital asset.

Check out the full analysis here!

Asset Reduction in Ethereum ETFs

Recent data shows that the Ethereum ETF has lost assets significantly. Last week, it lost $120 million, while the previous week recorded a loss of $335 million.

This decline is indicative of growing concerns among investors about Ethereum’s prospects. Total assets flowing out of the Ethereum ETF now stand at $455 million, a significant figure compared to the net inflow of $2.7 billion.

Compared to Bitcoin , which has a net inflow of $37 billion, Ethereum seems to lag far behind. This decline may be due to Ethereum’s less impressive performance than other cryptocurrencies since 2024.

Also read: JAN3 CEO Bitcoin Prediction: “BTC Price Heads to $1 Million with White House Support”

Industry Competition and Staking Challenges

Ethereum also faces challenges from increased competition in the crypto industry. Networks like Solana and BNB and layer-2s like Base and Arbitrum provide stiff competition.

In addition, Ethereum does not allow staking through its ETFs, a feature that allows token holders to earn income by supporting network security.

According to data from StakingRewards, more than $73 billion of Ethereum has been staked at a yield of around 3.25%. By 2025, Ethereum will no longer be the most profitable player in the crypto industry, with fees totaling only $202 million. This figure is lower than the fees generated by networks such as Jito, Uniswap, Tron, and Solana.

Also read: The Greatest Stock Market Crisis Has Arrived? Here’s What Robert Kiyosaki Says!

Technical Analysis of Ethereum Price

From a technical analysis, the Ethereum price has shown a strong downward trend in recent months. It has dropped from its peak of $4,105 in November last year to $2,160. The current price is crucial, just above the important support level of $2,000.

This level is also the point where the price failed to go lower in August and September last year. More importantly, the price is currently at the neckline of a triple-top chart pattern. If this support is lost, there will be further downward momentum, with the next psychological level to watch out for being $1,500.

Conclusion

The current situation suggests that Ethereum is at a crossroads. With declining interest in ETFs and increasing competition challenges, only time will tell whether Ethereum can maintain its position as a major player in the crypto market or will continue to lose ground.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News. Red Alert: Ethereum Price as Spot ETH ETFs Shed $455M. Accessed on March 11, 2025

- Featured Image: Decrypt