Trump’s Big Move to Establish a US Bitcoin Reserve-Listen to the Challenges!

Jakarta, Pintu News – On March 6, US President Donald Trump signed an executive order to establish a strategic reserve of digital assets. The move involves using tokens already owned by the government, rather than new purchases, which has fallen short of market expectations.

In an exclusive White House meeting with prominent crypto leaders, Trump outlined his vision for a government-backed crypto reserve. This initiative marks a significant shift in the regulatory landscape, with potential repercussions for Bitcoin and the digital asset market more broadly.

Data from Polymarket shows an increase in market predictions for the establishment of a US Bitcoin reserve from 24% to 32%. Discussions about the reserve have sparked conversations in states such as Utah, Arizona, and Ohio, while other states such as South Dakota and Montana have rejected related legislative efforts.

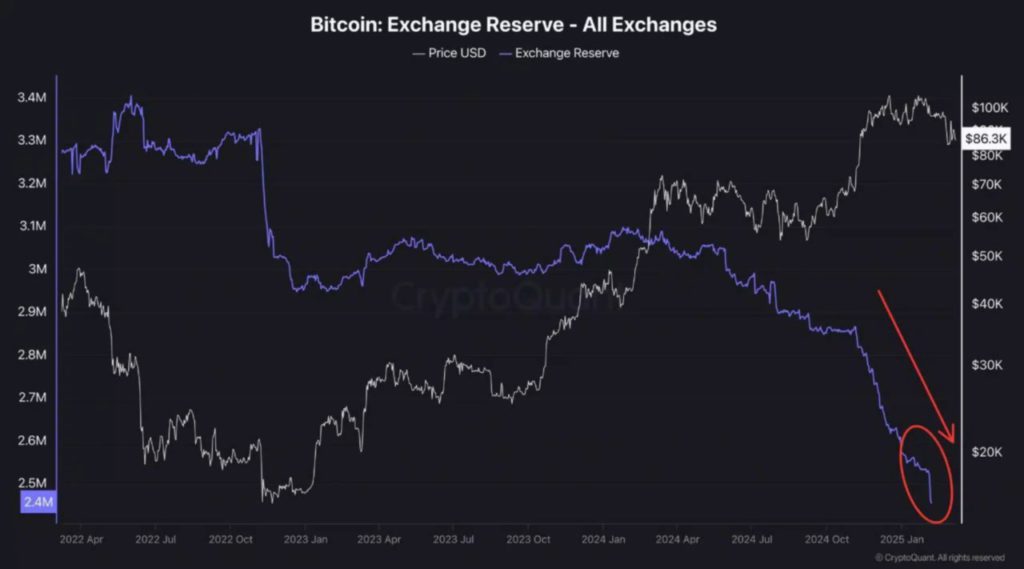

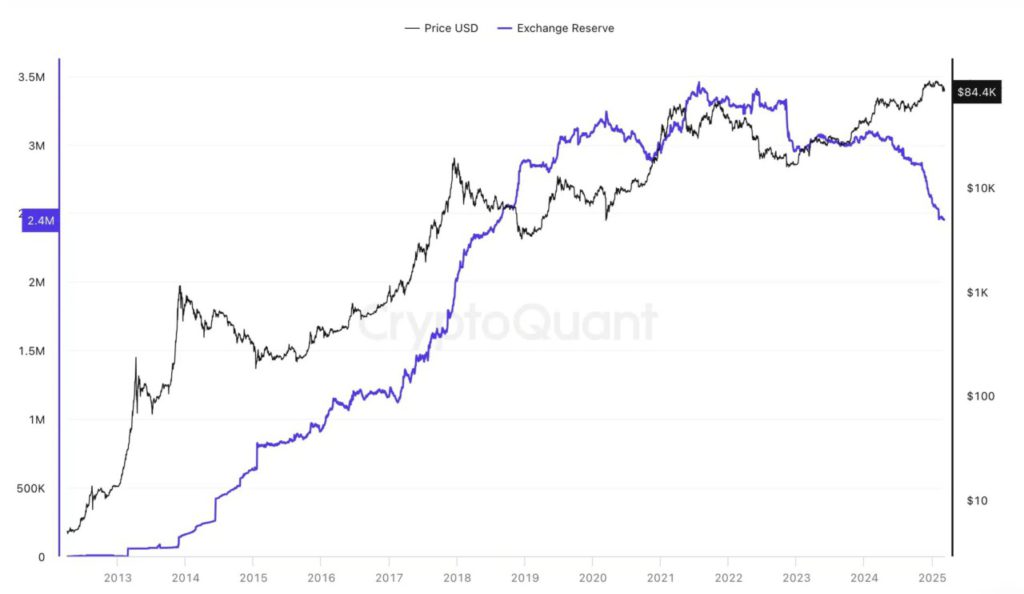

Declining Reserves on the Exchange

Meanwhile, reserves on crypto exchanges continue to decline, signaling a possible supply shortage. According to data from Moon Whales, investors are increasingly moving their holdings to personal wallets, indicating a preference for long-term storage over immediate sale. Data from CryptoQuant also reinforces this trend, with exchange reserves continuing to decline.

A decline in stock exchange reserves is often interpreted as bullish sentiment, as reduced supply can create price pressure if demand increases. This trend also reflects the growing interest in DeFi, staking, and cold storage solutions for better security and alternative yield opportunities. While lower reserves can boost prices, it can also reduce market liquidity, increasing volatility as fewer assets can be traded.

Also Read: MicroStrategy Stock Downside Risk Amid Crypto Market Volatility

Future Prospects of Bitcoin

Despite bullish optimism from some segments of the market, the overall momentum appears fragile. Bitcoin (BTC) price is currently under pressure, trading at $84,557.57 after falling 1.89% in the last 24 hours according to CoinMarketCap. Going forward, Bitcoin (BTC) price movements will likely depend on broader adoption trends and institutional interest.

These changes have kept traders on their toes, with anticipation of Bitcoin’s (BTC) next move likely to depend heavily on such factors. With new initiatives such as the US Bitcoin reserve, the market may see a new dynamic in the way digital assets are perceived and integrated in national financial strategies.

Conclusion

President Trump’s move to establish a Bitcoin (BTC) reserve marks a turning point in the integration of crypto in US financial policy. Despite challenges and dissent among the states, this initiative could be the beginning of a major shift in the way the US government interacts with blockchain technology and digital assets.

Also Read: Shiba Inu (SHIB) and the Challenges to a Price Rally in the Cryptocurrency Market (11/3/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Meta Description

Trump signs executive order for US Bitcoin reserves, marking a major shift in financial and crypto policy.

Reference

- AMB Crypto. Trump signs order for U.S. Bitcoin reserve, but there’s a catch. Accessed on March 11, 2025

- Featured Image: Bitcoin News