Bitcoin (BTC) Weakens Below $80,000, What Will Happen Next? (12/3/25)

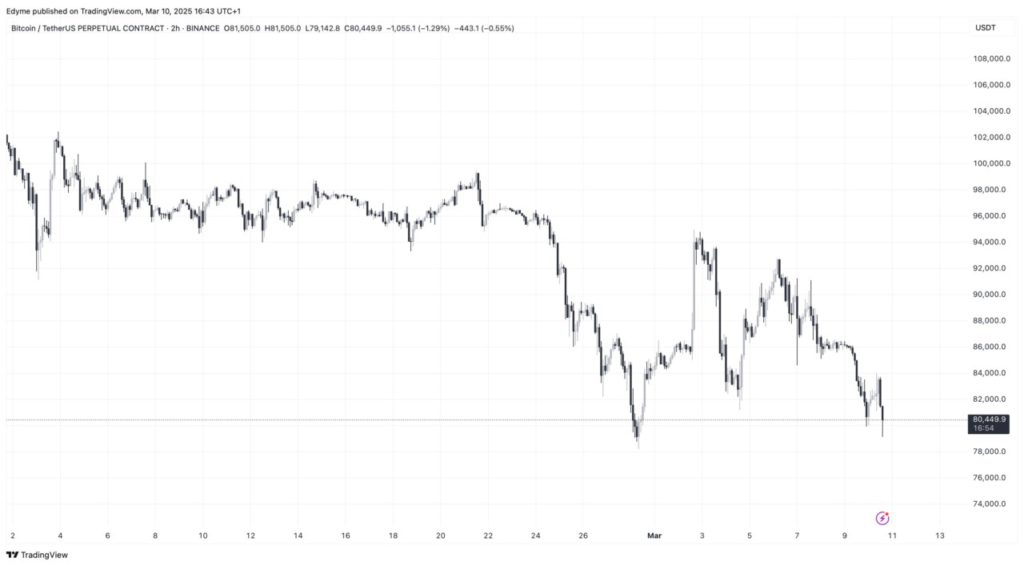

Jakarta, Pintu News – Bitcoin has experienced another price drop, this time falling below the $80,000 mark. After hitting a record high in January at $109,000, the cryptocurrency has continued to lose momentum. In the past week, Bitcoin (BTC) has dropped by 14.6%, with an additional 4.4% drop in the past 24 hours. Currently, Bitcoin (BTC) is trading at $79,766, almost 27% below its previous high.

CME Gap Phenomenon and Its Impact

Recent analysis by CryptoQuant analyst Ibrahim Cosar highlights the CME gap phenomenon that often affects short-term Bitcoin (BTC) price fluctuations. Ibrahim notes that Bitcoin (BTC) opened at $82,110 on the Chicago Mercantile Exchange (CME), creating a gap to the $86,000 level. This gap could provide clues about the next move of Bitcoin (BTC), which may try to return to the $86,000-$90,000 range in the coming days.

The CME Gap is the difference between Bitcoin (BTC)’s closing price on the CME before the weekend and its opening price after the weekend. This gap is often replenished when the price of Bitcoin (BTC) returns to the level where trading was halted. Ibrahim noted that the $10,000 gap formed on February 28 was filled within 19 hours.

Also Read: Bitcoin and Stock Market Plummet, Arthur Hayes Asks Investors to Be Patient: Why is Crypto Red?

Key Support Levels and Market Sentiment

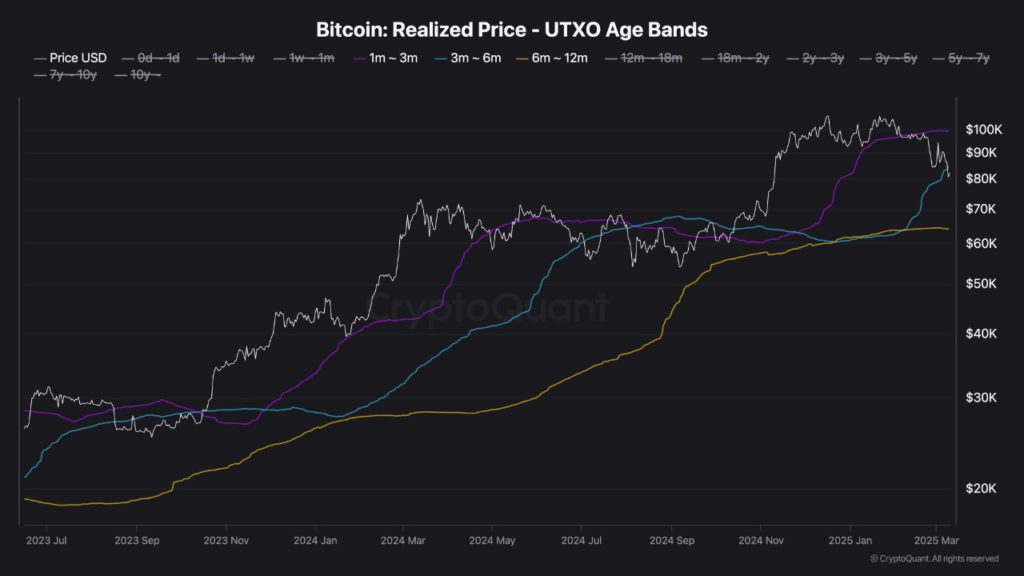

Shayan, another market analyst, points to $83,000 as a critical support level based on the interaction of Bitcoin (BTC) with the UTXO 3-6 Month Realized Price. This metric tracks the average acquisition price of medium-term holders and has served as a significant support or resistance zone.

Shayan revealed that Bitcoin (BTC) recently tested this level, and staying above it could signal strong investor confidence, potentially strengthening bullish sentiment. However, Bitcoin (BTC)’s drop below $80,000 suggests that the $83,000 support level has been exceeded. If Bitcoin (BTC) fails to regain ground above this threshold, market sentiment could shift to fear, leading to increased selling pressure from medium-term holders.

Outlook and Future Price Predictions

In the current scenario, Bitcoin (BTC) may be entering a distribution phase, where short- to medium-term investors sell their holdings, which further lowers the price. Ibrahim has identified the $78,000-$80,000 range as the next key support zone, which might determine the short-term trajectory of Bitcoin (BTC).

While there is potential to attempt to fill the gap in the $86,000-$90,000 range, this does not necessarily signal a full reversal in Bitcoin’s (BTC) downward trend. Price action through March and early April will be key in determining whether a stronger recovery is on the horizon.

Conclusion

With various factors affecting the price of Bitcoin (BTC), the market may still witness volatility in the near future. Investors and market watchers should pay attention to key support levels and market sentiment to take informed investment decisions.

Also Read: Drastic 19% Drop in Solana Futures – Here’s Solana’s Technical Outlook in March 2025

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Slips Below $80,000, Here’s What Could Happen Next. Accessed on March 12, 2025

- Featured Image: Generated by AI