Franklin Templeton Files for Ripple (XRP) ETF – Is This the Catalyst for XRP’s Big Comeback?

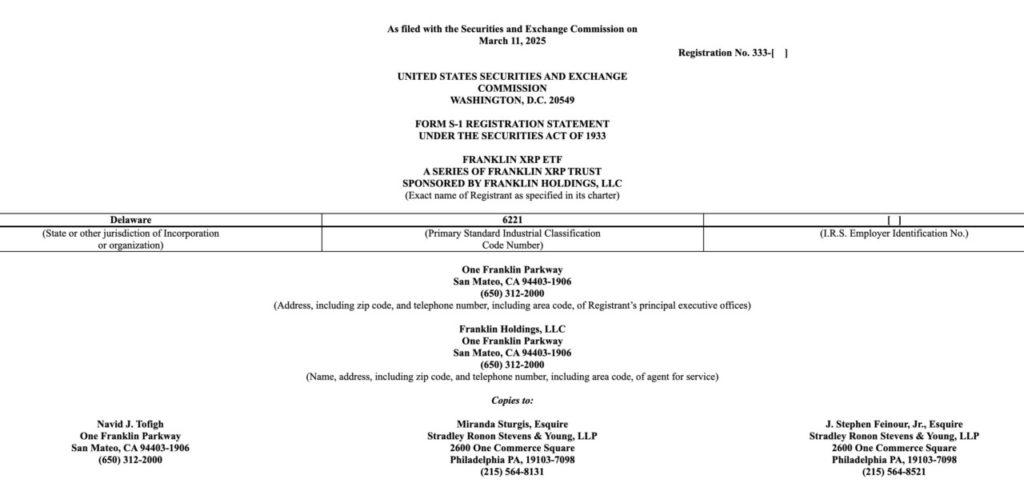

Jakarta, Pintu News – Franklin Templeton, one of the leading asset managers, recently filed an S-1 form with the US Securities and Exchange Commission (SEC) to offer a Ripple ETF.

The move marks the latest attempt by the company to expand its portfolio of financial products based on crypto assets. This filing comes not long after they filed for the Solana ETF and offered their existing Bitcoin and Ethereum ETFs.

Franklin Templeton files S-1 for XRP ETF

On March 11, 2025, Franklin Templeton has officially filed an S-1 registration form with the US Securities and Exchange Commission (SEC) to launch an XRP-based ETF. This filing follows an earlier move in February 2025, where Franklin had registered the Franklin XRP Trust in Delaware.

Read also: VanEck proposes Avalanche ETF! Will AVAX Price Recover?

With this move, Franklin Templeton joins several other asset managers such as Bitwise, Grayscale, Canary Capital, and WisdomTree, who have also submitted their XRP ETF proposals to the SEC.

If approved, the ETF will be listed on the CBOE BZX Exchange and allow investors to gain exposure to XRP, which is currently the fourth largest crypto asset by market capitalization.

Who Will Manage the XRP ETF?

In its filing document, Franklin Templeton revealed that:

- Coinbase Custody will act as the custodian to hold the XRP assets in this ETF.

- Coinbase will also act as the prime broker, meaning they will handle trading and liquidity for the ETF.

- The ETF’s net asset value will be calculated based on the CME CF XRP-Dollar Reference Rate.

Franklin Holdings will be the main sponsor of the ETF and has committed to cover most of its operational costs in exchange for a sponsorship fee.

Regulatory Challenges: Will SEC Approve XRP ETF?

Although the SEC has approved Bitcoin (BTC) and Ethereum (ETH) based ETFs, XRP is still in a regulatory gray zone.

The SEC and Ripple Labs are still engaged in a legal dispute regarding the legal status of XRP, where the SEC alleges XRP to be an unregistered security.

However, the SEC has officially recognized many XRP ETF filings, including from Grayscale on February 14, 2025, which started the 240-day review process.

With more entities applying for an XRP ETF, the chances of approval could increase, although there is still uncertainty regarding the final outcome of the Ripple vs SEC trial.

Impact on XRP Price

News of the XRP ETF filing triggered an 8% price surge in the first 24 hours (11/3/25), with the current price at $2.19.

Read also: Alert! Pi Network Indicator Signals PI Could Plunge Below $1 This March!

CasiTrades crypto analysts stated that XRP is currently still maintaining a strong support zone at $2.04, with the next resistance levels being at $2.25 and $2.70.

If the SEC eventually approves this ETF, XRP could experience a significant price spike just like Bitcoin did after the launch of the Bitcoin Spot ETF in early 2025.

However, if approval is delayed or there is a negative ruling in the Ripple vs SEC case, the XRP price could experience strong selling pressure.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Franklin Templeton Files S-1 for XRP ETF with US SEC. Accessed on March 12, 2025

- Crypto Briefing. Franklin Templeton to Launch XRP ETF. Accessed on March 12, 2025

*Featured Image: Coinpedia