Analyst’s Astonishing Prediction: Bitcoin (BTC) Will Break $180,000, Really?

Jakarta, Pintu News – Despite Bitcoin ’s recent decline in value, an analyst from CryptoQuant, Ibrahim Cosar, gave a bold prediction that Bitcoin (BTC) will reach $180,000 by 2026.

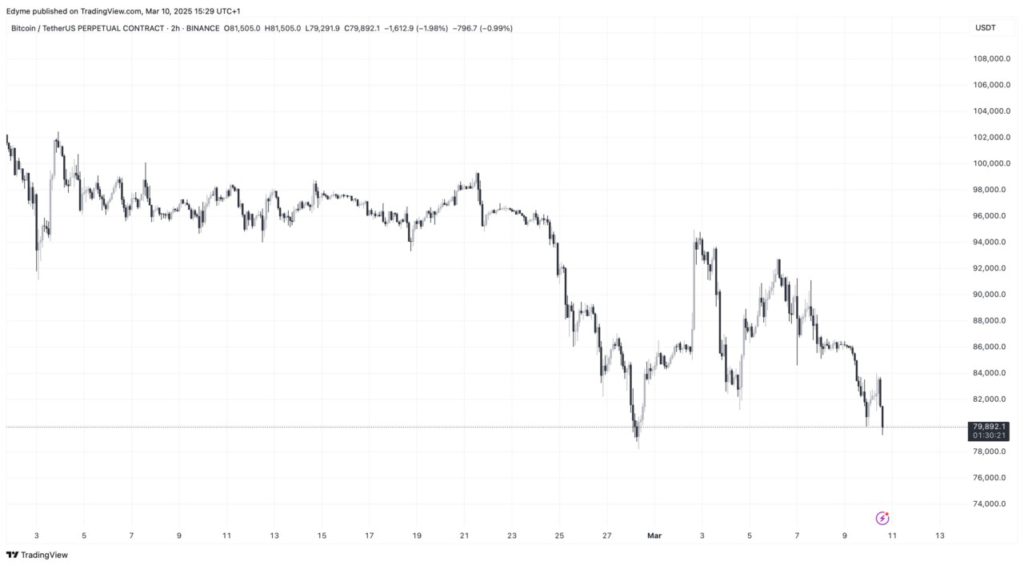

This prediction is based on historical price cycles and projections from major financial institutions that are starting to look at the cryptocurrency’s long-term potential. Although Bitcoin (BTC) is currently trading below $80,000, this analysis suggests that the asset has the potential to more than double in value within the next two years.

Long-term Analysis: Significant Upside Potential

Ibrahim Cosar emphasized that Bitcoin’s (BTC) price movement pattern in the past year shows similarities to previous bull cycles. With major financial institutions starting to make similar projections, the validation of previous predictions is strengthening. If Bitcoin (BTC) follows the historical pattern, the $150,000 to $200,000 range could be reached in the upcoming bull cycle.

Investors who enter the market at current levels could potentially earn more than 100% profit if Bitcoin (BTC) reaches its predicted target in 2026. According to Ibrahim, buying at key support levels has historically provided the best opportunity for long-term gains. By taking advantage of the right time to buy, investors can make significant gains without having to wait more than a year.

Also Read: Bitcoin and Stock Market Plummet, Arthur Hayes Asks Investors to Be Patient: Why is Crypto Red?

Short-term Market Trends and Buying Opportunities

Although the long-term projections remain bullish, Bitcoin (BTC) price in the short-term continues to fluctuate. Another analyst from CryptoQuant, Bilal Huseynov, provided insight into open interest (OI) trends, which could indicate whether it’s a good time to buy Bitcoin (BTC). Changes in open interest over the past 7 days indicate a “deleveraging” phase, which historically aligns with potential buying opportunities.

This phase last occurred in August 2024, when the price of Bitcoin (BTC) hovered between $58,000 and $60,000 before surging to a record high of around $106,000. If historical trends repeat themselves, current market conditions could set the stage for a similar recovery.

Projections and Investment Strategy

Taking into account analysis from experts and historical trends, investors are advised to consider a long-term strategy in Bitcoin (BTC) investment. Utilizing information about open interest and buying at the right support points can provide maximum profits.

While the crypto market is known for its volatility, a well-thought-out and data-driven approach can minimize risks and increase potential profits. Investors should also realize that timing in the crypto market is crucial. Patience and a deep understanding of market cycles can help in making informed investment decisions.

Conclusion

While there is uncertainty in short-term price movements, long-term analysis shows great potential for growth in the value of Bitcoin (BTC). With the right strategy and a good understanding of the market, investors can capitalize on this opportunity to earn significant profits.

Also Read: Drastic 19% Drop in Solana Futures – Here’s Solana’s Technical Outlook in March 2025

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin’s Downtrend Continues, But Analyst Predicts $180k Target: Is It Possible? Accessed on March 12, 2025

- Featured Image: Generated by AI