New Patterns in the Ethereum Market: Whale Accumulation and Smart Money Selling (3/13/25)

Jakarta, Pintu News – Ethereum market dynamics have recently shown a significant shift among key players. In the past 24 hours, it was noted that whales and smart DEX traders (SDT) became net buyers, while Smart Money (SM) tended to sell. This article will delve deeper into what exactly happened and the implications for the market.

Buying and Selling Behavior: Whale and SDT

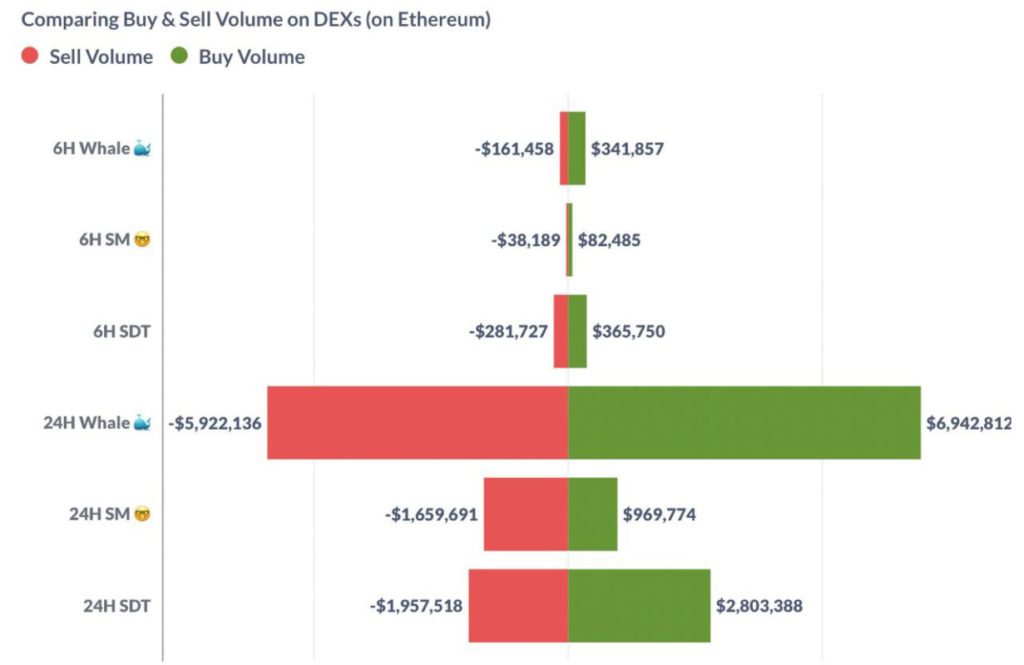

Ethereum (ETH) whales showed strong buying activity with their buying volume reaching $6,942,812, surpassing their selling volume of $5,922,136. This indicates that whales may see the potential for future growth in Ethereum (ETH) prices and choose to accumulate more assets. Meanwhile, smart DEX (SDT) traders are also following a similar trend.

They recorded a buying volume of $2,803,388 compared to a selling volume of $1,957,518. Both groups, whales and SDTs, seem to have confidence in Ethereum’s (ETH) long-term prospects, which could be based on their own analysis or internal information.

Also Read: Bitcoin’s RSI Dominance Down? Crypto Analyst Seth Says Altcoin Market Opportunities Await!

Smart Money Behavior: Sales Trends

In contrast to whale and SDT, Smart Money (SM) showed a tendency to sell with a selling volume of $1,659,691 compared to purchases of only $969,774. This could indicate that Smart Money may be taking advantage of the recent price increase or have a more skeptical view of Ethereum (ETH) price stability in the short term.

This behavior is interesting as Smart Money is often perceived to have access to better data and analysis. However, in this case, their activity is not in line with what the whales and SDTs are doing, which could suggest different strategies or responses to different market conditions.

Netflow Analysis and Market Implications

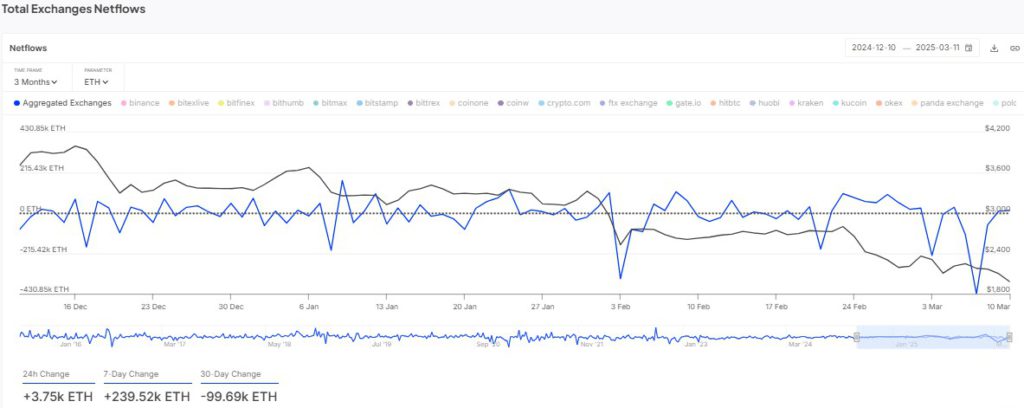

Ethereum (ETH) netflow analysis shows a positive change in the last 24 hours with a netflow change of +3.75k ETH. However, when looking at the trend of the last three months, the average netflow is -430.58k ETH, which indicates a persistent outflow.

Despite an increase in the last 7 days of +239.52k ETH, the 30-day figure shows -99.69k ETH, indicating that there is still a tendency to take profits. These fluctuations suggest that the market may still be unstable and investors should be wary of sudden changes.

Conclusion

Taking into account all the data and recent activity from whale, SDT, and Smart Money, Ethereum (ETH) investors need to pay attention to various factors before making investment decisions. Despite the bullish signals from whale and SDT, the selling behavior by Smart Money and netflow fluctuations suggest that the market may still face uncertainties.

Also Read: Will ETH Fall Below $1,500 Before the Market Recovers? Here’s the Price Pattern Analysis! (3/13/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ethereum Market Dynamics: Assessing Accumulation Trends. Accessed on March 13, 2025

- Featured Image: CoinMarketCap