Bitcoin (BTC) Stuck Below $82,000, What Will Happen Next? (13/3/25)

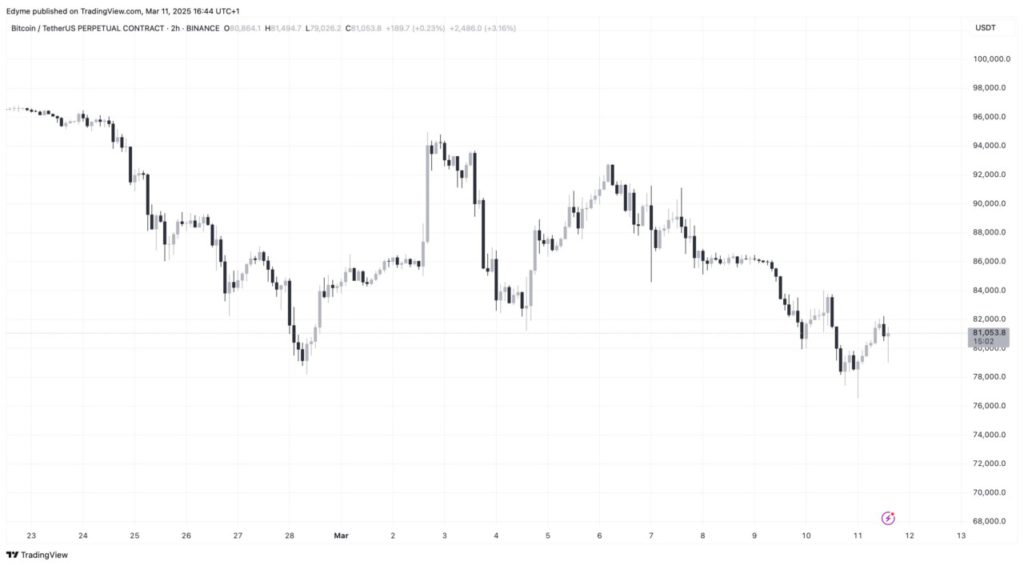

Jakarta, Pintu News – Bitcoin is still struggling to regain upward momentum, with prices continuing to hover below $82,000. Despite the increased demand shown by the Coinbase premium, the market is still clouded by uncertainty. Recent analysis suggests that selling pressure from miners and the unclear direction of the market are the main factors affecting the current price.

Coinbase Premium Analysis and Market Sentiment

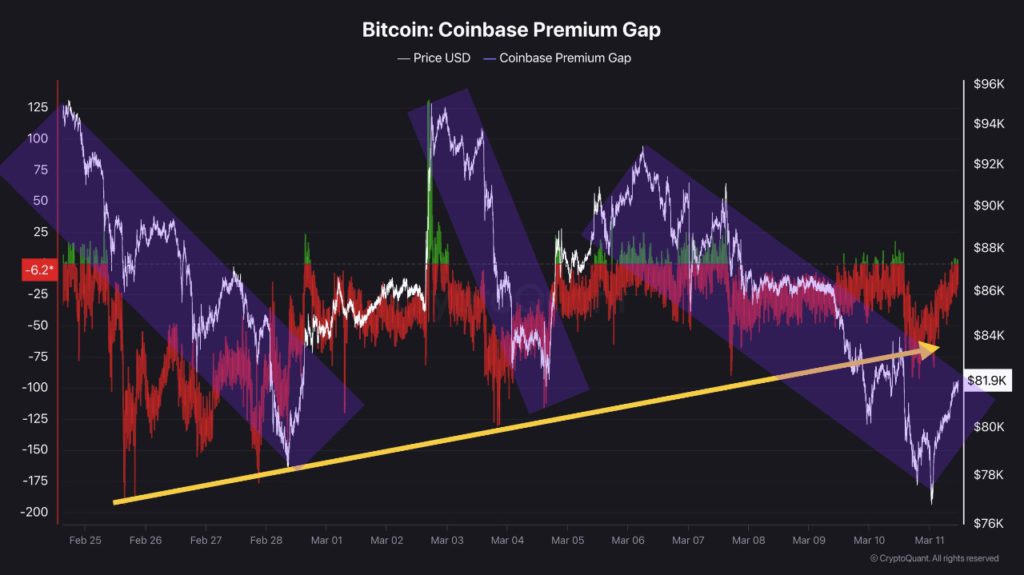

Despite the downward trend in Bitcoin (BTC) prices, Coinbase premiums continue to record low increases, indicating strong demand in the United States. Analyst from CryptoQuant, Avocado Onchain, noted that despite signs of accumulation, there are no clear signals of a significant change in trend yet.

This suggests that investors may still be cautious in making investment decisions. Currently, the Bitcoin (BTC) market is in a downward price channel, with repeated price drawdowns occurring, making the direction of the trend difficult to predict. Avocado Onchain emphasizes that the current market is designed to create confusion and instability among investors, which may affect long-term investment decisions.

Also Read: Bitcoin’s RSI Dominance Down? Crypto Analyst Seth Says Altcoin Market Opportunities Await!

Selling Pressure from Miners and its Implications

Bitcoin (BTC) miners have increased their selling activities, especially when the price dropped to $77,700. According to IT Tech analysts from CryptoQuant, this is an indication of selling pressure that could limit Bitcoin (BTC) price recovery in the short term.

Miners usually sell Bitcoin (BTC) to cover operational costs, especially when the price drops. If this selling pressure continues and buyer demand is not strong enough to absorb the excess supply, Bitcoin (BTC) price stabilization may be delayed. However, if demand remains strong, it is possible that the price will stabilize and could even attempt a rebound in the near future.

Investment Strategy and Market Decisions

In these uncertain market conditions, Avocado Onchain advises investors not to be overly influenced by bullish news or panic selling on dips. Strategic decisions should be made based on in-depth analysis and not just reactions to market fluctuations.

This is important to avoid missing opportunities that may arise if the market recovers. Avocado also emphasized the importance of understanding the current market dynamics and making wise investment decisions. Investors are advised to monitor market indicators such as Coinbase premium and miner sales activity to make more informed decisions.

Conclusion

Although Bitcoin (BTC) is still in a volatile phase, an in-depth understanding of the factors affecting the market can help investors make informed decisions. By paying attention to indicators such as Coinbase’s premium and miners’ selling activities, investors can be better prepared for the upcoming market fluctuations.

Also Read: Will ETH Fall Below $1,500 Before the Market Recovers? Here’s the Price Pattern Analysis! (3/13/25)

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Struggles Below $82k While Coinbase Premium Rises, What’s Next. Accessed on March 13, 2025

- Featured Image: Generated by AI