Bitcoin Clings to $81,000 – Is a Bigger Crash on the Horizon? (March 14, 2025)

Jakarta, Pintu News – The price of Bitcoin continues to fall, struggling to hold at the $81,000 level amid renewed trade tensions between the US and its North American neighbors.

Despite inflation data showing a decline, bearish sentiment still dominates the market. After three consecutive days of falling below $80,000, is Bitcoin at risk of breaking support at $75,000?

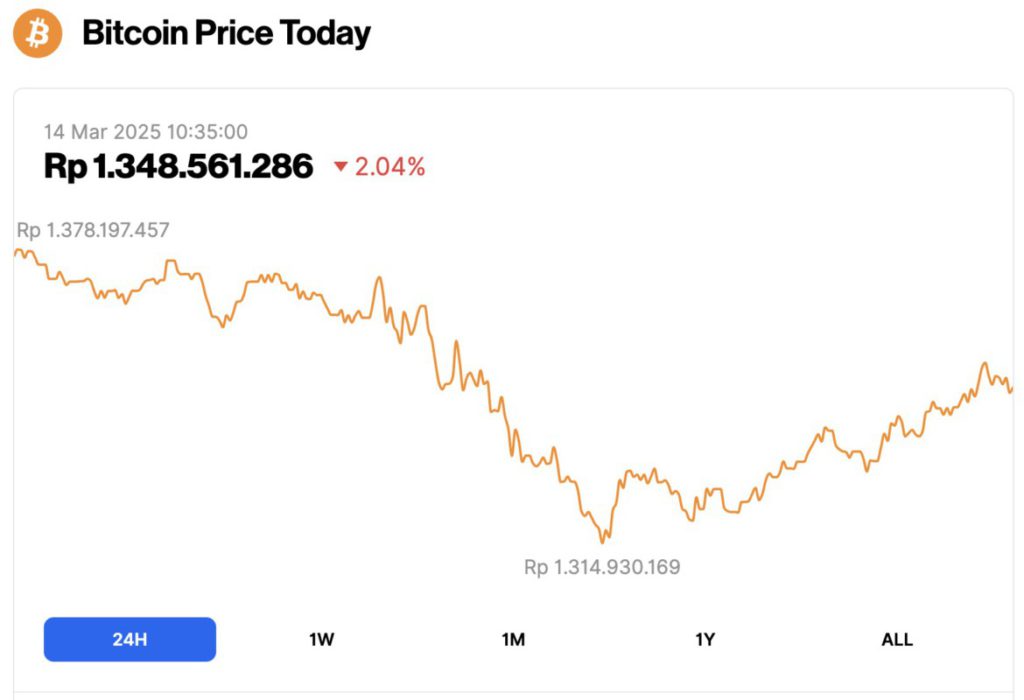

Bitcoin Price Drops 2.04% in 24 Hours

On March 14, 2025, Bitcoin (BTC) was trading at $81,911, equivalent to IDR 1,348,561,286, marking a 2.04% decline over the past 24 hours. During this period, BTC hit a low of IDR 1,314,930,169 and peaked at IDR 1,378,197,457.

According to CoinMarketCap, Bitcoin’s market capitalization is now $1.62 trillion, with trading volume in the last 24 hours falling 21% to $30.3 billion.

Bitcoin (BTC) holds at $81K, bears eye further declines

Bitcoin (BTC) is still having a hard time gaining momentum on Thursday, showing volatile movements but staying within a certain range.

The latest US Producer Price Index (PPI) data confirmed that industrial inflation is easing, in line with the Consumer Price Index (CPI) report released on Wednesday.

Although these indicators corroborated the trend of easing inflation, Bitcoin failed to capitalize on the news and instead extended its decline for the third consecutive day.

Bitcoin opened at $83,700 on Thursday (13/3), but soon faced selling pressure that led to a 4% drop, so it is holding just above $81,000 at the time of writing. The $79,000 level was tested earlier in the trading session, signaling weakening support as market sentiment remains fragile.

With continued macroeconomic uncertainty and trade policy concerns, traders remained cautious and avoided aggressive buying despite positive inflation data.

Why is Bitcoin Price Falling Today?

Reporting from Coingape (3/14/25), Bitcoin had tried to recover and approached the $82,000 level within a few hours after the release of the Producer Price Index (PPI) data. However, the increase did not last long.

Read also: 5 Crypto Recommended to Sell Ahead of FOMC Meeting

Investors interpreted the lower inflation figures as a sign that the Trump administration might extend tariffs against Canada and Mexico for longer, instead of easing them.

This stance raises concerns that prolonged trade tensions could reduce the investment power of retail traders as well as their interest in riskier assets such as Bitcoin.

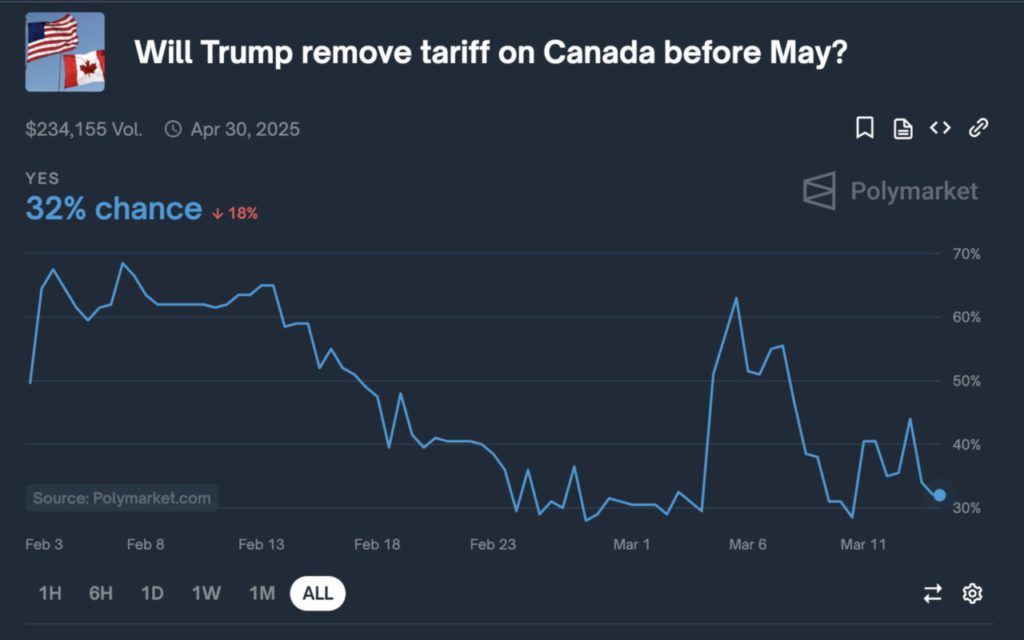

This concern was further reinforced by the falling odds on Polymarket regarding the possibility of Trump ending the trade war with Canada before May 2025. After the release of the PPI data, these odds plummeted 18%.

Historically, this trend suggests that as hopes of a trade war settlement decline, investor appetite for risk also weakens, leading to capital outflows from speculative markets.

The betting trend in the Polymarket is often considered a neutral indicator for investors’ expectations of major policy decisions.

This 18% drop in opportunity suggests that, instead of capitalizing on lower inflation to drive bullish momentum, crypto investors remain wary.

The current prevailing market sentiment reflects the fear that policymakers could use inflation stability as an excuse to maintain high rates in the long run, which contributed to a 4% drop in Bitcoin price on Thursday (13/3).

Bitcoin Price Prediction: Support at $75K at Risk if Bearish Sentiment Continues

Bitcoin’s price outlook showed a continued downward trend on Thursday, trading at $80,981 after a volatile session that briefly dipped below $79,955. The daily chart reflects the still strong bearish sentiment, with Bitcoin struggling to return to the major moving average levels.

The 50-day moving average at $87,034 remains a key resistance level, while the lower Bollinger Band at $77,361 indicates potential further downside risks if bearish pressure intensifies.

Read also: Bitwise Launches OWNB ETF, Bitcoin Investment Without Holding BTC!

If Bitcoin breaks below this level, the price could test the psychological support at $75,000.

The Relative Strength Index (RSI) indicator is currently at 38.35, indicating weakening momentum and approaching oversold conditions. However, the RSI has not dropped below 30, which means there is still potential for further downside before buyers start to step in.

Conversely, if the RSI manages to break the centerline at 50, it could be a confirmation of a bullish reversal. However, for now, the market sentiment is still fragile.

The Delta Volume indicator confirms continued selling pressure, with a predominance of red bars at the bottom of the chart. Several consecutive days of negative delta volume indicate that the market is still controlled by the bears, who absorb any attempts at price recovery.

If Bitcoin fails to break back through the resistance level at $83,700, the risk of a deeper correction remains, with the possibility of testing the $75,000 level in the next few trading sessions.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Price at Risk of $75,000 reversal as PPI gains heightens Trade War Fears. Accessed on March 14, 2025