Has the Decline in Whale Activity Ended Bitcoin’s Decline? (3/14/25)

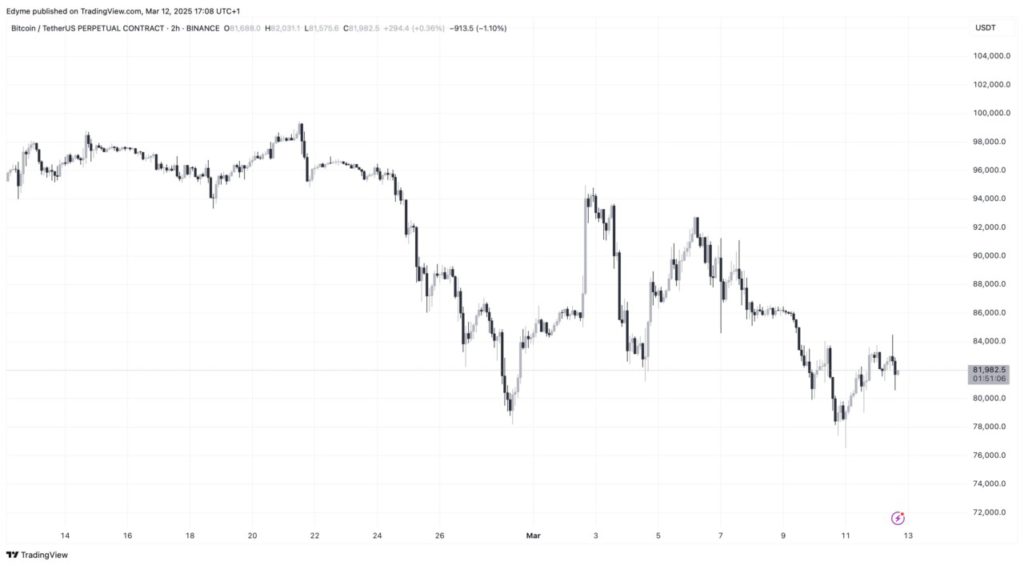

Jakarta, Pintu News – The Bitcoin market is showing signs of recovery after a period of significant decline. In recent weeks, Bitcoin (BTC) has declined by 16.2% in the past month. However, in the last 24 hours, it has seen a rise in price which has led to speculation about the end of the correction phase.

Bitcoin Recovery: Early Signs of Resurgence

In a recent analysis, Bitcoin (BTC) showed an increase in price to $81,647 in the last 24 hours. This increase has come to the attention of analysts who have begun to examine whale activity and exchange trends to determine if the correction phase is nearing its end. Although Bitcoin (BTC) is still registering declines in the weekly and monthly timeframes, early indications point to a potential trend reversal.

This price increase has prompted analysts to delve deeper into whale activity on crypto exchanges. Whales, or large holders of Bitcoin (BTC), have a significant influence on price dynamics. A reduction in selling pressure from them could be an early indicator that the market may be stabilizing.

Whale Activity on Binance and its Impact on Bitcoin Trends

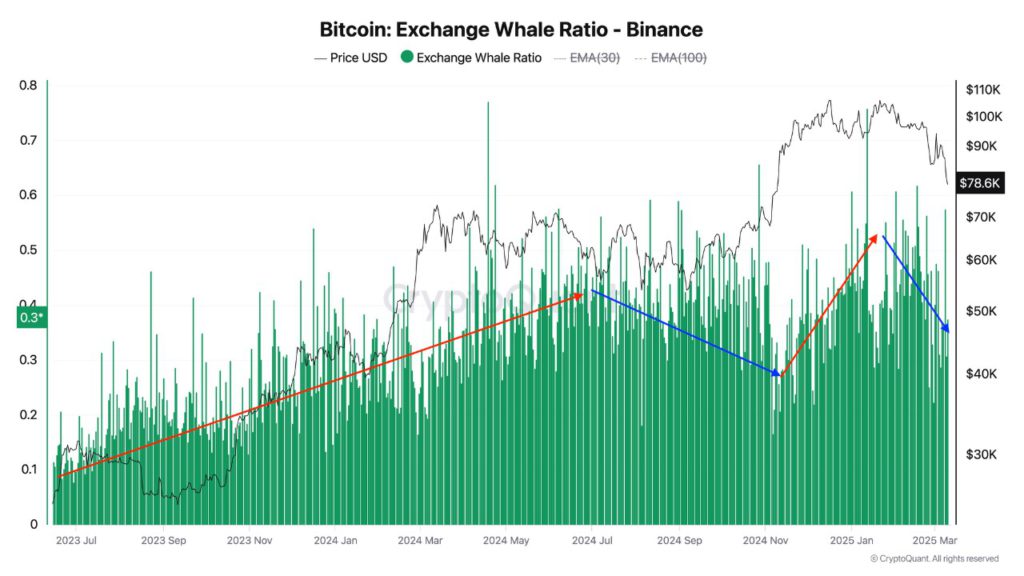

Darkfost, an analyst from CryptoQuant, has identified an important trend in whale activity on Binance that could affect Bitcoin (BTC) price movements. Binance, as the largest crypto exchange by volume, plays a crucial role in market liquidity, so whale activity on the platform is very important to monitor.

Darkfost’s analysis of the Bitcoin Exchange Whale Ratio on Binance shows that the selling pressure from whales is starting to ease. This ratio measures the proportion of the 10 largest inflows to the total inflows on the exchange. A decrease in this ratio signals a reduction in selling pressure, which could help stabilize the price of Bitcoin (BTC) or even encourage a rebound.

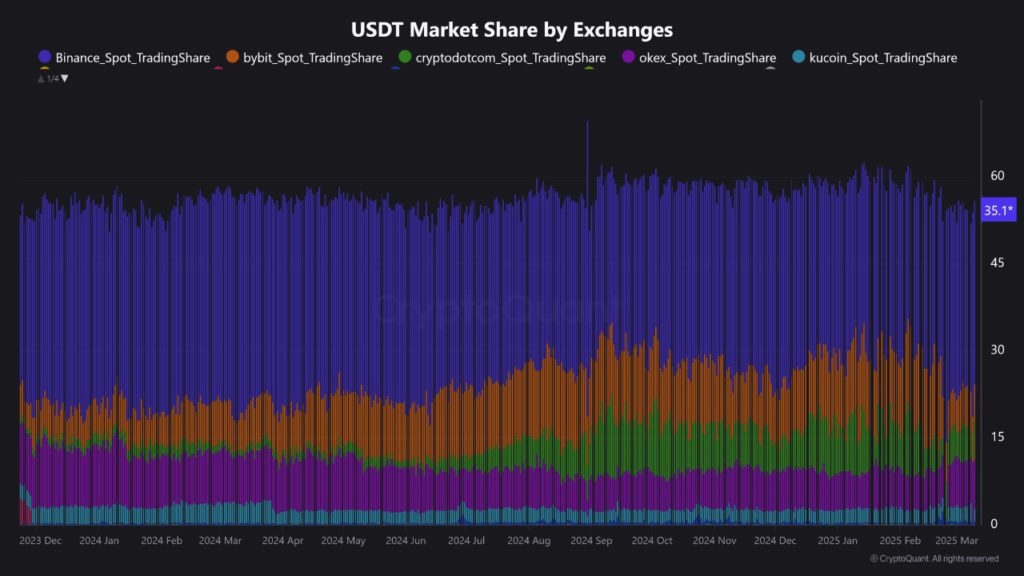

Binance’s Dominance in Spot and Futures Trading

In a separate analysis, CryptoQuant’s Crazzyblockk highlighted Binance’s dominance in the spot and futures markets. Binance holds the largest market share in crypto trading, cementing its position as a key player in price discovery and liquidity. Currently, Binance has 45.5% market share of Tether futures, far ahead of other trading platforms. In the spot market, Binance maintains 35% of the total trading volume, reinforcing its role as an industry-leading exchange.

Conclusion: Bitcoin Recovery Prospects

With reduced selling activity by whales on Binance and Binance’s dominance in crypto trading, there is increased potential for Bitcoin (BTC) price stabilization and recovery. Market watchers and investors will continue to monitor these indicators to make informed investment decisions. The latest price increase may be an early signal of a broader recovery, although time is still needed to confirm this trend.

Also Read: Pi Network Price Predictions to 2050: What to Expect?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Shows Signs of Recovery, Is the Whale Sell-Off Finally Over? Accessed on March 14, 2025

- Featured Image: Generated by AI