Bitcoin Crashes to $84K as Futures Open Interest Plummets 35% — Is This the Start of a Major Sell-Off?

Jakarta, Pintu News – The price of Bitcoin has experienced another decline and is now trading at around $84,000 today, March 21, 2025. After setting an all-time record high recently, selling pressure has started to mount in the market, triggering profit-taking from investors.

One striking indicator is the sharp 35% drop in BTC futures open interest, indicating reduced speculative interest and a potential weakening of short-term momentum.

Is this just a healthy correction or the start of a deeper downward trend? Let’s discuss this further.

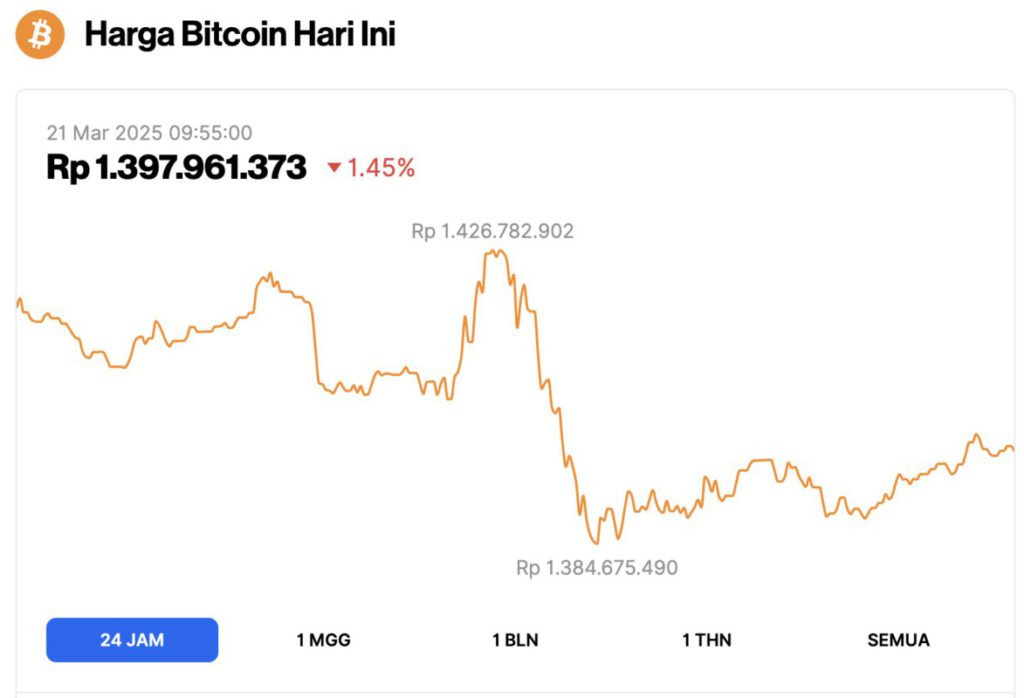

Bitcoin Price Drops 1.45% in 24 Hours

As of March 21, 2025, Bitcoin (BTC) is trading at $84,618, or approximately IDR 1,397,961,373, marking a 1.45% drop over the past 24 hours. Within this timeframe, BTC reached a high of IDR 1,426,782,902 and dipped to a low of IDR 1,384,675,490.

According to CoinMarketCap, Bitcoin’s market capitalization is now down to $1.67 trillion, with trading volume in the last 24 hours also down 28% to $25.92 billion.

Read also: These 3 Crypto Could Skyrocket If Bitcoin Hits $100K

Bitcoin Open Interest in Futures Market Drops 35% amid Bearish Pressure

According to Crypto Basic (20/3), Bitcoin’sopen interest in the futures market has plummeted 35% since hitting anall-time high, as downward pressure continues.

For context, Bitcoin has struggled to break back through the psychological level of $90,000, remaining stuck below it for almost two weeks. Despite reaching an ATH (All Time High) above $109,000 in January, the asset has struggled to maintain upward momentum.

On the contrary, the bearish pressure is getting stronger, fueling the debate whether the current bull market is over or there is still a chance of a new rally that could push BTC to new highs. Amidst this uncertainty, the latest data from Glassnode shows a major shift in market conditions.

One of the key developments was the sharp decline in Bitcoin’s open interest, which fell from $57 billion at ATH to $37 billion, reflecting a drastic drop of 35%.

This decline indicates reduced speculative trading andhedging activity.

Read also: March 2025 Crypto Watchlist: 3 Altcoin Set to Challenge Solana’s Throne

What does the drop in Bitcoin Open Interest mean for BTC?

Bitcoinopen interest reflects the total value of derivative contracts still outstanding. A decline of this magnitude suggests that traders may be closing their positions due to market uncertainty or avoiding leveraged trading.

According to Glassnode, this decline reflects a broader trend of reducedon-chain liquidity, indicating increased risk-off sentiment among investors.

Moreover, the dissolution of the cash-and-carrystrategy-where traders profit from the price difference between the spot and futures markets-suggests that thelong-side bias is weakening.

These developments, coupled with outflows from ETFs as well as the closure of futures contracts at the CME, put further downward pressure on Bitcoin’s spot price. As ETFs have lower liquidity than futures contracts, short-term volatility could also potentially increase.

Other On-Chain Metrics to Consider

In addition to Bitcoin Open Interest, Glassnode also highlighted an important development regarding the Hot Supply metric.

This metric tracks the amount of BTC that has been held for one week or less. In the last three months, Hot Supply dropped dramatically from 5.9% of the total circulating supply to just 2.8%, reflecting a drop of over 50%.

This suggests that fewer new coins are being traded, reducing the supply of liquid Bitcoin.

Read also: Bitcoin Weakens, Crypto Traders Start Buying These 3 Altcoin!

In addition, BTC inflows to exchanges also experienced a similar trend, dropping from 58,600 BTC per day to 26,900 BTC, or about 54%.

This decrease in inflows can be interpreted as reducedsell-side pressure, but it also signals weakened demand, as fewer coins are being moved to exchanges for trading.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- The Crypto Basic. Bitcoin Open Interest Has Dropped 35% to $37B Since ATH: What This Means for Price. Accessed on March 21, 2025