Bitcoin Market is Predicted to Cool Down in the Next 4-6 Weeks, What will be the Impact?

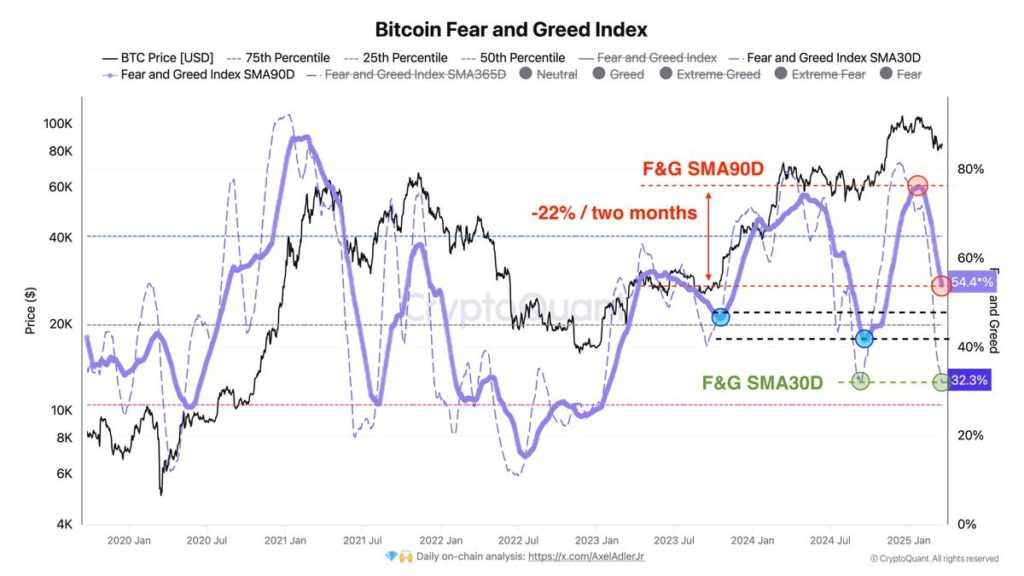

Jakarta, Pintu News – Investor sentiment has been a reliable indicator in analyzing the dynamics of the cryptocurrency market, especially Bitcoin . Based on the latest on-chain data, crypto analyst Axel Adler Jr. predicts that the Bitcoin market could experience a cooling period in the next 4 to 6 weeks. This refers to the changing trend in the Bitcoin Fear and Greed Index, which has been used to measure market psychology.

Sentiment Index Declines: From Extreme Greed to Moderate Levels

The Bitcoin Fear and Greed Index is an indicator that measures the average investor sentiment in the BTC market. The index is divided into five zones: extreme fear, fear, neutral, greed, and extreme greed. Historically, the fear zone is often associated with market lows, while the greed zone coincides with price peaks or potential corrections.

According to Adler Jr. in the past two months, the 90-day simple moving average (90-day SMA) of this index has dropped by about 22 points. This means that the market has moved from a state of extreme greed to a more moderate level of greed. This suggests that investors are becoming more cautious and the market may be preparing to enter a consolidation or correction phase.

Read More: Solana (SOL) Price Movement Faces Important Barriers and Supports March 2025

Market Cooling Predicted in 4-6 Weeks

Adler estimates that if the index drops another 10 to 15 points, the market will enter a cooling off phase. In this phase, market participants usually become more rational, with less emotional reactions to negative news and price fluctuations.

He added that at the current pace, it would take about 4 to 6 weeks for the index to drop that much. If this prediction is accurate, then we could see the Bitcoin market moving in a consolidation pattern or even a mild correction before rallying again.

Historical Pattern: When Indices Fall, BTC Price May Rise

While a drop in the index is often associated with a price correction, Adler reminds us that historical patterns can be different. The last time the index’s monthly average (30-day SMA) hit a low like it is today was when the price of Bitcoin corrected to $54,000. After that, BTC hit a new all-time high.

Thus, if this historical pattern repeats itself, then even if the index goes down, the price of Bitcoin could actually go up after the consolidation period ends. But of course, this still depends on many external factors such as global sentiment, regulation, and market liquidity.

Current Bitcoin Price and Market Position

At the time of writing, Bitcoin is trading slightly below $84,000, registering a 0.5% drop in the last 24 hours. This is still a high price in a long-term context, but it tends to stagnate compared to the surge that occurred earlier this year.

This stagnation supports the analysis that the market is entering a transition phase. On the one hand, investors are no longer as euphoric as before. On the other hand, there has been no major selling pressure to push prices down sharply. This fits Adler’s market cooling narrative.

Conclusion

Changes in the Bitcoin Fear and Greed Index are an important signal for investors to adjust their strategies. If the predictions of a market cooling over the next 4-6 weeks prove to be correct, then there will be opportunities for asset accumulation before the next potential rally. But as always, investors are advised not to rely on just one indicator, but rather combine it with other technical and fundamental analysis to make wiser decisions in this dynamic cryptocurrency market.

Read More: Chainlink (LINK) Tests Critical Support, Potential Price Recovery on Investors’ Eyes

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- NewsBTC. Bitcoin Market May Cool Off In 4 To 6 Weeks. Accessed March 24, 2025.

- Featured Image: Generated by AI