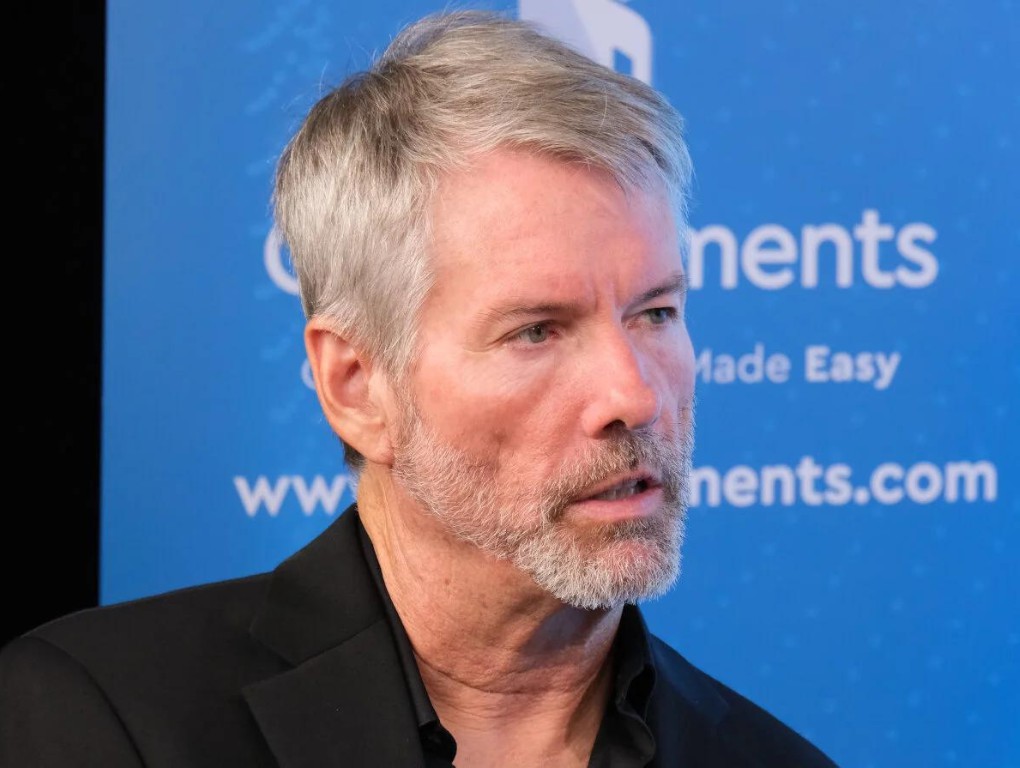

Michael Saylor’s Strategic Move: Doubling Bitcoin Holdings Amid Market Volatility!

Jakarta, Pintu News – Michael Saylor, founder of Strategy, never stops looking for ways to increase his company’s Bitcoin holdings.

With the launch of a new preferred stock called STRF (“Strife”), Strategy is looking to raise more funds to buy Bitcoin (BTC). This move shows how aggressive the company is in strengthening its position in the cryptocurrency market.

Check out the full news below!

STRF Introduction: New Steps in Strategy

Earlier in the week, Strategy announced the launch of a new perpetual preferred stock, STRF, aimed at institutional investors and a select few non-institutional investors.

Compared to STRK’s previous shares, STRF offers a higher coupon of 10% compared to 8%, and has no common stock conversion clause. The net proceeds from the offering will be used for Bitcoin (BTC) acquisition and working capital.

On Friday, Strategy announced an increase in the offering from $500 million to $722.5 million. In the initial sale, the company successfully sold 8.5 million Series A Perpetual Strife Preferred Stock shares at $85 per share, raising approximately $711.2 million.

Also read: Japanese Real Estate Company Accepts Property Payments with XRP, SOL, and DOGE!

Bitcoin Ownership Expansion

With the addition of these new funds, Strategy plans to expand its Bitcoin (BTC) holdings, which already stand at over 499,200 units. Their next Bitcoin (BTC) purchase is expected to push their total holdings to over 500,000 Bitcoin (BTC).

This demonstrates Strategy’s strong commitment to investing a significant portion of its assets in Bitcoin (BTC). Michael Saylor, via platform X, revealed that this increase is part of a long-term strategy to continue strengthening Strategy’s position as one of the largest institutional holders of Bitcoin (BTC).

Also read: Ripple Addresses SEC! Offers 3 Powerful Solutions to End Crypto Regulatory Chaos in the US

Long-term Vision and Acquisition Strategy

Under Saylor’s leadership, Strategy plans to raise $42 billion in the next few years through the sale of securities to acquire Bitcoin (BTC). Their focus on fixed-income assets shows Strategy’s adaptability to crypto market fluctuations.

Currently, Bitcoin (BTC) ‘s value stands at $84,386, indicating significant growth potential. This aggressive strategy not only boosts Bitcoin’s (BTC) Strategy portfolio but also positions it as a key player in the global crypto industry.

Conclusion

Strategy’s bold move under Michael Saylor’s direction represents a long-term play in the cryptocurrency space. With a significant capital raise and a focus on Bitcoin (BTC), Strategy is on the path to becoming more than just a software company; they are transforming into a dominant entity in the cryptocurrency market.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. Michael Saylor Explains Strategy’s Bitcoin Bet: Key Takeaways. Accessed on March 24, 2025

- Featured Image: Decrypt