Fidelity Enters the Crypto Arena: Launches Tokenized US Treasury Funds on Ethereum to Take On BlackRock!

Jakarta, Pintu News – Fidelity Investments, a global asset management giant with nearly Rp96 quadrillion ($5.8 trillion) under management, is shaking up the crypto world once again.

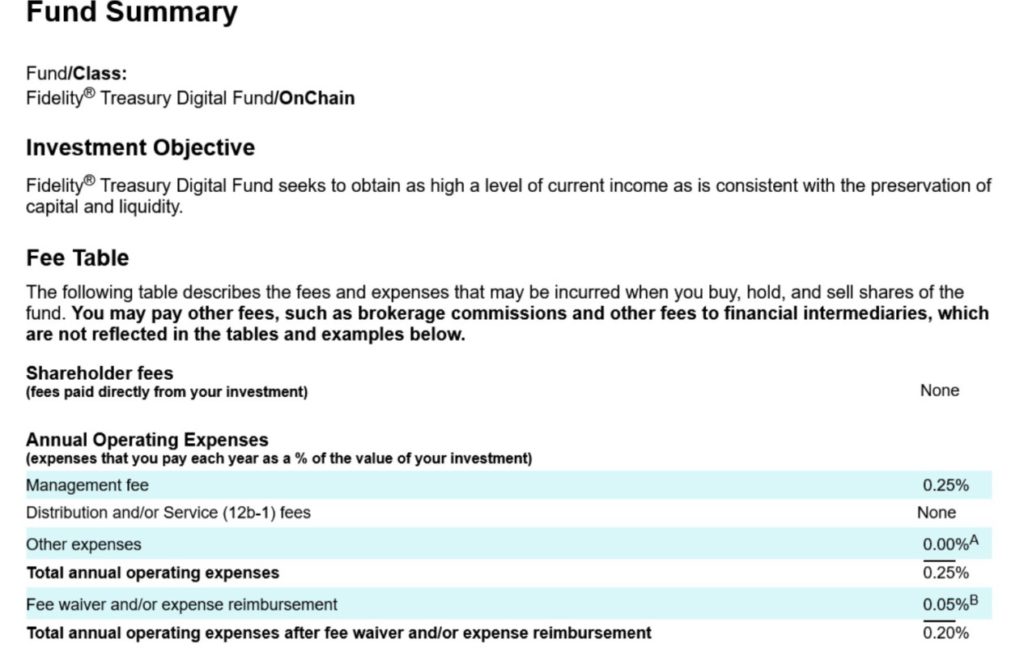

The company has just filed documents with the United States Securities and Exchange Commission (SEC) to launch a tokenized share class of their US dollar-based money market fund.

The fund, named Fidelity Treasury Digital Fund (FYHXX), will be secondary listed on the Ethereum blockchain network under the share class name “OnChain”. This move marks a new chapter in the integration of traditional finance with the cryptocurrency world.

Tokenization on Ethereum, Transparency and Innovation for Financial Markets

Fidelity explains that the FYHXX fund consists almost entirely of US government debt securities (US Treasury Bills), which is about 99.5%, and will not directly invest in cryptocurrencies such as Bitcoin or Ethereum (ETH).

Read also: Ripple Addresses SEC! Offers 3 Powerful Solutions to End Crypto Regulatory Chaos in the US

Transaction recording will be done through Ethereum for transparency and secondary record keeping, while the main ledger remains on the traditional system. This means that the Ethereum blockchain will be used as a supplementary record that is reconciled daily by Fidelity’s authorized transfer agents.

The main objective of the OnChain class is to provide investors with visibility and tracking of publicly verifiable transactions. Although not a primary record of ownership, the use of blockchain in this record-keeping mechanism is considered a step forward in the modernization of financial infrastructure.

Fidelity is also looking to expand to other blockchain networks in the future to expand its reach and efficiency.

Fidelity’s Serious Strategy to Rival BlackRock in the Crypto World

While BlackRock currently leads the real world assets (RWA) tokenization market with its BUIDL product worth over IDR 24 trillion ($1.46 billion), Fidelity is starting to catch up.

The move follows Fidelity’s earlier initiative in late 2024 to introduce staking in their Ethereum ETF. Tokenization of traditional financial funds is becoming a new trend that major companies are interested in integrating blockchain technology into their systems.

With Fidelity joining the Ethereum-based tokenization space, the company is putting itself in direct competition with other large financial institutions.

According to data from rwa.xyz, the current value of the US Treasury tokenization market is over IDR 79 trillion ($4.78 billion), and over IDR 54 trillion ($3.3 billion) of that is tokenized on the Ethereum network.

Ethereum is seen as a top choice thanks to its decentralization, security, and wide adoption in the crypto sector.

Read also: Ethereum Price Corrected Today (3/24/25): What Happened to ETH?

The Impact on Ethereum and the Future of Financial Tokenization

Not only did this news impact the traditional financial industry, it also had a positive effect on the price of Ethereum. Following Fidelity’s announcement, the price of ETH increased by almost 2%, trading above IDR 33,000,000 ($2,000).

This rise comes amid negative pressure on ETH in recent weeks, including Standard Chartered’s 60% cut in its 2025 price projection.

BlackRock even stated that Ethereum is the “natural default answer” for TradFi (Traditional Finance) companies looking to take advantage of real asset tokenization. Ethereum’s advantages in security, scalability, and a mature ecosystem make it the backbone of tokenization in the digital finance era.

Fidelity also seems to emphasize that the future of the world of investment and cryptocurrency will go hand in hand through technological bridges such as Ethereum.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Fidelity Files For Tokenized US Dollar Money Market Fund On Ethereum. Accessed March 24, 2025.

- Cointelegraph. Fidelity Files Ethereum-Based US Treasury Fund Called ‘OnChain’. Accessed March 24, 2025.