XRP Struggles to Break $2.56 Resistance: Is this a Sign of Continued Consolidation?

Jakarta, Pintu News – XRP , one of the popular cryptocurrencies, has recently had difficulty breaking through the key resistance level of $2.56. This obstacle has occurred twice this month, suggesting that there are strong barriers before reaching the $3.00 target. Despite some positive movement, this failure may signal a continued consolidation phase, especially given the current market conditions.

XRP Investors Face Uncertainty

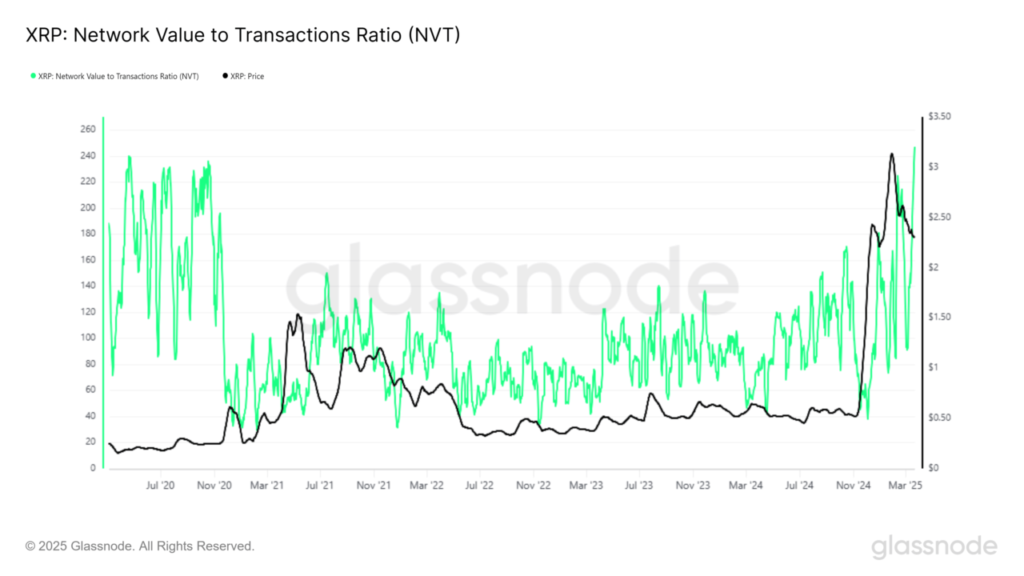

The Network Value to Transaction (NVT) ratio for Ripple (XRP) has reached a five-year high, a condition that hasn’t been seen since January 2020. This ratio compares a cryptocurrency’s market capitalization to the volume of transactions conducted on its network. A high NVT ratio indicates that while investors are optimistic, that optimism is not converting into real growth or network usage.

This often indicates an overheated market, which may be due for a correction when enthusiasm subsides. Current conditions suggest that XRP’s value is outpacing its transaction activity, which is a bearish signal. This imbalance could lead to a price correction, which would further hamper XRP’s attempts to break through key resistance levels.

Read More: Solana (SOL) Price Movement Faces Important Barriers and Supports March 2025

XRP’s Macro Momentum Shows Signs of Pressure

Ripple’s (XRP) network growth is currently at its lowest point in four months, reflecting a decline in the rate of new address creation. This metric is crucial for assessing a cryptocurrency’s traction in the market, as an increase in the number of active addresses usually indicates wider adoption. In the case of XRP, the lack of new address creation suggests that the altcoin is struggling to attract new investors. The lack of incentive for new investors to join the network further weakens XRP’s prospects.

XRP’s difficulty in finding an exit point

Currently, Ripple (XRP) is trading at $2.40, slightly below the $2.56 resistance. This level has proven to be a strong barrier, with XRP failing to break it twice this month. As a result, the altcoin is likely to continue consolidating between the $2.27 and $2.56 range. This consolidation period may continue if market conditions remain unchanged. If bearish conditions worsen, XRP could fall below the $2.27 support.

In this case, the price may drop to $2.14 or lower, erasing most of the recovery from the $2.00 level. A continuation of this downward movement would reinforce the bearish view. However, if XRP can break the $2.56 resistance and turn it into support, the bearish thesis will be invalidated. A successful breakout could push XRP towards $2.95 and, eventually, to the $3.00 mark.

Conclusion

With the current challenges faced by Ripple (XRP), investors and market watchers should pay attention to key indicators that could provide further insight into the future direction of this cryptocurrency. Failure or success in breaking through key resistances will largely determine the price dynamics of XRP in the near future.

Read More: Chainlink (LINK) Tests Critical Support, Potential Price Recovery on Investors’ Eyes

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. XRP: New Investor Rate Falls, Price Struggles. Accessed on March 24, 2025

- Featured Image: Crypto Rank