Bitcoin to Hit $110K? Arthur Hayes Drops Bold Prediction — Here’s What’s Fueling the Surge!

Jakarta, Pintu News – Former BitMEX CEO Arthur Hayes has made another splash by predicting that the price of Bitcoin will soar to $110,000 in the near future.

This prediction comes as the crypto market prepares for the release of US core PCE inflation data, which is a key reference for the Federal Reserve’s monetary policy. Hayes believes that the Fed’s policy shift from quantitative tightening (QT) to quantitative easing (QE) will create a flood of liquidity that drives Bitcoin prices higher.

Amid global uncertainty, the oldest cryptocurrency is back in the spotlight as a promising hedging asset.

From QT to QE: The Key to Bitcoin’s Price Rise

Read also: Pakistan Turns Power Waste into Profit: Is Bitcoin the Country’s Economic Lifeline?

Arthur Hayes thinks that the Fed’s policy shift is the main trigger for the current Bitcoin price increase. According to him, the Federal Reserve will soon shift from the QT policy-which suppresses the money market-to a looser QE and support risky assets such as cryptocurrencies.

In his latest tweet, Hayes mentioned that inflation is temporary and the trade tariffs imposed by the Trump administration will not have a major impact on BTC prices.

Apart from Hayes, analyst from 10X Research, Markus Thielen, also shared a similar view. He thinks that the Fed’s dovish stance on inflation, as well as signals of political relaxation, will help boost investor confidence.

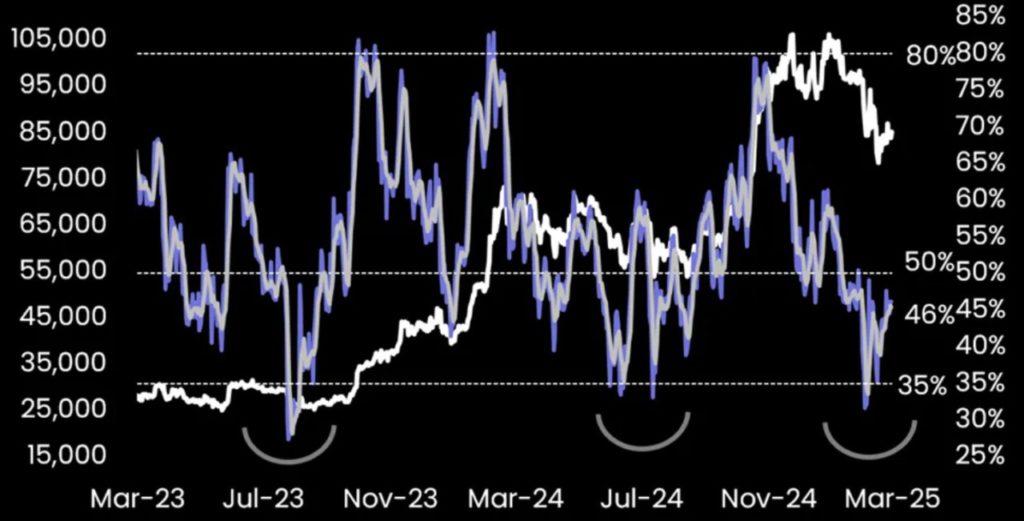

Technical indicators have also strengthened, supported by a long-term accumulation trend from large Bitcoin holders. This suggests that the market is still in a bullish phase, although there is no catalyst to trigger a parabolic spike in the near future.

After Reaching the Peak, BTC May Experience a Correction to $76,500

Bitcoin’s current price (25/3/25) has risen 1.80% and is trading at IDR 1,446,027,101 ($86,932), with daily trading volume jumping 128% to $34.04 billion.

This sharp rise was also reflected in the derivatives market, where open interest in Bitcoin futures contracts increased by 7.79% and surpassed IDR 928 trillion ($56 billion). This surge signals investors’ optimistic sentiment towards BTC’s future price movements.

However, Hayes also cautioned that after reaching the peak of IDR 1.82 billion, a correction to IDR 1,266,684,000 ($76,500) is still possible. This is considered part of the natural cycle of the crypto market, which is known for its high volatility but tremendous profit potential.

As such, investors are asked to remain cautious even though the short-term outlook looks promising.

Institutions Rush BTC: ETFs and Corporates Drive Demand

Furthermore, institutional interest in Bitcoin has been steadily increasing in recent weeks, providing additional fuel for the next potential rally.

Spot Bitcoin ETFs in the US recorded six consecutive days of inflows, signaling strong demand from institutional investors. BlackRock alone absorbed more than IDR8.89 trillion ($537 million) in the period, according to data from Farside Investors.

Read also: Michael Saylor All-In! Raises a Fantastic $722 Million to Buy Bitcoin

On the corporate side, Japanese company Metaplanet just bought 150 BTC worth around Rp1.25 trillion ($12.6 million), bringing its total holdings to 3,350 BTC. With an average purchase price of Rp1,379,330,192 ($83,801), the company has posted a 68.3% gain over the year.

Meanwhile, MicroStrategy’s Michael Saylor also implied further BTC buying in the near future.

All in all, Arthur Hayes’ optimistic prediction is new fuel for a crypto market that is showing signs of revival.

With support from the Fed’s monetary policy, institutional capital flows, and analysts’ confidence, Bitcoin has great potential to break its new high of IDR1.82 billion.

While volatility remains an integral part of the cryptocurrency market, the current direction of movement gives hope that the future of BTC is still very bright for long-term investors.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Price Going To $110K Says Arthur Hayes Before US PCE Data Release. Accessed March 25, 2025.

- Crypto Briefing. Bitcoin Price Prediction: Arthur Hayes Expects $110K BTC Before Pullback. Accessed March 25, 2025.

- Crypto Times. Bitcoin Jumps to $87,000 as Arthur Hayes Predicts $110K Soon. Accessed March 25, 2025.