Aave’s 30% Upside Potential: Analysis and Predictions in Navigating the April 2025 AAVE Market Situation

Jakarta, Pintu News – After experiencing a significant decline of 30.91% in the past month, Aave is starting to show signs of recovery. In the past week, it has risen by 6.66% and an additional 1.40% in the past 24 hours.

Increased liquidity in the Aave protocol has contributed to this growth, and there is further potential for price increases once it overcomes some key barriers.

Navigating the AAVE Rocky Road

Aave (AAVE) is currently at an important junction, attempting to break out of the descending line pattern formed on its 4-hour chart. This pattern is often considered bullish in most cases in the market. If Aave (AAVE) takes a bullish path, the asset needs to break the descending line-its first obstacle-and then rally at least 30.72% towards the next major obstacle, which is the supply region marked on the chart.

This region is important because it triggered Aave (AAVE)’s decline that started on March 5. Aave (AAVE) could experience a further decline from the supply level or consolidate within the region, as seen on the left side of the chart. If market momentum remains high and Aave (AAVE) breaks out of this supply region, the asset could surge again, with a potential upside of up to 42%.

Also Read: Trump Family Invests Big in MNT Token Post Mantle Network Update!

Ecosystem Growth and Reduced Selling Pressure

Analysis from AMBCrypto suggests that the flow of liquidity into the Aave ecosystem (AAVE) will play a key role in achieving the ability to overcome the current declining line resistance. The ratio of market capitalization to Total Value Locked (TVL) is a metric used to assess the value of the ecosystem relative to price growth.

When low, it indicates that the ecosystem is growing with more interactions from the participants, which has a long-term effect on the price. Currently, the ratio stands at 0.15, signaling the growth of the ecosystem. Therefore, it is only a matter of time before Aave (AAVE) rallies. In the spot market, selling pressure has decreased among traders who were previously very bearish.

On March 19, these traders sold $5.5 million worth of Aave (AAVE), a trend that continued in the following days with another million-dollar sale. Recent data shows that sales have dropped to just $110,000-a significant drop. This change suggests that sellers are dwindling, and buying may begin soon.

Optimism in the Derivatives Market

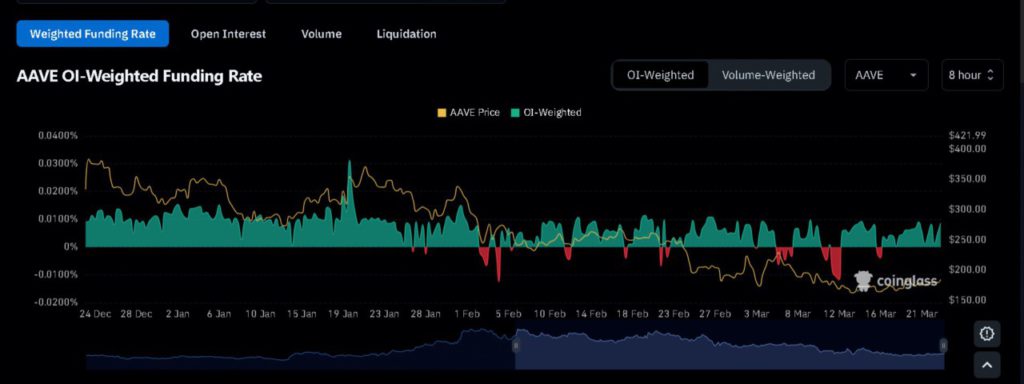

Even in the derivatives market, traders are betting on a rise in the price of Aave (AAVE). Currently, the OI Weighted Funding Rate, which combines funding and Open Interest to determine market sentiment, has turned positive to 0.0087%. This positive reading indicates that buyers in the market are taking over, as more unsettled contracts are dominated by long positions, which pay premium fees periodically to maintain their positions.

The volume of the derivatives market is also leaning in a bullish direction, as the Taker Buy-Sell Ratio has changed to 1.0056. Whenever this ratio crosses above 1, it indicates more buying than selling in the last 24 hours. If this key metric continues to turn positive, then Aave (AAVE) could see big price gains this week.

Conclusion: AAVE’s Bright Prospects

With increased liquidity and decreased selling pressure, as well as positive sentiment in the derivatives market, Aave (AAVE) is on track to achieve significant price gains. Market watchers and investors will continue to monitor these indicators to make informed investment decisions. The potential gain of 30.72% charted on the chart could be realized if these conditions continue to support the growth of Aave (AAVE).

Also Read: Metaplanet Adds 150 Bitcoins, New Strategy After Eric Trump’s Advisor Appointment!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Aave eyes 30% rally despite key hurdles – How it can happen. Accessed on March 25, 2025

- Featured Image: Crypto Economy