Is Bitcoin (BTC) about to experience selling pressure? Whale Activity Increases!

Jakarta, Pintu News – Large Bitcoin holder activity has picked up again, signaling possible impending selling pressure. Data from exchanges shows a quiet but significant distribution. The exchange’s Whale Ratio, which is an important indicator in Bitcoin (BTC) analysis, has reached its highest level in recent months, sparking concerns about potential massive selling.

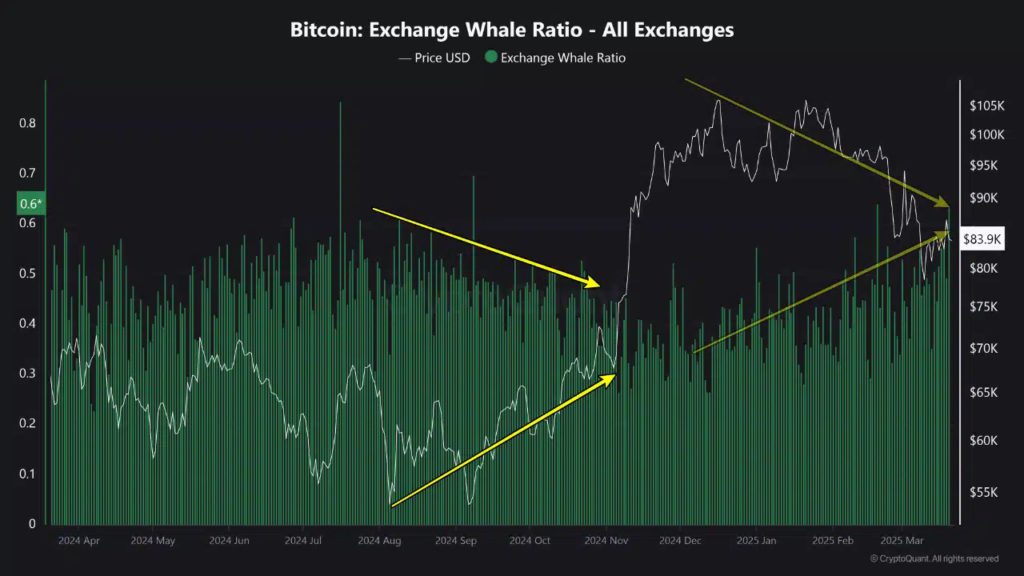

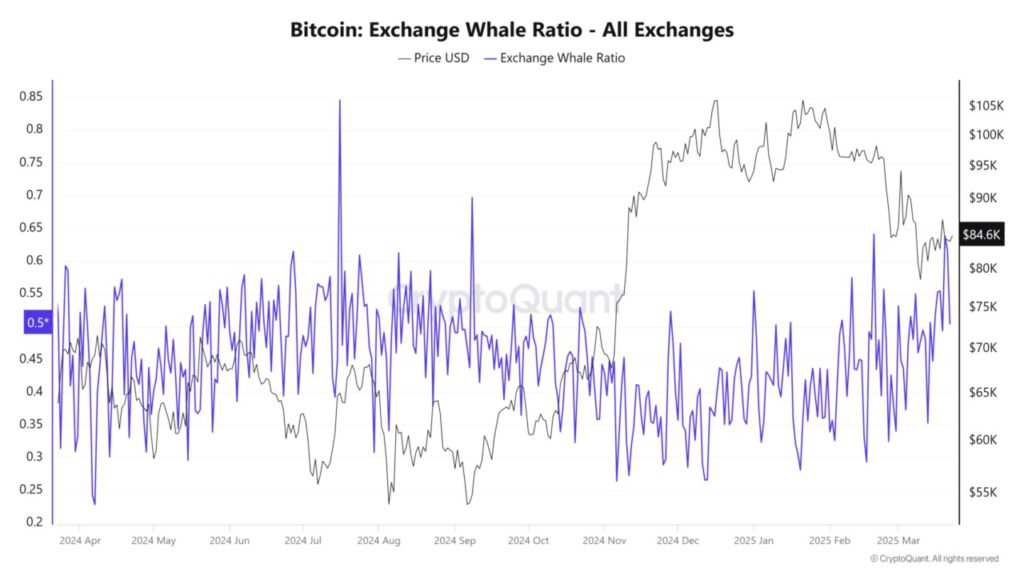

Exchange Whale Ratio Analysis

The Exchange Whale Ratio (EWR) has surged past the 0.6 mark, an indicator that large holders tend to distribute their holdings when this value is exceeded. According to analysts from CryptoQuant, this increase could signal impending selling pressure in the market. This increase coincides with an important turning point in Bitcoin’s (BTC) price action.

Since the fourth quarter of 2024, EWR has shown a significant increase. Although whale inflows did not peak at the time of the highest price, the previous gradual increase suggests early profit-taking. In December 2024, despite the decline in Bitcoin (BTC) price, whale inflows increased, suggesting distribution.

Also Read: Trump Family Invests Big in MNT Token Post Mantle Network Update!

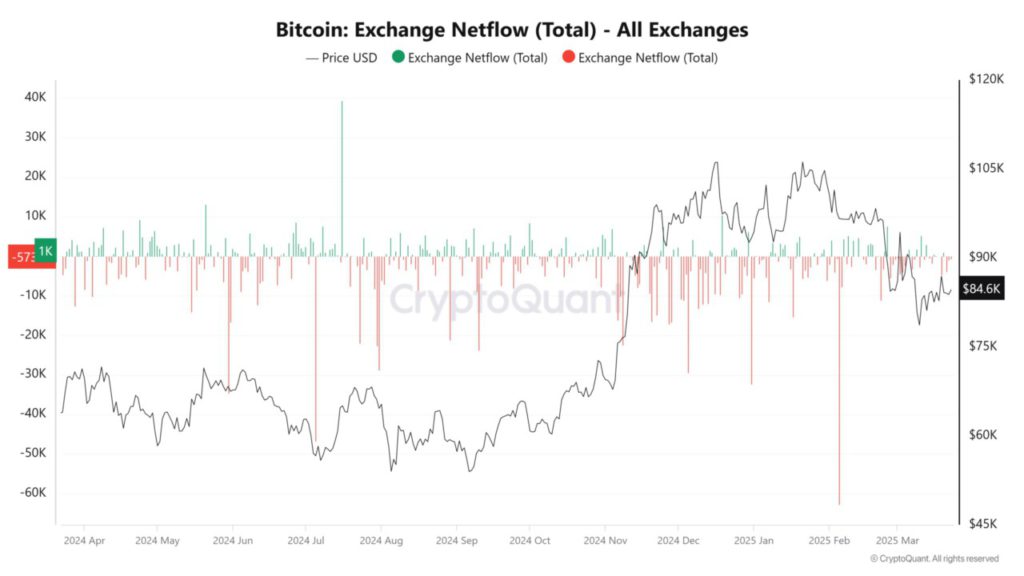

Exchange Fund Flow Dynamics

Net fund flow data from exchanges shows a change from bullish outflows to signs of redistribution. Between April and October 2024, monthly outflows typically range from 30,000 to 60,000 BTC. However, this trend began to change in the fourth quarter of 2024. On November 24, net inflows reached +7,033 BTC, indicating that early market participants began to realize profits.

After reaching the highest price on December 17, the fund flow showed a withdrawal of 1,531 BTC, smaller than the previous accumulation phase. Post-peak, fund flows became more volatile. While not entirely bearish, the moderate net fund flow combined with the high EWR suggests that whales are still transferring coins to exchanges, albeit on a smaller scale.

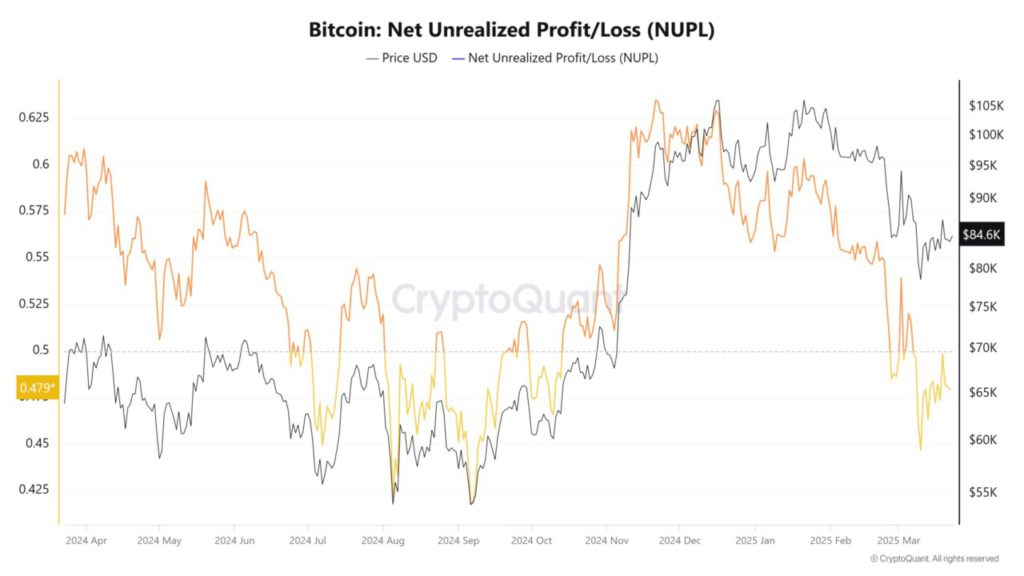

Profit/Unrealized Ratio Analysis (NUPL)

The NUPL ratio, which measures unrealized profits in the network, increased from 0.442 to 0.627 between August and December 2024, reflecting widespread profits and supporting the Bitcoin (BTC) rally. By March 2025, the NUPL dropped to 0.480, indicating that the market was still profitable but had entered the realization phase. The sharper decline in NUPL compared to the price correction suggests that whales and long-term holders are among those realizing profits.

Conclusion: Is This Just a Pause or a Turning Point?

With whale activity on the rise, profit-taking underway, and volatility still present, the market seems to be holding its own. Despite indications of distribution, the NUPL still showing gains and the stabilization of net fund flows signal that the market is still in a state of balance. Is this just a pause before the next spike or are we about to witness a pivot in the Bitcoin (BTC) market dynamics?

Also Read: Metaplanet Adds 150 Bitcoins, New Strategy After Eric Trump’s Advisor Appointment!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin’s exchange whale ratio spikes to yearly high; will whales trigger a sell-off? Accessed on March 25, 2025

- Featured Image: Generated by AI