Stablecoins Reach Record Highs: New Signals for the Future of Crypto in 2025

Jakarta, Pintu News – While the crypto market is experiencing an overall price decline and correction, recent data from stablecoins shows a different story. With total market capitalization hitting a new record high, stablecoins seem to be the key to the next big move in the market.

What Increasing Stablecoin Market Capitalization Means

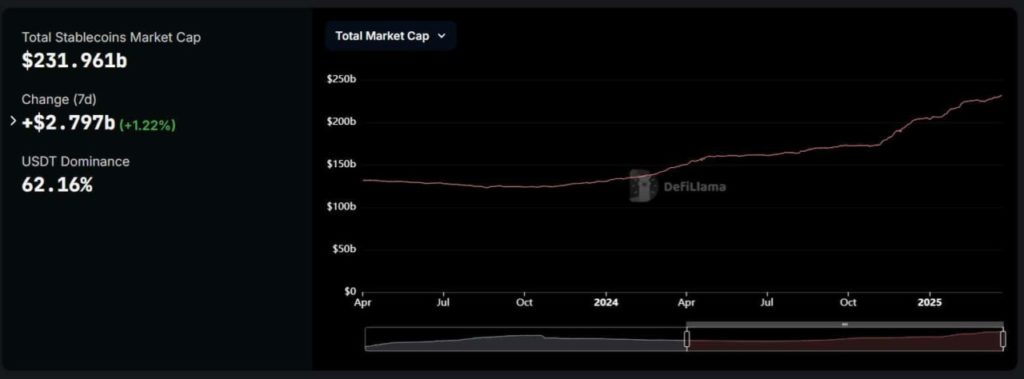

The stablecoin market capitalization has reached a new peak of $231.96 billion, with an increase of $2.8 billion in just the last week according to data from DeFiLlama. This continued growth, which has increased by more than 50% since mid-2023, indicates a consistent flow of liquidity into the market, often an early indicator of bullish momentum.

Historically, the prolonged expansion of stablecoin supply has aligned with the accumulation phase that precedes market rallies. Current conditions are in stark contrast to the sharp outflows that occurred during the 2022 bear market, when capital left exchanges. With Tether maintaining dominance at 62.16%, the data supports the view that the market is still well positioned to continue the bull cycle.

Also Read: Trump Family Invests Big in MNT Token Post Mantle Network Update!

History of Bitcoin’s (BTC) Big Rally

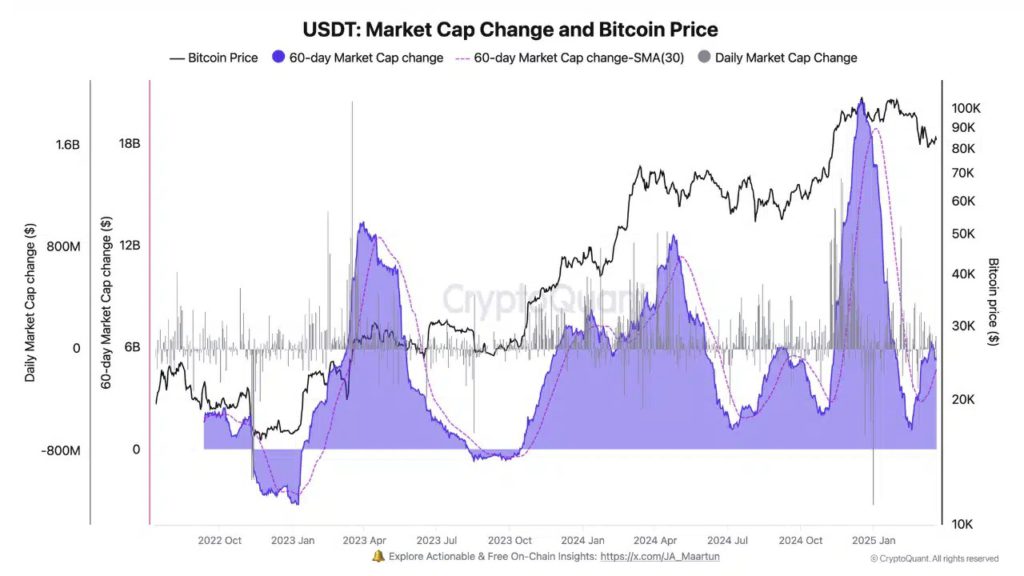

Changes in the 60-day market capitalization of Tether (USDT) show a clear historical pattern: when the supply of USDT increases rapidly, Bitcoin tends to follow with strong price increases. Data from CryptoQuant shows that spikes in USDT issuance in early 2023, late 2023, and early 2024 all preceded significant price spikes in Bitcoin (BTC).

After the latest correction, the 60-day change has turned positive again, indicating a new influx of liquidity. This is in line with previous bullish setups, where new stablecoin supply signals investors’ readiness to re-enter risky assets – often acting as a precursor to broader market momentum.

Potential Market Reengagement

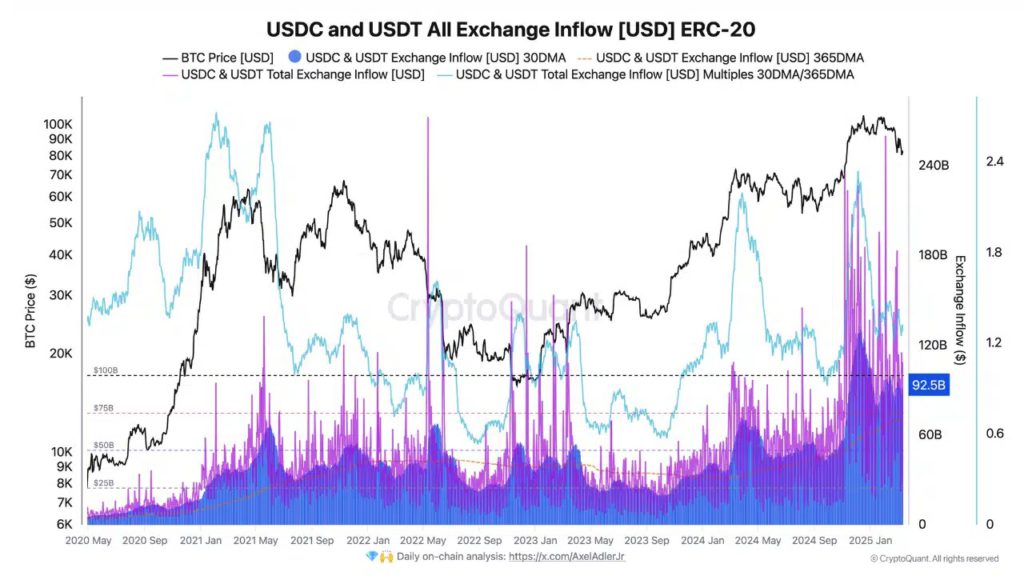

This chart tracks Tether (USDT) and USD Coin inflows to exchanges alongside the price of Bitcoin (BTC). Historically, spikes in stablecoin inflows have coincided with local peaks or bottoms, often foreshadowing volatility. The latest surge – reaching over $92.5 billion – marks one of the highest levels of inflows ever recorded. This suggests that investors are moving ‘dry powder’ onto exchanges, usually a sign of preparation for market action.

The 30DMA/365DMA ratio also shows a marked increase, suggesting that short-term inflows are accelerating compared to the long-term average. While not a directional signal on its own, the increased presence of stablecoins on exchanges suggests renewed participation… perhaps, the early stages of a new market cycle.

Conclusion

Stablecoin activity offers a clear window into investor sentiment. Increased market capitalization and inflows to exchanges signal that capital isn’t exiting the ecosystem – it’s waiting. In contrast to volatile assets, stablecoins reflect readiness: the intention to deploy funds when conditions align. When Tether (USDT) or USD Coin (USDC) inflows increase, it often precedes higher trading activity or a market rally.

Also Read: Metaplanet Adds 150 Bitcoins, New Strategy After Eric Trump’s Advisor Appointment!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Stablecoins at All-Time Highs: What This Signals for Crypto’s Future. Accessed on March 25, 2025

- Featured Image: Coingape