Will Stellar (XLM) Experience Recovery After Drastic Decline? Here’s What Analysts Are Saying!

Jakarta, Pintu News – The crypto market is always full of unpredictable dynamics, and Stellar is no exception. With a history of sharp price fluctuations, investors and market watchers are keeping a close eye on any moves that may signal a change in trend. Recent analysis suggests some patterns that could be key to understanding the future of Stellar (XLM).

Short-term Bubble Risk Analysis

The Stellar (XLM) short-term bubble risk oscillator has shown a consistent pattern of predicting price declines. Whenever this oscillator reaches above 0.5, the price of Stellar (XLM) tends to experience a significant drop. For example, in 2017, when Stellar (XLM) peaked at $0.9, it wasn’t long before the price fell to $0.1.

A similar pattern occurred again in 2021 and 2025, with the price drop reaching more than 80%. When this oscillator shows a drop below 0.5 and the price stabilizes above $0.4, it may signal the beginning of a bullish phase. This gives hope that Stellar (XLM) may be entering a period of stabilization and continued growth.

Also Read: Trump Family Invests Big in MNT Token Post Mantle Network Update!

Down from All-Time Highs

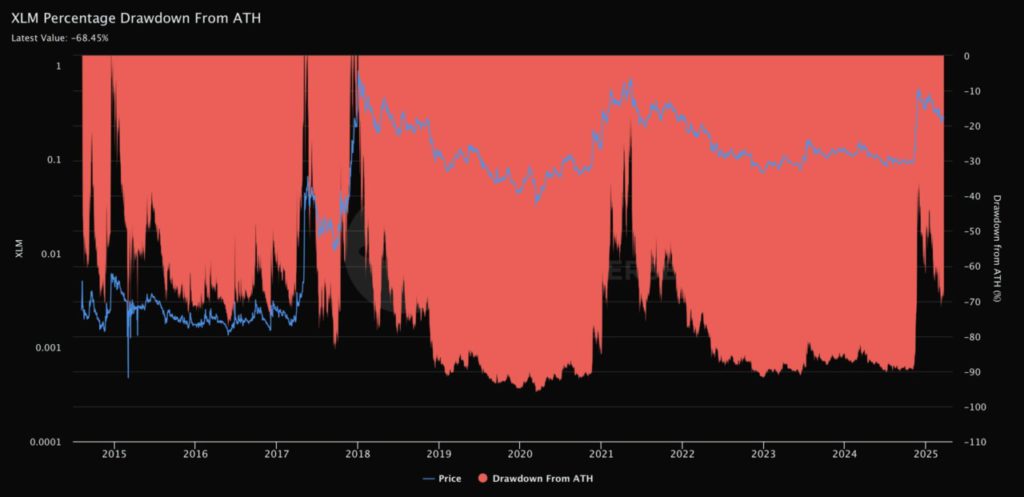

Stellar (XLM) has experienced some drastic drops from its all-time high. After reaching $0.9 in 2018, the price of Stellar (XLM) dropped by more than 90% to $0.1. A similar drop occurred after reaching $0.7 in 2021, with a drop of up to 80%.

This pattern shows that Stellar (XLM) is a highly volatile asset and is likely to experience a sharp decline after reaching a peak. However, if the price can stabilize above $0.4 and the decline from the high does not exceed 50%, this could be a strong indicator that Stellar (XLM) may be about to experience a recovery and enter a more stable bullish phase.

Liquidation Risk and Safe Entry Zone

The Stellar (XLM) liquidation heatmap shows key liquidity zones and price fluctuations between $0.262026 and $0.289401. With the current price at $0.263026, there is a significant risk of liquidation if the price rises above $0.28. Zones with lower liquidity are at $0.27 and $0.265, which offer safer entry points with minimal liquidation pressure.

If the price of Stellar (XLM) can break above $0.289401 with reduced liquidation pressure, this could be a signal of a bullish trend, making entry points above $0.29 even more feasible for momentum-following traders.

Conclusion

Although Stellar (XLM) has experienced many ups and downs, recent analysis suggests that there is potential for recovery if several conditions are met. Stabilization of the price above $0.4 and a decrease in the risk of liquidation could be key to a sustained growth phase. Investors and market watchers should continue to monitor these indicators to make informed investment decisions.

Also Read: Metaplanet Adds 150 Bitcoins, New Strategy After Eric Trump’s Advisor Appointment!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Mapping Stellar’s Market Cycles: Can XLM’s Current Downtrend Reverse? Accessed on March 25, 2025

- Featured Image: VOI