Top Crypto Price Analysis & Predictions: Fartcoin, Ethena, and Pi Network!

Jakarta, Pintu News – Crypto prices remained stable on Monday (24/3/25) morning as investors welcomed the latest reports on tariffs imposed by Donald Trump.

The reciprocal tariffs planned to take effect on April 2 will not cover industrial sectors such as automotive and microchips. As a result, the price of Bitcoin surged past $86,000, while Ethereum rose above $2,000.

Stocks in the United States also saw a recovery, with futures contracts related to the Dow Jones up 230 points, and the Nasdaq 100 up 150 points. This article also discusses some of the top tokens such as Fartcoin , Ethena , and Pi Network (PI).

Fartcoin Price Prediction

Read also: Dogecoin Open Interest Hits $1.73 Billion, Analysts Predict DOGE to Soar up to 1200%!

Fartcoin, one of the top meme coins on the Solana network, has performed quite well in recent weeks.

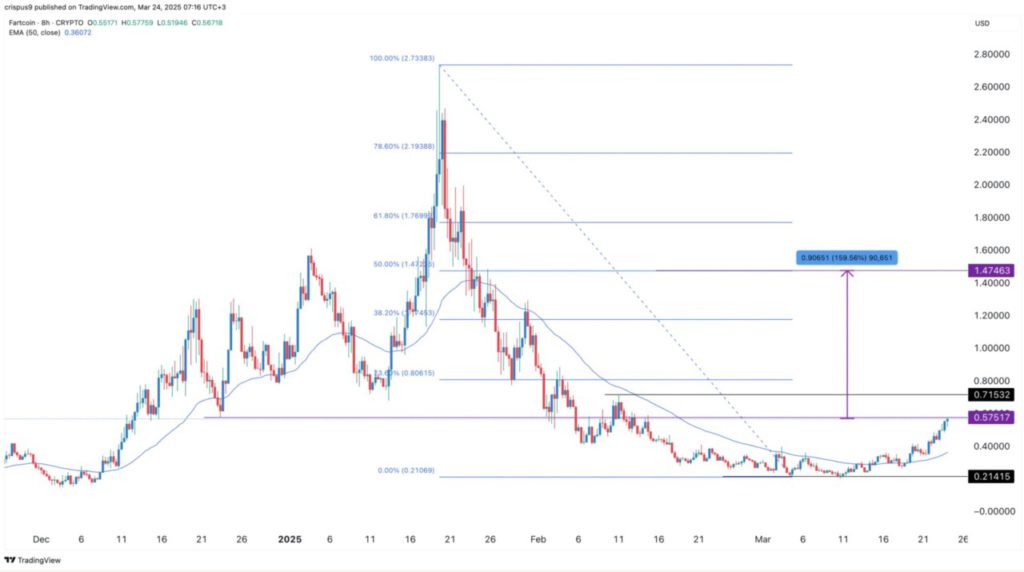

It hit a low of $0.2140 this month, and is now slowly starting to form a rounded bottom pattern, which is known as a popular uptrend continuation (bullish) signal.

On the eight-hour chart (3/24/25), it can be seen that the top of this curved bottom pattern is at $0.7153, which was the highest point on February 11. The price of Fartcoin has also broken the 50-period moving average, signaling that buying (bullish) pressure is building.

The Relative Strength Index (RSI) and MACD indicators are both pointing in an upward direction, signaling an acceleration in price gains. Fartcoin has also retested the important resistance level at $0.5750, which was the low point on December 21 last year.

As of March 24, 2025, the price of Fartcoin is approaching the 23.6% Fibonacci Retracement level of $0.80. Therefore, it is likely that the token’s price will continue to rise, with the primary target being the $0.7153 resistance level-the highest point on February 11.

If the price manages to break through this level, then there is potential for a further increase towards the 50% retracement level at $1.4745, or an increase of about 160% from the current level. However, if the price drops below the $0.40 support level, then this upside prospect could be considered canceled.

Ethena Price Prediction

Ethena (ENA) has become one of the most popular and well-capitalized cryptocurrencies, backed by its proprietary stablecoin USDe and investment from World Liberty Financial.

The USDe stablecoin has attracted more than $5.3 billion in assets, making it the 26th largest coin in the world.

USDe increased in popularity because it offers a fairly high yield of around 4%. Currently, the stablecoin is used by nearly 600,000 users. In addition, Ethena is also growing thanks to another stablecoin, USDtb, which has attracted more than $1.18 billion in funding.

However, in recent months, the ENA token has not performed so well. Its price plummeted from a high of $1.3265 on December 16 to $0.3378. This decline was largely due to the massive sell-off in the crypto market and concerns that Ethena’s stablecoin could suffer a similar fate to Terra.

However, there are indications that the ENA price has bottomed out at $0.3378. The MACD and Relative Strength Index (RSI) indicators show a bullish divergence pattern, which signals a potential reversal.

Therefore, it is likely that the price of ENA will continue to rise, with the main target at the $1 resistance level-about 160% higher than the current position.

Pi Network Price Analysis

Read also: Analysts Find Bullish Pattern, Pi Network Price Could Surge?

On the two-hour chart (24/3/25), it can be seen that the Pi Network (PI) token price briefly peaked at $3, but has now plummeted and broken the important support level of $1.

The price has also gone below all the moving averages, indicating that bearish selling pressure is still dominating the market.

But on the positive side, the price of Pi coin formed a falling wedge pattern, which often signals an upward reversal. The upper side of this wedge connects the highest points since February 28, while the lower side connects the lowest points since March 2. These two lines are now approaching the point of confluence.

As such, it is likely that the Pi coin price will experience a fairly strong recovery in the near future, with the potential to rise all the way to the $1.80 level-an increase of about 86% from the current price. This level was the highest point on March 18.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Invezz. Top crypto price predictions: Fartcoin, Ethena, Pi Network. Accessed on March 25, 2025