Ethereum Holds Strong at $2,000 — Is a Massive Surge to $10,000 Just Around the Corner?

Jakarta, Pintu News – Ethereum is once again drawing attention in the crypto market as the amount of ETH held on centralized exchanges drops to an all-time low.

This trend, revealed by recent on-chain data, suggests that more investors are moving their ETH off exchanges—often a sign of long-term holding intentions.

For traders and investors, this shift is raising questions about what comes next. A shrinking supply on trading platforms typically reduces selling pressure, which could pave the way for upward price momentum.

With fewer tokens readily available for trade, even small surges in demand could have a bigger impact on price. So, where is Ethereum headed next—and could today be the beginning of a major move?

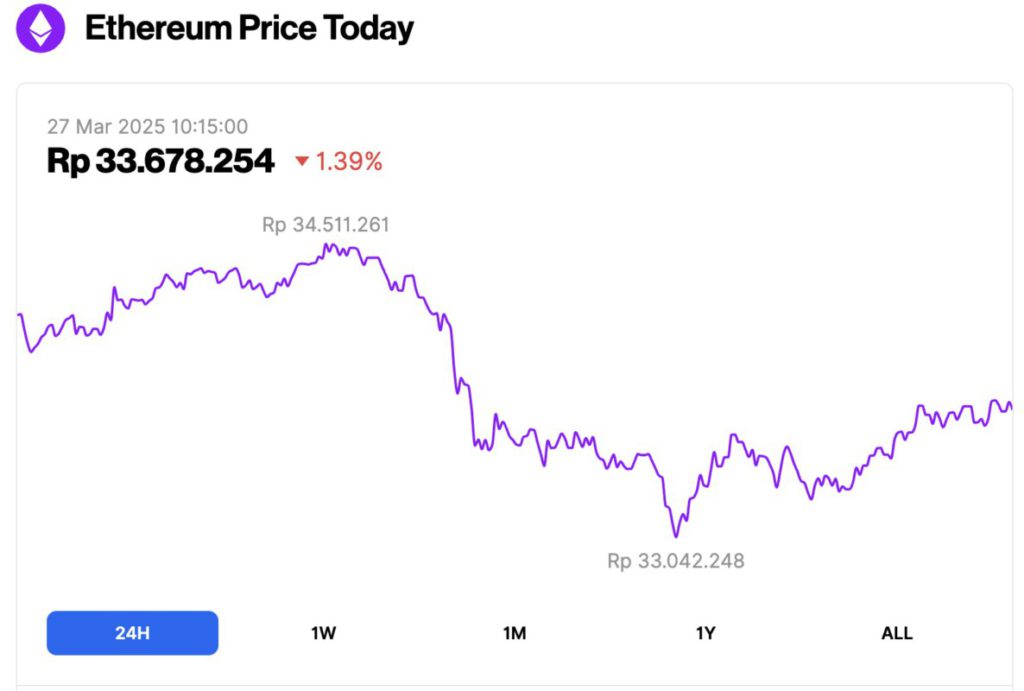

Ethereum Price Drops 1.39% in 24 Hours

As of March 27, 2025, Ethereum (ETH) was trading at approximately $2,029, or around IDR 33,678,254. Over the past 24 hours, the price has slipped by 1.39%. During that time, ETH reached a high of IDR 34,511,261 and dipped to a low of IDR 33,042,248.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $244.89 billion, with daily trading volume falling 16% to $13.19 billion within the last 24 hours.

Read also: Bitcoin Holds Steady at $87K Today (March 27) — Is a Massive Price Surge Just Around the Corner?

ETH Supply Crisis and Its Impact

The percentage of Ethereum (ETH), the world’s second-largest cryptocurrency, held on centralized exchanges continues to fall sharply.

According to on-chain data shared by Chain Brief on the X platform, currently only around 14% of the total ETH supply remains on centralized crypto exchanges. This is the lowest level ever recorded for the second-largest crypto asset.

Based on historical trends, a decrease in the amount of ETH on exchanges usually indicates that investors are moving their assets to private wallets or staking platforms, which indirectly reduces the supply available for trading.

This change also reflects the growing interest in decentralized finance and self-management of assets. More and more investors are choosing to store their ETH off-exchange, reinforcing Ethereum’s image as a long-term investment asset.

If demand for ETH continues to rise, the increasingly limited supply on exchanges could trigger a significant price spike in the near future.

Ethereum Consolidation: Toward the Next Price Spike?

In line with current market conditions, the data shows that Ethereum’s price movement is entering a consolidation phase after breaking through the psychological level of $2,000.

In a post on the X platform, renowned crypto analyst and trader Adam Horton mentioned that ETH is now moving sideways.

Read also: Ethereum to Reach $5,000 Before Solana Hits $300? Here’s Arthur Hayes’ Prediction

The current price is also observed stabilizing above the 50-day Exponential Moving Average (EMA), which is considered an important support level for traders.

Despite the apparent market calm, some analysts believe that Ethereum is preparing for its next breakout. Previous price analysis suggests a potential price spike to $4,000, provided that this consolidation continues in a tight range below $2,000.

Can Ethereum Price Touch $10,000?

Recent developments have market analysts starting to get optimistic that Ethereum price could break $10,000. For example, the Crypto Elites account on the X platform revealed that the ETH price breakout agenda has started to take shape.

According to the update, traders and investors may soon witness a significant price spike. This speculation is driven not only by supply dynamics, but also by several other factors, such as institutional adoption, Ethereum network updates (Pectra Upgrade), and ongoing ETF (Exchange-Traded Fund) filings.

Indirectly, with more and more ETH coming out of centralized exchanges and being accumulated by long-term investors, the current market conditions create an ideal environment for massive price increases.

The Ethereum community is now closely monitoring various short-term triggers that could potentially fuel this upward momentum. If demand continues to increase while supply remains limited, Ethereum could well surpass its previous record price and accelerate towards $10,000.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum Price Eyes $10,000 Breakout Amid Supply Squeeze Worry. Accessed on March 27, 2025