Bitcoin (BTC) Poised to Surge to $100,000, Bitcoin’s Ichimoku Cloud Shows Momentum?

Jakarta, Pintu News – Bitcoin has seen a rise of almost 5% in the last ten days and is currently trying to reach the $90,000 level again. Accumulation activity by whales, coupled with strong technical indicators, adds to optimism about a potential price surge.

Increased Accumulation by Whale

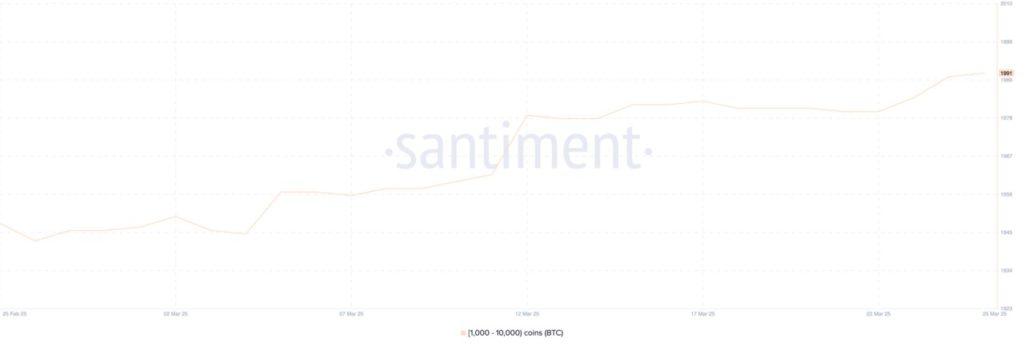

The number of Bitcoin (BTC) whale wallets, each of which holds between 1,000 and 10,000 Bitcoin (BTC), has increased from 1,980 on March 22 to 1,991 on March 25. This is the highest number since December 15. Although the increase is modest, it is highly significant as it reflects re-accumulation by large holders after more than three months of muted activity.

Following the activity of whale wallets is crucial because these large players can often move markets; their accumulation or distribution patterns can be an early signal of broad sentiment changes or major price movements. Whales are often regarded as “smart money,” and when their numbers increase, this often indicates increased confidence in the short-term market outlook.

Also Read: Will Bitcoin (BTC) Break $90,000? Check out the Analysis!

Bitcoin’s Ichimoku Cloud Shows Positive Momentum

The Ichimoku Cloud chart for Bitcoin (BTC) shows a bullish structure, with price action clearly above the cloud and the cloud itself turning green and rising. The Tenkan-sen (blue) is above the Kijun-sen (red), indicating that short-term bullish momentum is still in play.

However, these two lines have started to flatten out, indicating a possible pause or consolidation. The future cloud (Kumo) is wide and upward sloping, which signals strong underlying support and growing trend strength. Also, the Chikou Span (trailing line) is positioned well above the past price action, further confirming the bullish sentiment.

Although there could be some sideways movement in the short term, the overall Ichimoku setup continues to favor the bulls unless there is a breakdown under the clouds that changes the outlook.

Potential to Reach $100,000 in April

The Bitcoin (BTC) EMA line is lining up for a potential golden cross, which could signal the beginning of a new bullish phase. If this crossover occurs and Bitcoin (BTC) price manages to break the resistance at $88,807, it could trigger a move towards $92,928. Continuation of the strong uptrend could then send Bitcoin (BTC) to test $96,503 and $99,472, with a possible breakout above $100,000 if momentum accelerates.

On the other hand, if Bitcoin (BTC) fails to break $88,807 and faces a trend reversal, it could pull back to test support at $84,736. If this level breaks, there could be a further decline towards $81,162.

Conclusion

With strong technical indicators and increased activity from whales, the outlook for Bitcoin (BTC) looks bright. Although there is a possibility of short-term consolidation, the current market structure favors a bullish scenario. Investors and traders will continue to monitor these dynamics closely, as subsequent price movements will largely determine the direction of the cryptocurrency market as a whole.

Also Read: Ethereum (ETH) Prepares for the Next Big Move, Will it Rise April 2025?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Eyes Breakout as Whale Accumulation Surges. Accessed on March 28, 2025

- Featured Image: Generated by AI