Crypto market pressured by trade war concerns and US interest rate policy

Jakarta, Pintu News – Global market concerns regarding trade wars and high interest rate policies in the United States have put significant pressure on the cryptocurrency market since the beginning of 2025. Despite a number of positive developments in the crypto ecosystem, global macroeconomic sentiment still dominates the direction of digital assets such as Bitcoin .

Import Tariff Uncertainty and its Impact on Bitcoin

Bitcoin price has recorded a decline of more than 17% since US President Donald Trump announced import tariffs on Chinese goods on January 20, the day after his inauguration. The policy has raised concerns in global markets, especially as it could trigger further trade tensions between major countries.

According to Nicolai Sondergaard, research analyst at Nansen, this pressure is likely to last until at least early April, when the tariffs are scheduled to take effect on April 2. Sondergaard said that further developments of this policy could be the main trigger for market movements in the coming months.

This situation makes risky assets, including crypto, lose a clear direction. If an agreement between the countries concerned can be reached, then the period from April to July could be a window of time for new positive catalysts in the market.

Also Read: Will Bitcoin (BTC) Break $90,000? Check out the Analysis!

High Interest Rates Limit Investors’ Risk Appetite

In addition to international trade issues, high interest rates implemented by the Federal Reserve are also exacerbating the pressure on the crypto market. Sondergaard explained that investors are waiting for a rate cut signal from the Fed, which so far has not been seen in the near future.

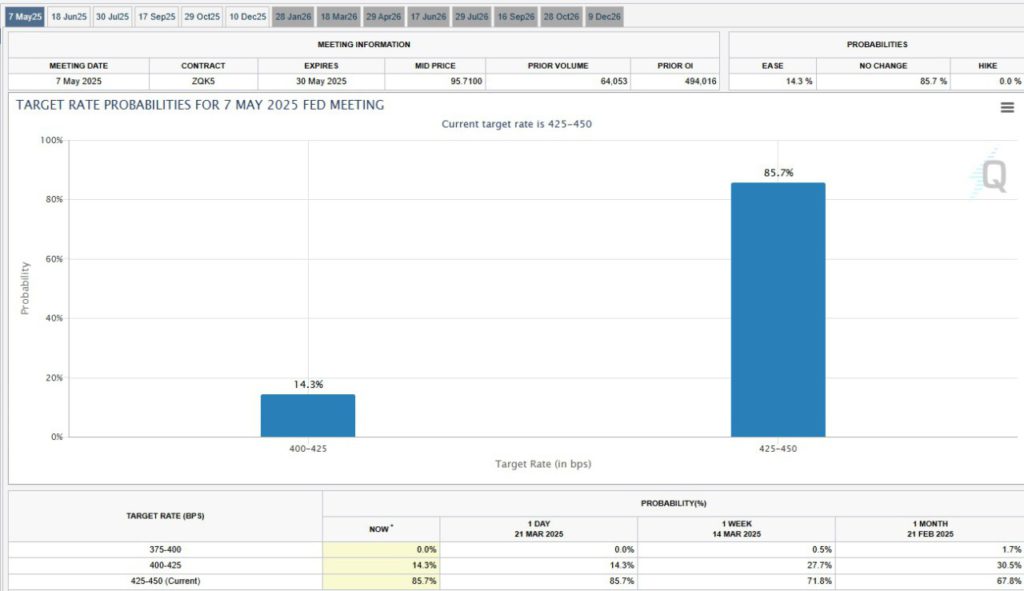

Currently, the market estimates an 85% chance that the Federal Reserve will keep interest rates on hold at its next Federal Open Market Committee (FOMC) meeting on May 7. This uncertainty has made investors cautious about placing their funds in risky assets such as cryptocurrencies.

However, the views of Iliya Kalchev, an analyst with digital asset investment platform Nexo, suggest that this could improve in the near future. According to him, concerns about inflation and a potential recession are temporary, especially if trade tariffs are muted. Economic stability and falling inflation will be a positive signal for investors.

Economic Data in the Spotlight Ahead of Fed Decision

Several key economic reports will be in the market’s focus in the coming weeks. Kalchev emphasized the importance of monitoring indicators such as the Consumer Confidence Index, fourth quarter Gross Domestic Product (GDP) data, weekly jobless claims, and the Personal Consumption Expenditures (PCE) report due next week.

These reports will help determine the future direction of the Fed’s interest rate policy. If the data shows economic weakness, then the chances of a rate cut will increase, which could be a breath of fresh air for the crypto market.

Cover

The cryptocurrency market is currently under double pressure from geopolitical uncertainty and monetary policy. Although the long-term trend remains positive thanks to innovations in the crypto industry, the short-term direction is heavily influenced by external factors. Investors are advised to stay alert to the dynamics of the trade war and signals from the US central bank, as both will be key in determining the market’s direction during the second quarter of 2025.

Also Read: Ethereum (ETH) Prepares for the Next Big Move, Will it Rise April 2025?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Crypto Markets Pressured by Trade War Concerns Until April, Says Analyst. Accessed March 28, 2025.

- Featured Image: Generated by AI