Dogecoin Dips 2% — Is DOGE on the Edge of a Major Crash or a Surprise Comeback?

Jakarta, Pintu News – Dogecoin is currently at a crucial point that could determine the direction of its price movement, according to an expert analyst. He said that the Dogecoin price could either drop to its lowest level in months, or recover to its previous high.

The crypto market in general is under bearish pressure, and Dogecoin is one of the assets affected. Between January and April 2024, Dogecoin’s price recorded a significant drop from over $0.40 to around $0.16.

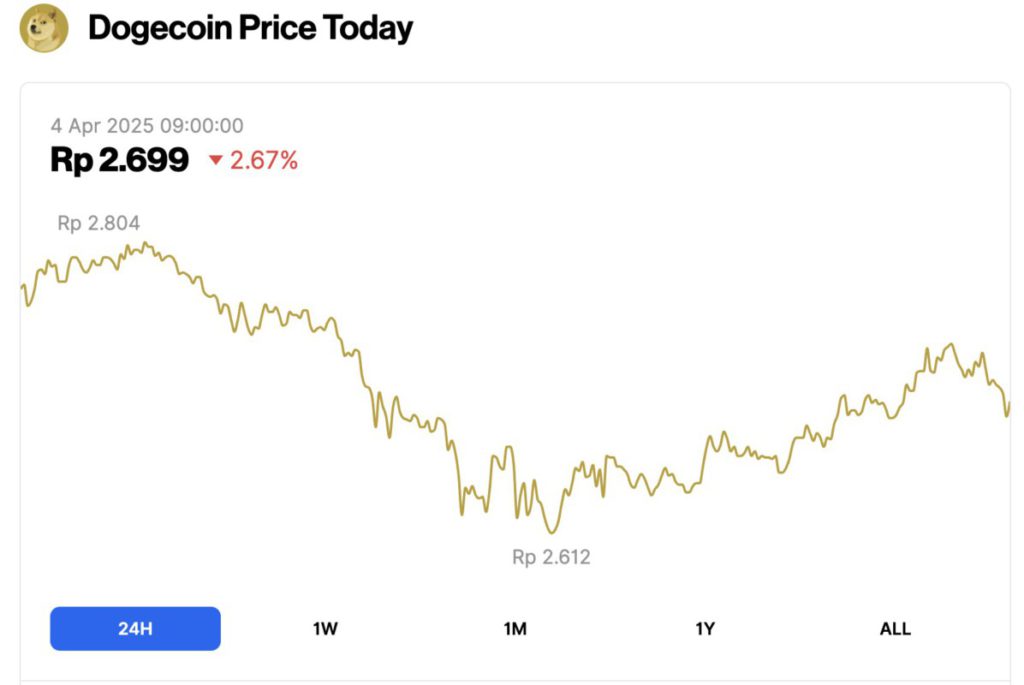

Dogecoin Price Drops 2.67% in 24 hours

On April 4, 2025, Dogecoin (DOGE) saw a 2.67% drop over the past 24 hours, bringing its price down to $0.1606, or approximately IDR 2,699. During the day, DOGE reached a high of IDR 2,804 and dipped to a low of IDR 2,612, reflecting a notable swing in trading activity.

At the time of writing, Dogecoin’s market cap stands at around $23.9 billion, with trading volume also dropping 37% to $1.16 billion within 24 hours.

Read also: Ethereum Slips Again — Is a Crash to $1,000 Now on the Horizon? (April 4, 2025)

Key Support and Resistance Levels for Dogecoin

Although DOGE is currently experiencing a short-term decline, crypto analyst Ali Martinez points out that Dogecoin’s overall price movement from 2018 to 2025 is still in a long-term uptrend.

According to Martinez, Dogecoin is currently at a crucial point that will determine its next direction. If the price is able to stay above this support level, Dogecoin could potentially continue its uptrend towards the resistance at $0.57, which would mean an increase of about 256.25% from the current level.

However, if the support at $0.16 fails to hold, a sharp drop towards $0.06 could occur-a drop of around 62.5%.

Interestingly, Martinez wasn’t the only one monitoring Dogecoin’s price movements. Another analyst, deeppatidar14, observed a bullish divergence pattern on the Dogecoin chart over a 3-month time span.

This pattern appears when the price prints higher lows, while the RSI (Relative Strength Index) indicator prints lower lows-a technical signal that often signals a potential reversal or price rally.

Deeppatidar14 also reminds traders to focus more on technical data and numbers, and not be easily swayed by emotional news or market sentiment.

Read also: Bitcoin Holds Strong at $83K on April 4 — Institutions Are Scooping Up BTC Like Never Before!

Inverse Head and Shoulders Pattern on Dogecoin Detected

On the other hand, Tardigrade Trader crypto analysts identified an inverse head and shoulders pattern on Dogecoin’s chart-a technical pattern that generally signals a potential trend reversal to the upside.

This pattern formed on the 4-hour chart (2/4), with the left shoulder forming when the Dogecoin price dropped to $0.1658 on March 29, then forming a head at the $0.1601 level on March 31. Meanwhile, the right shoulder formed after the most recent drop to $0.1677.

The neckline of this pattern is around $0.1760, and if Dogecoin manages to break this level to the upside, then a trend reversal towards price strengthening is likely.

In addition to technical analysis, increased on-chain activity also reinforces positive signals. In the last seven days, the number of new addresses rose by 102.40%, and active addresses increased by 111.32%-indicating growing user interest and engagement with Dogecoin.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- The Crypto Basic. Expert Says Dogecoin at a Make-or-Break Level, as It Could Surge to $0.57 or Slump to $0.06. Accessed on April 4, 2025