XRP Price Prediction for April 6, 2025: Testing the $2 Support Level, Is a Deeper Correction Ahead?

Jakarta, Pintu News – Amidst the unrelieved crypto market pressure, long-term investors’ movement towards Ripple is showing an interesting trend.

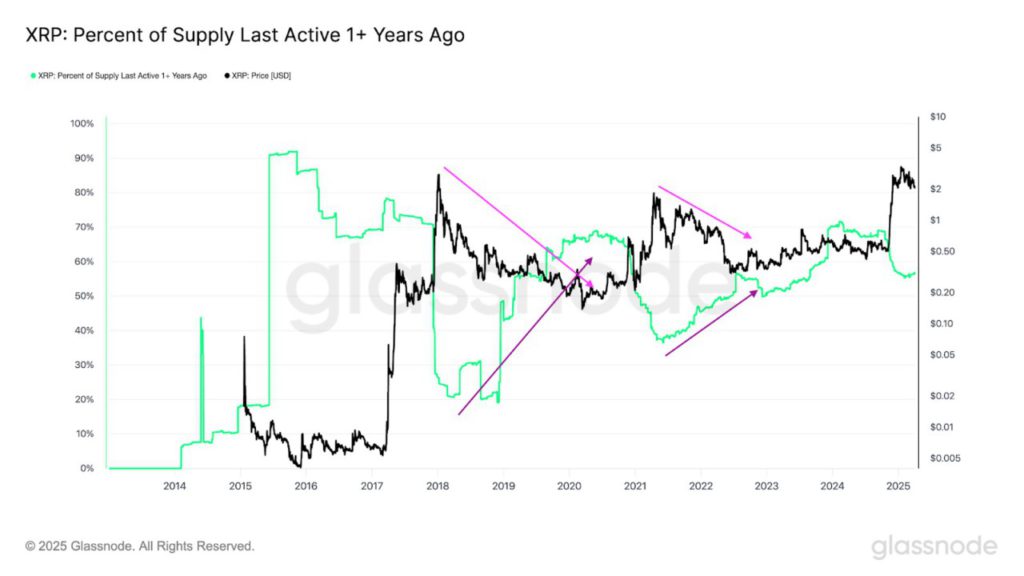

Based on the latest data, XRP holders who have been inactive for more than a year have started accumulating again since February 2025. This phenomenon emerged after the price of XRP experienced a sharp correction of around 30% since the beginning of the year.

However, is this “buy the dip” action a long-term bullish signal, or does it signal the danger of further correction in the near future?

Old Holder Accumulation: Positive Signal or Trap?

According to data from Glassnode, the number of XRP tokens that have not changed hands for more than a year is starting to rise again. This phenomenon was noted after a downward trend following the XRP price spike in late 2024 and early 2025.

Typically, an increase in accumulation by long holders signals increased investor confidence in the cryptocurrency’s long-term prospects. However, if you look at the history of XRP’s movements, this phase is often followed by consolidation or price drops in the short term.

According to Coinfomania, a similar trend occurred in 2018, when XRP reached an all-time record high. As prices soared, long-term holders offloaded their holdings.

Therefore, if massive accumulation occurs again while prices are falling, it is possible that the short-term trend is still bearish. On the other hand, it could also be the foundation for the next big rally like the one in the 2020-2021 period.

Read also: Grayscale Releases 2 New Bitcoin ETFs: BTCC and BPI, What’s the Difference?

Bearish Pressure and Worrying Technical Patterns

Technically speaking, the weekly chart of XRP is currently showing a descending triangle pattern-a formation that usually indicates further downside potential. This pattern often appears after large price spikes and is often the start of a deeper correction phase.

Over the past few days, external selling pressure has also intensified, pushing the price of XRP to continue testing the psychological support level at $2 or around Rp33,440.

If the selling pressure continues and the $2 support level is broken, then the next potential downside could be $1.20 or around IDR20,064. This level was previously strong resistance in 2021, which has now turned into technical support.

In addition, the RSI (Relative Strength Index) indicator is also showing a decline, signaling that the current market power is still in the hands of sellers. In the absence of any short-term positive sentiment, this downside opportunity is further exposed.

Conclusion

The accumulation trend of XRP by long-term holders shows high confidence in the future of this cryptocurrency. However, based on historical patterns and technical indicators, the price of XRP still has the potential to fall to the level of $1.20 (IDR 20,064) before bouncing back.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinfomania. Ripple’s Long-Term Holders Are Buying The Dip – Will XRP Price Crash Below $2 or Rebound Stronger Than Ever?. Accessed April 6, 2025.

- Featured Image: Bitcoin News