Bitcoin Targeting $100K? Whale Buying Pushes Back Against Trade War Sell-Off

Jakarta, Pintu News – Global financial markets have recently experienced significant turbulence due to the trade war between the US and China, but Bitcoin has shown remarkable resilience. With a stable price above $80,000, Bitcoin (BTC) is now in the spotlight of investors seeking safety amid market uncertainty.

This analysis will explore why Bitcoin (BTC) is the top choice amid this turmoil and how whale demand is affecting the market!

Why is Bitcoin (BTC) Price Rising Amid Trade War?

Bitcoin (BTC) has managed to maintain its position above $80,000 despite US trade tariffs triggering intense market turbulence. This stability in Bitcoin (BTC) price has caught the attention of investors and has the potential to trigger significant price increases. In contrast to the free-falling stock market, the stable value of cryptocurrencies indicates a shift in investor sentiment.

Bitcoin (BTC) is considered a strategic hedge because it operates independently of any government, making it less vulnerable to geopolitical tensions and tariff policies. As trade frictions escalate and global blocs prepare for retaliation, Bitcoin’s decentralized features have become attractive to investors seeking safety.

Unlike stocks that depend on earnings and executive strategies, Bitcoin (BTC) is unaffected by the earnings pressure of multinational corporations resulting from disruptions in global trade routes. Furthermore, Bitcoin (BTC)’s steady supply makes it resistant to inflationary risks that may arise from a looming supply chain crisis.

Also read: XRP Records Open Interest Above $3 Billion, Will Price Follow?

Whale Bitcoin (BTC) Transactions Increase 120% in a Week

As the Bitcoin (BTC) price begins to decouple from the broader market downturn, large investors and corporate companies are starting to take notice. On-chain data shows that whale activity on the Bitcoin (BTC) network increased despite the global market downturn.

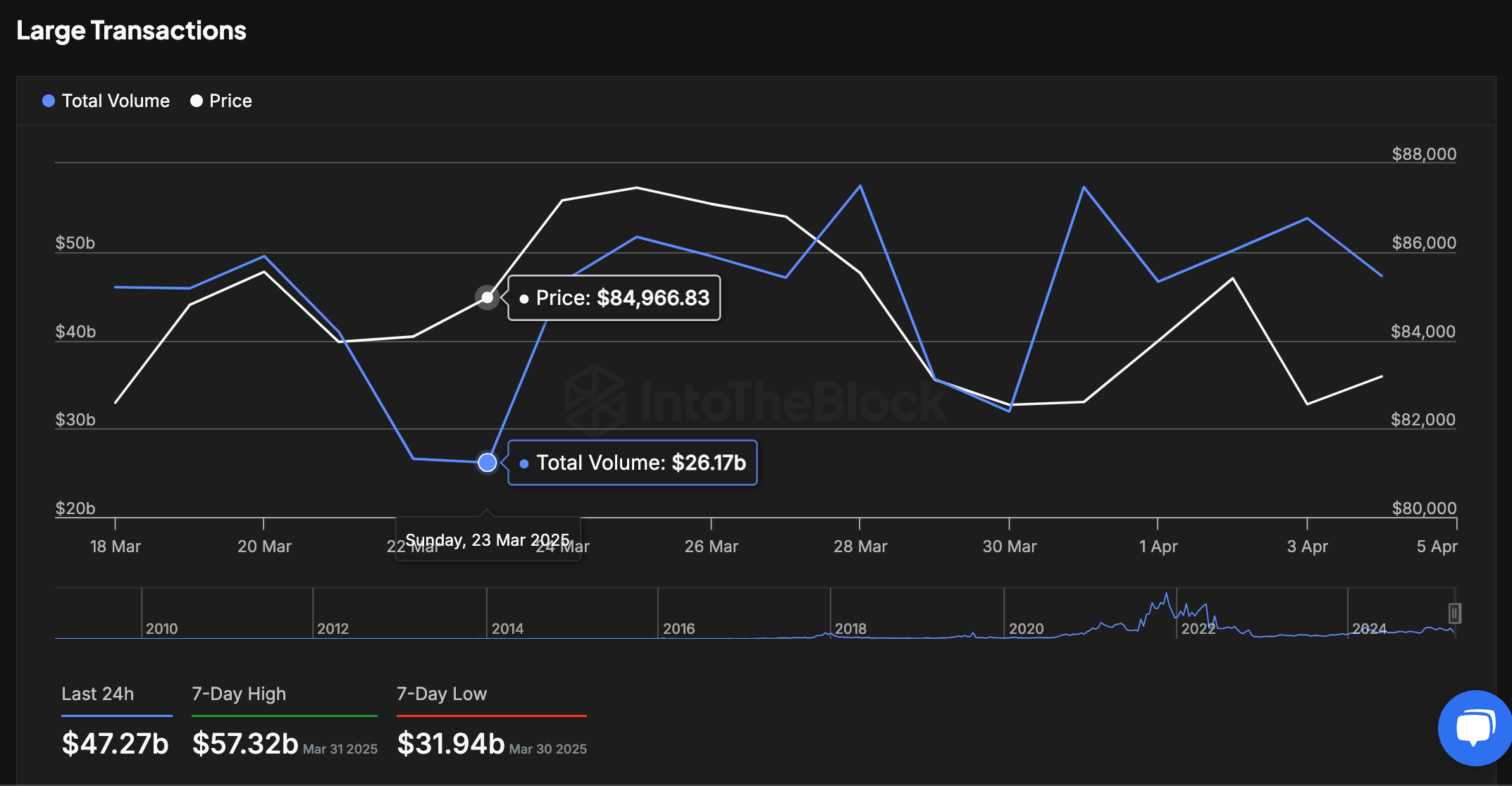

IntoTheBlock’s Large Transaction Volume chart monitors the total value of transactions exceeding $100,000 daily. On March 23, the total whale transactions exceeding $100,000 reached $26.17 billion. While investors abandoned US stocks and adjacent commodity markets, Bitcoin (BTC) whale transactions increased to $47.27 billion at the close of April 4.

The increase in whale transactions while the price of Bitcoin (BTC) remained stable shows that whale investors have accumulated large amounts of Bitcoin (BTC), neutralizing the bearish pressure from panic selling by retail hands under the pressure of the trade war.

Also read: Top 10 Cryptos Ready to Lead the Rally in April 2025

Bitcoin (BTC) Price Outlook: Bulls Target Rebound to $85,000

Bitcoin (BTC) price projections remain cautious yet bullish as macroeconomic instability triggers institutional rotation into digital assets. Although Friday’s close at $83,100 represented a daily loss of 0.94%, Bitcoin (BTC) continues to trade above the critical $83,000 support, withstanding broader financial market turmoil triggered by trade tensions between the US and China.

From a technical standpoint, price action has formed a minor bullish reversal after a two-day rebound, which was characterized by a 3.36% ($2,727) gain between April 4 and 5. Supertrend moving averages, specifically the 5-day and 8-day SMAs, started converging just below the current price level, suggesting upcoming resistance at $84,532.52, with interim support at $83,183.27.

The volume trend remains neutral, but the most noticeable divergence is seen on the Bull-Bear Power (BBP), which still printed a negative reading of -1,253.58. This indicates weak short-term momentum but does not erase the bullish setup completely.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Bitcoin Price Forecast: BTC Eyes $100K Rebound as $47 Billion Whale Demand Offsets Trade War Sell-Off. Accessed on April 7, 2025

- Featured Image: Generated by Ai