XRP Price Prediction April 7, 2025: Breaking $2 on the Weekend, What’s the Next Move?

Jakarta, Pintu News—On April 6, 2025, the price of Ripple rose back above the psychological level of $2, or around 34,000 IDR, after hitting a 30-day low of $1.80 (30,600 IDR).

These gains came as Bitcoin rallied above $82,000 (1.39 billion IDR) and Ethereum held at around $1,800 (30.6 million IDR), reflecting the crypto market’s resilience to external pressures such as trade wars. However, behind these positive movements, warning signals from the derivatives market point to a possible correction later in the week.

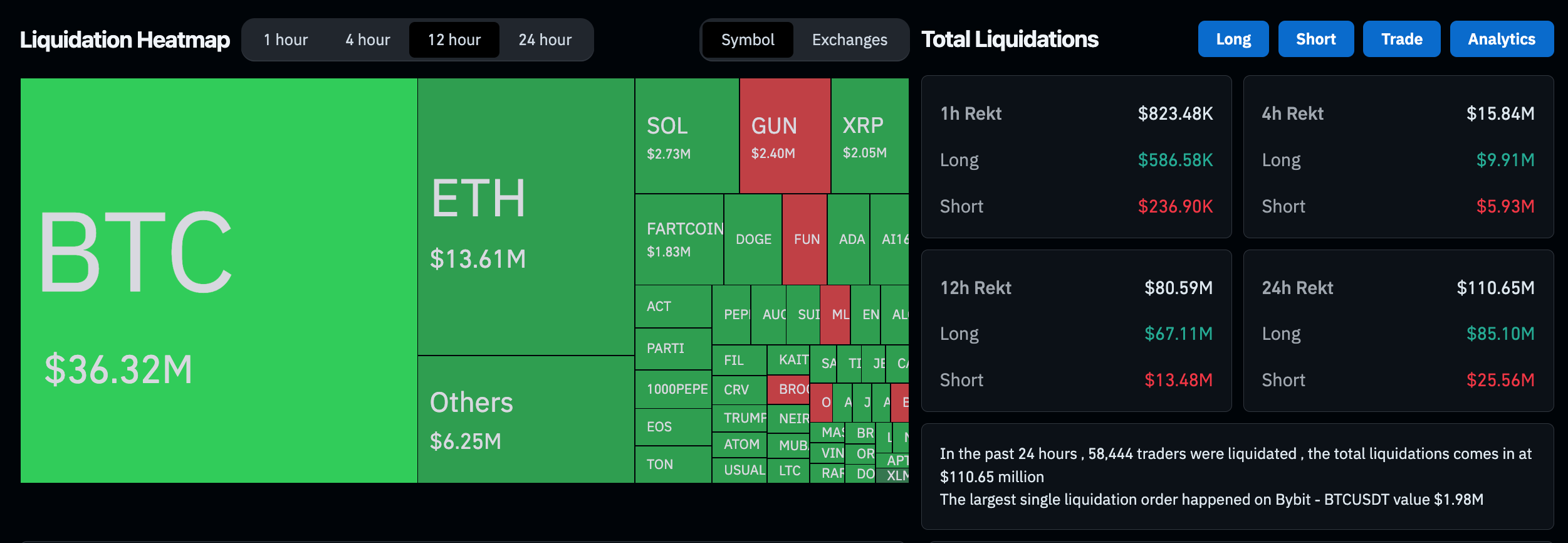

The total liquidation of $110 million in the last 24 hours, with BTC and ETH accounting for nearly $50 million, suggests that the selling pressure has not completely dissipated. Under these conditions, XRP and other altcoins could be stuck in a defensive consolidation phase if volume and demand do not recover soon.

Derivative Action Indicates Market Fatigue

Data from Coinglass shows that the derivatives market has been under heavy pressure in the past 24 hours. Of the total liquidations of $110.65 million (1.88 trillion IDR), long positions dominated at 76%, reflecting many over-leveraged traders being “forced out” of the market. Specifically for Bitcoin (BTC), $36.32 million in liquidations were recorded, followed by Ethereum (ETH) at $13.61 million.

This imbalance signals that the short-term bullish trend is starting to weaken. The liquidation of long positions in the last 12 hours, which reached $67 million compared to only $13 million in short positions, points to a potential correction or sideways movement in the near future.

In this context, altcoins like Ripple (XRP) are likely to suffer if the pressure continues to mount into early next week.

Read also: 1000 DOGE Price (7/4/25): Equivalent to the Price of 2 Anker 10,000 mAh Powerbanks?

XRP faces strong resistance at $2.20

Although the price of Ripple (XRP) has risen about 12.5% since last Thursday and briefly touched $2.15 (36,550 IDR), technical signals suggest selling pressure. The price is still below the 50 EMA ($2.21/$37,570) and 100 EMA ($2.28/$38,760) lines, indicating that momentum has not fully recovered. Supply pressure is still dominating, stunting recovery efforts.

Meanwhile, the 200 EMA ($1.95 / 33,150 IDR) is important support. If XRP prices drop below this level, the potential to fall back to the $1.80 (30,600 IDR) area is very open.

The True Strength Index (TSI) indicator is still in the negative zone (-0.80), but it is starting to flatten, suggesting that the selling momentum is slowly weakening. However, the market remains in the shadow of a correction without a clear breakout above $2.22 (37,740 IDR).

Read also: Price of 1 Pi Network (PI) in Indonesia Today (7/4/25)

Weak Demand, Watch Out for Weekend Moves

Amidst trade conflicts and macroeconomic uncertainty, many investors have started shifting funds from stocks to cryptocurrencies, which explains why altcoins like XRP rebounded. However, with US stock exchanges closing over the weekend, new capital flows will likely slow down until trading reopens.

XRP’s trading volume has also shown a downward trend, signaling that strong participation does not support recent price gains. Under these conditions, the altcoin risks additional pressure if the derivatives market continues to show bearish signals. Traders are advised to watch key support levels and limit exposure to sudden volatility.

Conclusion

Ripple (XRP) price did bounce back from this week’s low, but the challenges are not over yet. Data from the derivatives market shows that many long positions are being liquidated, signaling potential market exhaustion.

As long as XRP has not been able to break the $2.22 resistance, the chances of a correction remain open. Crypto traders and investors must be cautious, especially towards the beginning of next week, amid low volumes and yet to recover market demand.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News for the latest updates on crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Featured image: Crypto Rank