MicroStrategy halts Bitcoin purchases amid crypto market turmoil

Jakarta, Pintu News – MicroStrategy, one of the most active institutions in cryptocurrency investment, has stopped its recent Bitcoin buying activities. The move comes amid a massive correction in the crypto market, where the price of BTC dropped to below $80,000 or around Rp1.33 billion (with a conversion of 1 USD = Rp16,712). On the other hand, MicroStrategy (MSTR) shares also took a hit, dropping more than 13% due to a combination of crypto price pressure and global economic tensions.

MicroStrategy Pauses Bitcoin Purchases: What’s the Impact?

According to reports, MicroStrategy made no Bitcoin purchases between March 31 and April 6, 2025. This is quite striking given that the company had previously routinely purchased BTC through funding from stock sales. In recent weeks, the company led by Michael Saylor had even acquired 22,048 BTC worth $1.92 billion, as well as 6,911 BTC for $584 million.

By the end of the first quarter of this year, MicroStrategy had accumulated 528,185 BTC, purchased for a total of $35.63 billion (IDR595 trillion) or an average price of $67,458 (IDR1.12 billion) per Bitcoin. With the price of BTC now plummeting, the investment is now close to breaking even and has even recorded a potential unrealized loss of $5.91 billion (IDR 98.8 trillion).

Also Read: XRP Price Prediction: Between Deep Correction and Hopes of Rebound in Crypto Market (8/4/25)

Potential Impact on the Market If MicroStrategy Sells BTC

If the decline in BTC prices continues and the value of MicroStrategy’s investment breaks the limit of significant losses, the company could be compelled to sell some of its assets. Although the sale is most likely to take place over-the-counter (OTC), news of a potential sell-off could trigger negative sentiment in the crypto market as a whole.

As an important note, MicroStrategy currently holds just over 2% of the total Bitcoin supply in circulation. This change in corporate strategy could have far-reaching implications for market confidence in the short-term prospects of BTC and crypto in general.

MSTR shares plummet amid global economic pressures

Not only has the price of Bitcoin taken a hit, the Nasdaq-listed shares of MicroStrategy have also recorded a sharp decline. MSTR shares fell by more than 13%, and are currently trading at around $256. This decline was not only triggered by the price of BTC, but also by President Donald Trump’s tariff policies that have again triggered global economic tensions.

The S&P 500 Index recorded a 3.5% decline at the opening of trading, approaching bear market territory, while the Nasdaq also showed the same trend. Against this backdrop, MSTR shares suffered a Year-to-Date (YTD) loss of 8%, erasing all gains since the start of the year.

Whale Activity and Bitcoin Market Direction

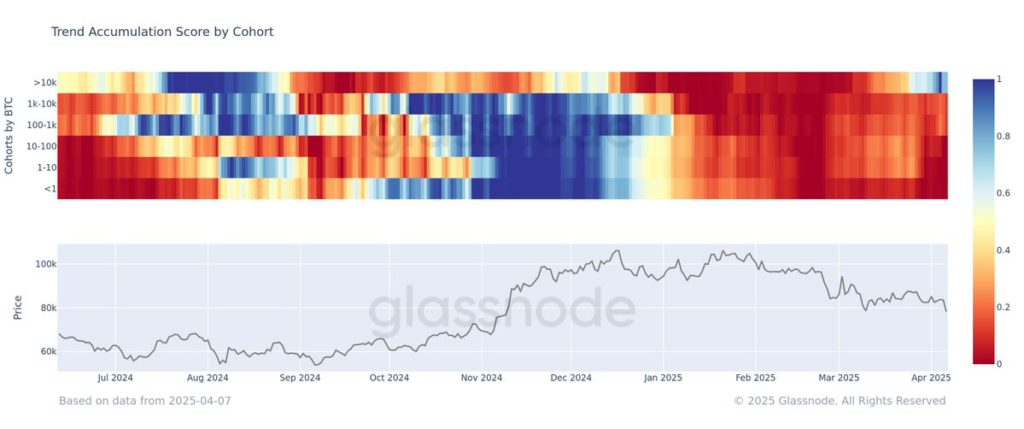

Although MicroStrategy stopped buying, other large investors or Bitcoin whales continue to show accumulation interest. Data from on-chain platform Glassnode shows that whales with holdings of more than 10,000 BTC reached the maximum accumulation score earlier this month, reflecting 15 days of active buying.

However, that accumulation score has now dropped to 0.65, signaling a slowdown in accumulation. CryptoQuant CEO, Ki Young Ju, even warned that the crypto bull market could be over. This suggests that uncertainty still dominates market sentiment towards the future of cryptocurrencies.

Conclusion

MicroStrategy’s decision to stop buying Bitcoin is an important signal for the cryptocurrency market amid turbulent macroeconomic conditions. The decline in Bitcoin price and MSTR stock shows how strong the correlation between digital assets and traditional financial markets is. While institutional investors like MicroStrategy are holding back, market participants need to remain vigilant for possible strategy changes that could have a major impact on the overall stability of crypto prices.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Boluwatife Adeyemi/Coingape. MicroStrategy Halts Bitcoin Purchase, MSTR Stock Slides 13%. Accessed April 8, 2025.

- Featured Image: Unchained Crypto