Jerome Powell Expected to Cut Emergency Rate, Crypto Market Volatile!

Jakarta, Pintu News – Federal Reserve Chairman Jerome Powell’s possible sudden announcement of an emergency interest rate cut has come under scrutiny. This comes after the tariff policy implemented by Donald Trump led to a crypto market crash. Today’s scheduled closed-door meeting by the US Central Bank is a key event that market participants are looking forward to.

Federal Reserve Emergency Meeting

Federal Reserve Chairman Jerome Powell and the Board of Governors will hold a closed-door meeting to discuss the possibility of an emergency interest rate cut. A release from the Federal Reserve indicates that this meeting will focus on reviewing and determining the interest rates charged by Federal Reserve banks.

This is in response to the negative impact the tariffs imposed by the Trump administration have had on the economy. The crypto market has recently experienced a sharp decline, with Bitcoin bottoming out at $76,000, indicating a decline of between 7% to 12%.

Global markets, including the S&P 500 and Nasdaq, are also in a bearish state. Analysts predict that an emergency rate cut may be needed before the next FOMC meeting in May.

Also Read: XRP Price Prediction: Between Deep Correction and Hopes of Rebound in Crypto Market (8/4/25)

Donald Trump’s Pressure on the Fed

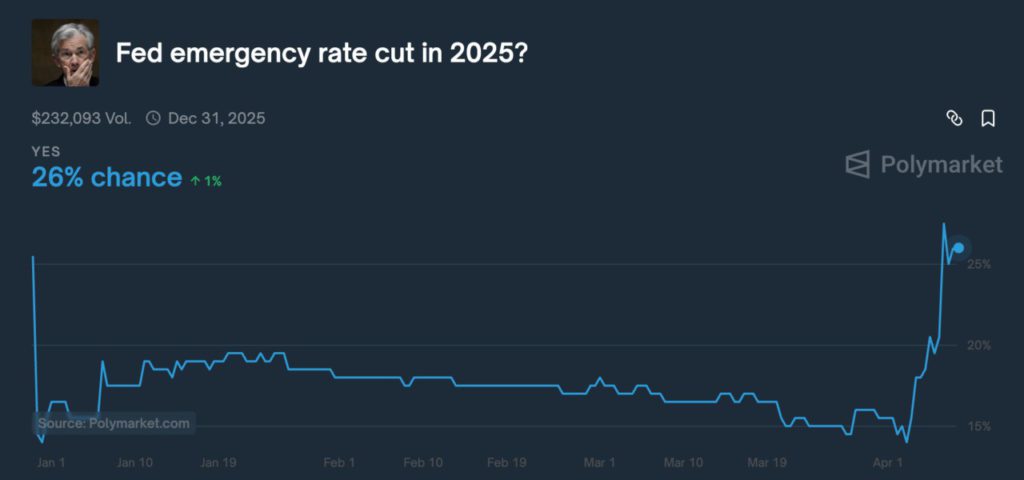

President Donald Trump has urged Jerome Powell and the Federal Reserve to cut interest rates, pointing to falling oil prices, interest rates, and food prices, as well as the absence of inflation. This push comes amid mounting pressure on the Fed to act quickly. The odds for an emergency rate cut this year have jumped to 26%, signaling a high probability of it happening in the near future.

A rate cut is considered a positive move for markets, including crypto markets, as it will increase liquidity and strengthen investor confidence in risky assets. Tariffs imposed by Trump could have a significant impact on the US economy, prompting the Reserve Bank to consider action.

Impact on Crypto Market and Global Economy

The tariff policies implemented by the Trump administration have triggered a price crash in the crypto market and affected the global economy as a whole. An emergency interest rate cut by the Federal Reserve is expected to ease some of this pressure. The crypto market, which has seen a sharp decline, may get the boost it needs to recover.

In addition, this policy is also expected to provide stimulus to the depressed US economy. Increased liquidity and lower interest rates are expected to boost investment and consumption, which in turn will help the economy recover.

Conclusion

With a meeting scheduled for today, all eyes are on the Federal Reserve and the decision that Jerome Powell will make. Whether an emergency rate cut will become a reality, and how it will affect global markets and specifically crypto markets, remains to be seen. However, one thing is for sure, this decision will greatly influence the direction of the markets going forward.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Trump’s Tariffs: Fed Chair Jerome Powell Could Announce Emergency Rate Cut Amid Crypto Market Crash. Accessed on April 8, 2025

- Featured Image: CNBC