April 2025 Sonic(S) Analysis: Liquidity Flow Shrinks, Derivatives Traders Join in the Selling!

Jakarta, Pintu News – Investor interest in Sonic is waning as liquidity in the market decreases. This decline not only affects Sonic’s exchange rate but also raises concerns among market participants. This article will delve deeper into the factors influencing Sonic’s price decline and what to expect going forward.

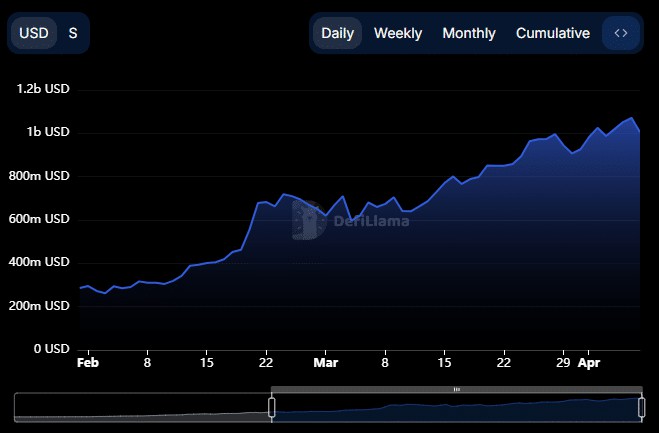

Liquidity Flow Shrinks

Sonic (S)’s recent price drop can be attributed to a significant reduction in liquidity at both the chain and protocol levels. This created strong selling pressure, given the lack of funds coming into the asset. Large investors seem to be pulling out, which signals a lack of confidence in Sonic’s long-term prospects.

When the liquidity of a cryptocurrency decreases, price volatility tends to increase. This makes Sonic (S) more vulnerable to speculation and market manipulation. Without a steady flow of funds, it is difficult for Sonic to maintain its exchange rate in volatile market conditions.

Also Read: Bitcoin (BTC) is recovering, but big hurdles still loom in April 2025

Derivatives Trader Joins the Sell

In the derivatives market, where traders open positions to speculate on price movements or manage risk without the need to own the actual asset, short or sell positions dominate. This suggests that market expectations for Sonic are not positive. Derivatives traders are often a barometer of market sentiment, and right now they tend to be pessimistic about Sonic’s future.

Increased selling activity in the derivatives market often accelerates price declines in the spot market. Therefore, if this trend continues, Sonic (S) may face even more intense selling pressure. Investors and traders should be very cautious about making investment decisions in this environment.

Price Movement on the Chart

Sonic (S)’s price movement is heavily dependent on its ability to not fall below a key demand level on the chart. This demand zone, which sits between $0.38 and $0.42, has proven several times to be a turning point for uptrends. If the price falls below this zone, it could trigger further declines.

On two previous occasions, when Sonic touched this zone, the price managed to rebound. However, with the current market conditions, there is no guarantee that the same pattern will repeat itself. Investors should monitor this area closely, as it could be key to predicting the next direction of Sonic’s price.

Conclusion

With all the pressures it faces, Sonic (S)’s future seems uncertain. Investors and traders should consider all the factors described above before making an investment decision. Monitoring price movements and market updates regularly is key to navigating this volatile crypto market.

Also Read: First XRP ETF in the US Launched, Provides New Investment Opportunities!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Sonic price prediction: Levels to look out for as liquidity dries up. Accessed on April 8, 2025

- Featured Image: Crypto Economy