Crypto Mining Stocks 2025: Miner Profitability & Sentiment Under Pressure

Jakarta, Pintu News – Shares of crypto mining companies have taken a dramatic dive, losing more than $12 billion in market value and returning to the levels of early 2024. This drop comes despite the price of Bitcoin remaining stable, a phenomenon that is rare and often an indicator of bigger problems in the crypto sector. Is this a sign of a big storm about to hit the crypto market?

Significant Loss of Market Value

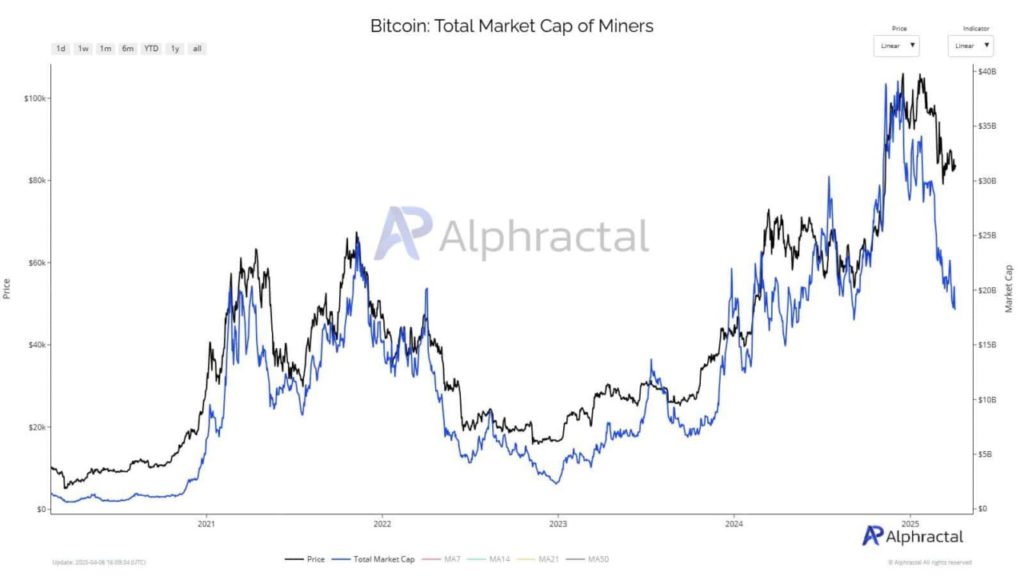

Since February, shares of Bitcoin (BTC) mining companies have lost more than $12 billion in market value, dropping from more than $36 billion to less than $24 billion. This wiped out all the gains made in early 2024.

Several major miners experienced sharp double-digit declines. These declines occurred despite the Bitcoin (BTC) price remaining steady above the $65,000 support. This suggests a significant misalignment between the value of miners’ stocks and the price of Bitcoin (BTC), which usually move in tandem.

Also Read: Bitcoin (BTC) is recovering, but big hurdles still loom in April 2025

Deviations from Bitcoin (BTC): A Warning?

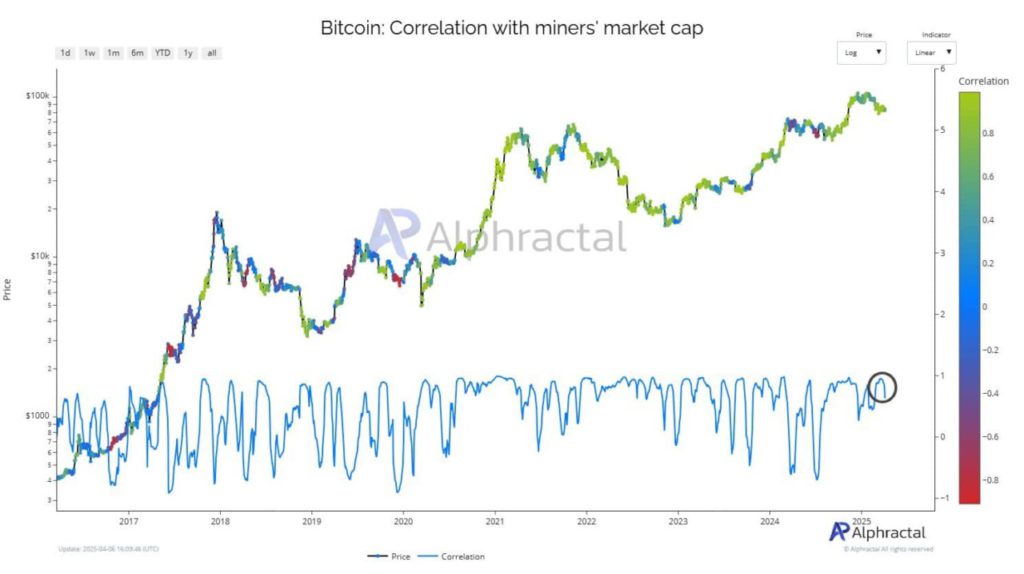

Recent data shows that the correlation between Bitcoin (BTC) price and miners’ market capitalization has declined sharply, approaching negative territory for the first time since mid-2022. Historically, deviations like this have often preceded volatility spikes or directional changes in Bitcoin (BTC) price.

Whether this signals a market revaluation of miners, structural pressures ahead of block reward cuts, or broader sentiment cracks, the situation feels different this time and may require further evaluation.

Profitability and Miner Sentiment under Pressure

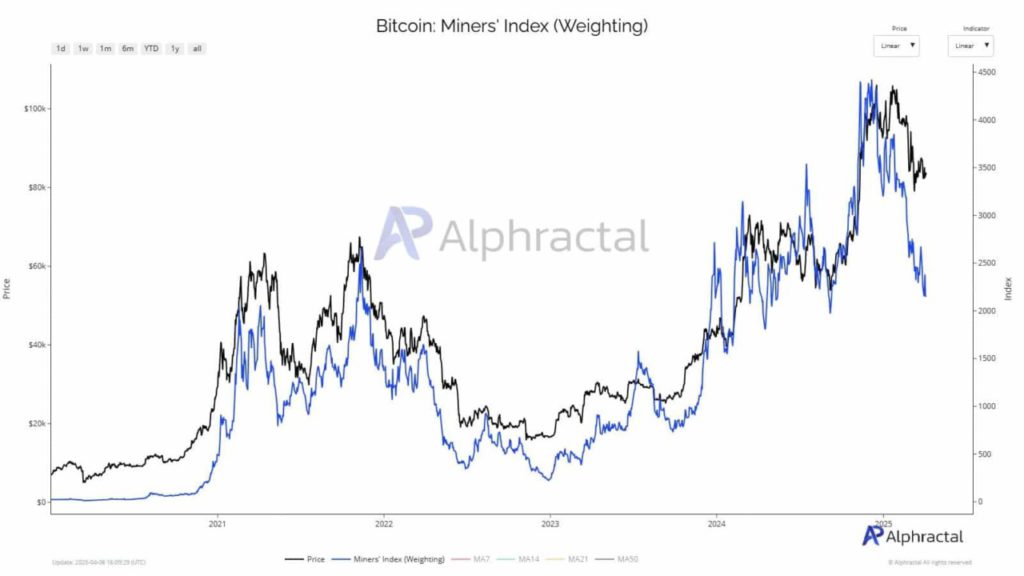

The post-block bounty-cut economy, rising energy costs, and trade-related uncertainties-especially regarding tariff hints by President Trump in April-have put pressure on Bitcoin (BTC) miners. The miners’ index shows a sharp deviation from the Bitcoin (BTC) price, reflecting deep stress in the sector. On the other hand, investor appetite seems to be shifting.

According to Galaxy Digital, for example, spot Bitcoin ETFs are increasingly in demand as they offer exposure without the operational and regulatory risks associated with mining companies. CEO Mike Novogratz also emphasized that ETF-driven inflows are a major bullish force for Bitcoin (BTC) in 2025.

Conclusion

The divergence between Bitcoin (BTC) miner stocks and Bitcoin (BTC) price may be a warning signal. A similar divergence in early 2022 preceded a broader correction, suggesting that miners could again be an early indicator of market stress. Institutions are starting to take notice-poor performance in mining equities suggests deeper operational and regulatory challenges, prompting a shift perhaps towards direct Bitcoin (BTC) exposure or ETFs.

Also Read: First XRP ETF in the US Launched, Provides New Investment Opportunities!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Mining stocks lose $12 billion despite Bitcoin’s stability: All the details. Accessed on April 8, 2025

- Featured Image: Coingape