Global trade war predicted to drive bitcoin growth, according to Binance CEO

Jakarta, Pintu News – Geopolitical tensions and global trade wars continue to create uncertainty in various sectors of the world economy, including the cryptocurrency market. One of the leaders of the crypto industry, Binance CEO Richard Teng, gave his views on this phenomenon. According to him, in conditions of economic uncertainty due to trade wars, Bitcoin can be increasingly looked at by investors as a hedge asset (store of value) that is not bound by any state authority.

Trade War Tensions and Their Impact on the Crypto Market

Richard Teng revealed that increased protectionism in international trade policies is creating high volatility in global markets, including crypto markets. In the short term, such economic turmoil often leads investors to take a cautious approach and reduce their exposure to risky assets, including cryptocurrencies.

He added that new policies regarding import tariffs, such as those between the United States and China, could potentially create additional pressure on the market. However, these conditions also open up opportunities for Bitcoin and other crypto assets to gain more attention as an alternative hedge amid uncertainty.

Also Read: Bitcoin (BTC) is recovering, but big hurdles still loom in April 2025

Bitcoin Valued as a Hedge Asset Amid Economic Uncertainty

While short-term volatility is inevitable, Richard Teng remains optimistic about Bitcoin’s role in the long term. He notes that the higher the economic and geopolitical uncertainty, the greater the potential for Bitcoin to be used as a store of value independent of the traditional financial system.

Bitcoin, as a non-sovereign digital asset, is considered to have the unique characteristic of shielding wealth from the risk of inflation or a country’s monetary policy. This makes Bitcoin one of the assets of choice for investors in the face of global uncertainty.

Crypto Market Response to Trade Policy Speculation

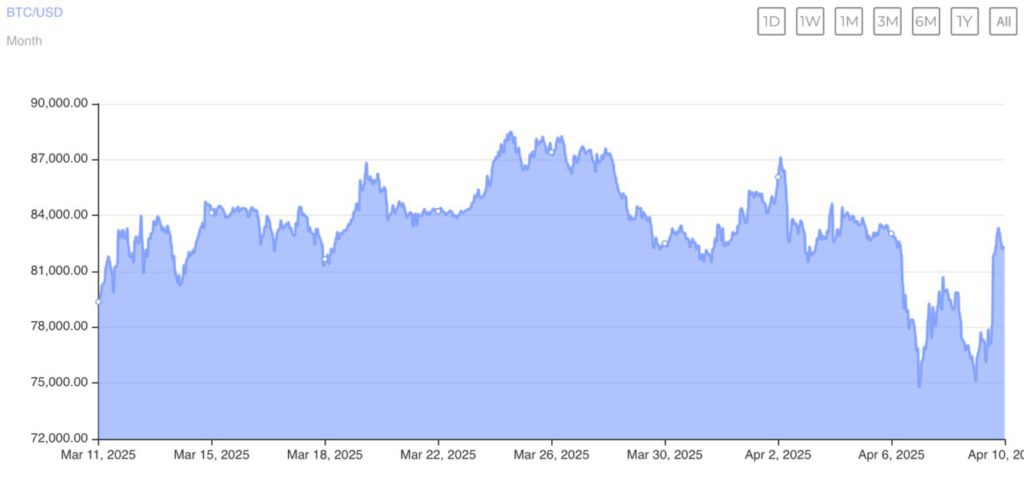

Bitcoin’s recent price movements have shown how sensitive the crypto market is to geopolitical developments and economic policy speculation. For example, news of a possible 90-day suspension of import tariffs by former President Donald Trump pushed the price of Bitcoin above $80,000 or around Rp1.35 billion (1 USD = Rp16,995).

However, after the news was denied by the White House, the price of Bitcoin corrected again to around $78,000 or Rp1.32 billion. This phenomenon shows that crypto market sentiment is still heavily influenced by global news and issues, especially those related to trade policies between countries.

Analysts Predict the Future of Bitcoin Price

A number of analysts from various financial institutions have also provided various predictions regarding the future direction of the Bitcoin price. According to the Investors.com report, if policies that support crypto adoption are widely implemented, Bitcoin has the potential to reach a price of $150,000 or around Rp2.54 billion by 2025.

On the other hand, if the policy does not go as expected, Bitcoin could fall back to the level of $80,000 or around Rp1.35 billion. This prediction shows how global political conditions and economic policies greatly affect the long-term prospects of crypto assets such as Bitcoin.

Bitcoin’s place in the global financial landscape according to Binance CEO

Richard Teng also emphasized that Bitcoin is now starting to be seen as an important part of the global financial system, just like money and the internet in the modern era. He believes that as financial technology evolves and crypto adoption increases, Bitcoin will continue to play a strategic role in the global economic system.

Binance itself sees the Bitcoin-based DeFi sector as one of the main catalysts in a potential surge in Bitcoin price going forward. According to the latest data, the current Bitcoin price is around $76,261 or around Rp1.29 billion, recording a decline of around 3.60% in the last 24 hours.

Conclusion

Global trade war tensions and uncertain macroeconomic conditions have not only put pressure on traditional markets, but also opened up opportunities for cryptocurrencies such as Bitcoin to grow. With its characteristics as a non-sovereign asset and store of value, Bitcoin is increasingly being considered as an alternative hedge against global economic uncertainty. The predictions of Binance’s CEO and analysts show that Bitcoin still has significant growth potential, especially if supported by pro-crypto policies.

Also Read: First XRP ETF in the US Launched, Provides New Investment Opportunities!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News Flash. Global Trade Wars May Drive Bitcoin Growth, Binance CEO Suggests. Accessed April 10, 2025.

- Featured Image: Mint