Changes in Bitcoin Ownership Patterns Amid Correction: Signals of Recovery or Continued Pressure?

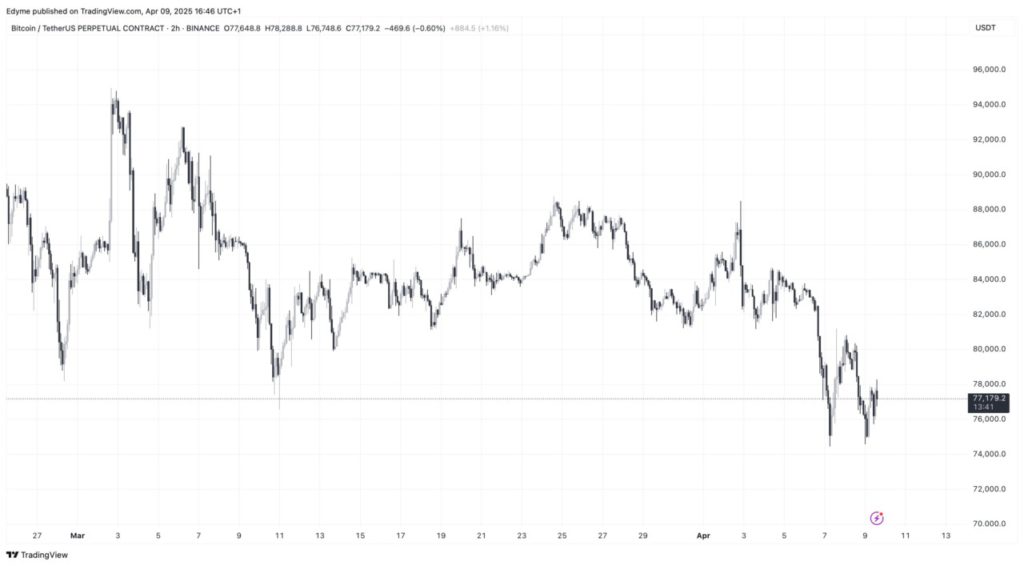

Jakarta, Pintu News – Bitcoin price is currently still under pressure in the cryptocurrency market, trading at around Rp1.30 billion ($76,899 equivalent). This represents a decline of 3.7% in the last 24 hours and a drop of around 29.4% from its all-time high recorded in January 2025 of over Rp1.85 billion ($109,000 equivalent).

Since dropping below Rp1.39 billion ($80,000 equivalent) at the end of last week, Bitcoin price has continued to struggle to return to an upward trend. This reflects the still considerable selling pressure in the crypto market in general.

Bitcoin Ownership Shifts Between Short- and Long-Term Investors

Behind the volatile price movements, the latest on-chain data reveals important changes in Bitcoin ownership patterns. Analysis from CryptoQuant contributor Onchained shows a shift in ownership from Short-Term Holders (STH) to Long-Term Holders (LTH).

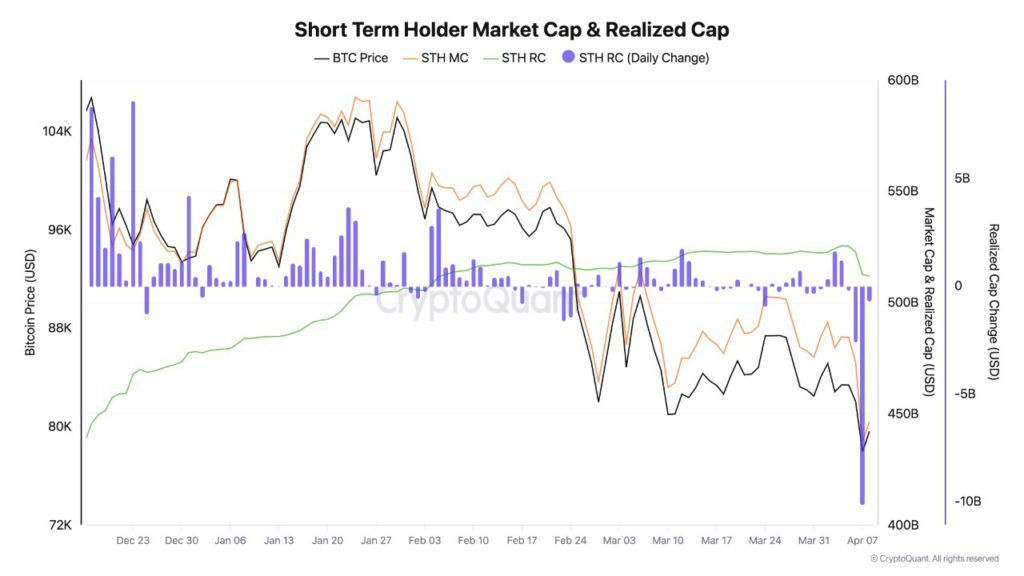

In the past week, Bitcoin experienced a decline of about 15%, from Rp1.49 billion ($88,000 equivalent) to Rp1.26 billion ($74,400 equivalent). On April 7, 2025, short-term investors recorded the largest realized loss of the cycle, with total losses reaching Rp169.9 trillion ($10 billion equivalent).

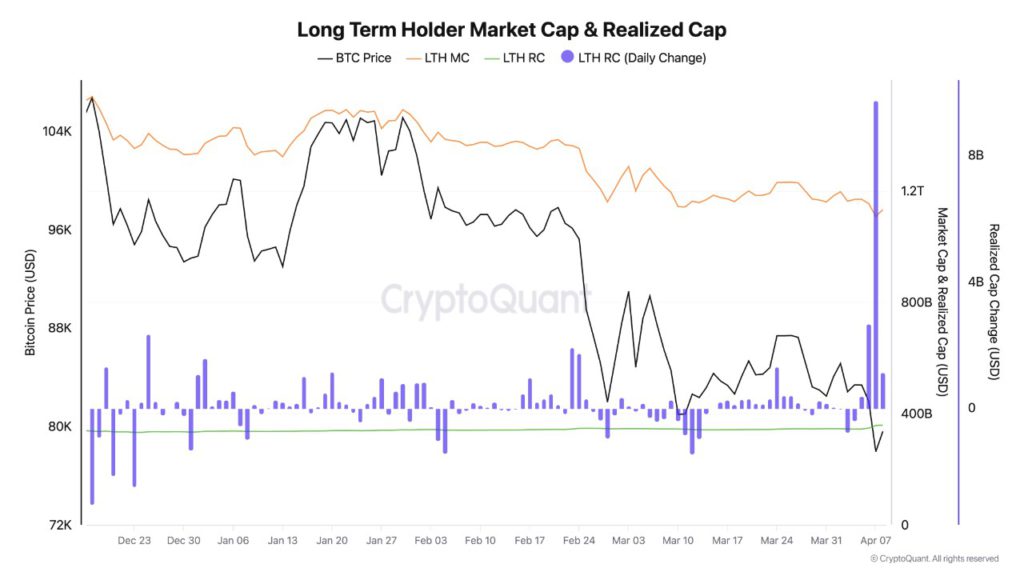

On the other hand, the data shows that long-term investors increased their Bitcoin holdings by almost the same amount, which is around Rp164.8 trillion (equivalent to $9.7 billion). This indicates that Bitcoin ownership is starting to move from the hands of short-term investors to investors who have a stronger belief in the crypto’s long-term prospects.

Also Read: Solana’s Whale Movement and Selling Pressure: What is the Impact on Crucial Support Levels?

Long-Term Investor Accumulation Continues

On 8 April 2025, realized losses from short-term investors began to fall to around IDR11.7 trillion ($693 million equivalent), signaling a possible easing of the panic sell-off. Meanwhile, long-term investors continued to add to their accumulation, with an increase in the value of their holdings of IDR19.2 trillion ($1.13 billion equivalent).

This phenomenon suggests that long-term investors see the current price correction as a strategic opportunity to add to their Bitcoin portfolio. This kind of behavior generally appears at the final phases of a correction or the beginning of a price recovery process.

According to Onchained, this is not a coincidence, but part of the crypto market cycle where Bitcoin moves from the hands of weaker investors to the hands of stronger and more experienced investors.

Implications of Changing Ownership Patterns on Crypto Market Structure

This change in Bitcoin ownership patterns between short-term and long-term investors is expected to affect the broader market structure. The reduced amount of Bitcoin in the hands of short-term investors has the potential to reduce selling pressure in the short term. Meanwhile, the continued accumulation by long-term investors reflects optimism about Bitcoin’s long-term prospects in the cryptocurrency market.

Historically, such patterns often precede price stabilization or even a trend reversal towards strengthening. As Bitcoin’s supply becomes more concentrated in the hands of long-term investors, the foundation for new price support begins to form.

However, whether this condition will mark the end of the current price correction or it is still the initial part of the recovery process, still requires further confirmation from future price movements.

Conclusion

The Bitcoin (BTC) market is currently undergoing a significant shift in ownership patterns, with long-term investors continuing to strengthen their accumulation amid a price correction. This change reflects a strong belief in the long-term prospects of the world’s largest cryptocurrency.

Although selling pressure is still present, a shift in ownership from short-term to long-term investors could be an important factor supporting the stabilization or recovery of Bitcoin price in the coming time.

Read More: Solana Price Moves Up: Potential Strengthening or Correction in April 2025?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Best Owie/NewsBTC. Bitcoin Ownership Patterns Shift Amid Price Correction. Accessed April 11, 2025.

- Featured Image: Generated by AI