New Ripple ETF (XRP) Sets Record Despite Market Slump!

Jakarta, Pintu News – Amid less than encouraging market conditions, Teucrium’s launch of a new ETF product based on Ripple recorded impressive results.

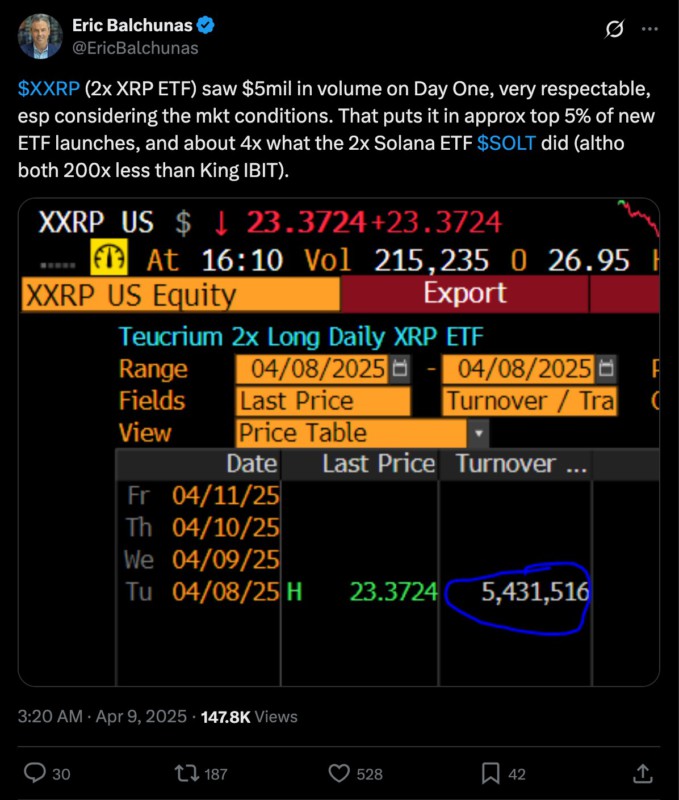

On its first day of trading on the New York Stock Exchange, the ETF managed to record a turnover of $5.43 million. This was despite the price of Ripple (XRP) being at its lowest point in the last five months. Bloomberg’s senior ETF analyst, Eric Balchunas, commented that this achievement is especially respectable given the bearish market conditions.

Ripple (XRP) ETF Outperforms Similar Solana (SOL) Products

Compared to a similar product from Solana , the newly launched Ripple (XRP) ETF had a first-day trading volume that was four times higher. According to Eric Balchunas of Bloomberg, this puts Teucrium’s product in the top 5% of all new ETF launches.

Nonetheless, the $5.43 million figure is still much smaller when compared to the debut of BlackRock’s Bitcoin ETF, which recorded a trading volume around 200 times greater. This ETF offers investors the opportunity to profit from price fluctuations of Ripple (XRP) in either direction.

This is especially important when the general cryptocurrency market is experiencing extensive selling pressure. The performance of this ETF shows that there is still strong interest in innovative financial products, even in volatile market conditions.

Also Read: Solana’s Whale Movement and Selling Pressure: What is the Impact on Crucial Support Levels?

Community Response to Ripple (XRP) ETF Launch

The altcoin community showed great enthusiasm for the launch of this ETF, despite the challenging market conditions. Data shows that in the 24 hours surrounding the launch, 137,000 traders were liquidated, with losses totaling over $413 million across the cryptocurrency market.

Although the trading volume of the Ripple (XRP) ETF is much smaller compared to BlackRock’s Bitcoin (BTC) ETF, some Ripple (XRP) advocates argue that a potential spot ETF, which they call “IXRP”, could provide stronger competition.

Ripple (XRP) ETF Risks to Watch Out For

Unlike spot ETFs that directly hold the underlying asset, Teucrium’s Ripple (XRP) ETF does not directly invest in the Ripple (XRP) token. This ETF is designed to provide double the daily performance of Ripple (XRP) price movements, which means it can double both profits and losses for investors.

Crypto Eri, a community figure, warned about the risk factors inherent in this ETF, stating that even if the price of Ripple (XRP) remains stable, volatility alone could lead to significant losses. More than 10 asset managers have filed applications with the SEC for a Ripple (XRP) spot ETF. Large firms such as Grayscale and Franklin Templeton are among the filers, although BlackRock has not shown any interest in launching an ETF product specific to Ripple (XRP).

Conclusion

The launch of the Ripple (XRP) ETF by Teucrium marks an important step in the evolution of financial products based on cryptocurrencies. Despite facing major market challenges, the ETF managed to attract attention and funds from investors, demonstrating the growth potential that still exists within the sector. Going forward, similar products may continue to emerge as attractive investment alternatives amidst high market volatility.

Read More: Solana Price Moves Up: Potential Strengthening or Correction in April 2025?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. XRP ETF Launch Impresses Even in Bear Market, Says Analyst. Accessed on April 11, 2025

- Featured Image: Generated by AI