Investors are withdrawing funds from Bitcoin ETFs, is this a sign of a crisis? Here’s what analysts say!

Jakarta, Pintu News – This week, funds managed in the form of Bitcoin ETFs recorded capital withdrawals for the fifth consecutive day. This phenomenon signals a decline in investor confidence in Bitcoin’s (BTC) short-term prospects, especially from institutions.

April ETF Data: Investor Concerns Over Bitcoin

During April, Bitcoin (BTC) ETFs only recorded inflows on one trading day. This suggests that institutional investors are starting to withdraw their investments from spot Bitcoin (BTC) ETFs, triggered by rapidly changing macroeconomic conditions. On Wednesday, the total withdrawal of funds from spot Bitcoin (BTC) ETFs reached $127.12 million.

Although Bitwise’s ETF BITB recorded the highest net inflow of $6.71 million on the day, BlackRock’s ETF IBIT experienced the largest net withdrawal totaling $252.29 million. This suggests that confidence in Bitcoin’s (BTC) short-term price projections is weakening, mainly due to macroeconomic uncertainty caused by Donald Trump’s ongoing global trade war.

Also Read: Solana’s Whale Movement and Selling Pressure: What is the Impact on Crucial Support Levels?

Bitcoin futures rise despite ETF withdrawals

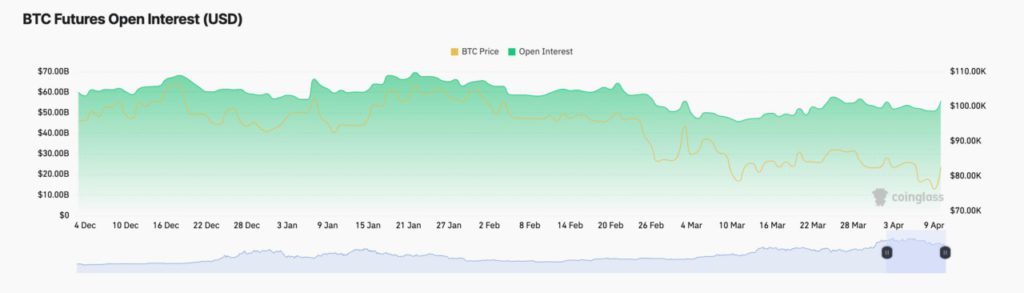

Despite a decline in spot ETF fund flows, the derivatives market showed resilience. Open interest in Bitcoin (BTC) futures continues to rise, signaling an increase in the number of new positions being opened each day. According to Coinglass, Bitcoin (BTC) futures open interest currently stands at $55 billion, with a 10% increase in a day.

This rise in open interest indicates increased trading activity and growing investor interest. Additionally, the funding rate for Bitcoin (BTC) remains positive, despite a general decline in market sentiment. Currently, the funding rate stands at 0.0070%. This shows that traders are still optimistic and willing to pay a premium to maintain long positions, signaling expectations of a rebound in the near future.

Contrasting Market Dynamics Between ETFs and Bitcoin Futures

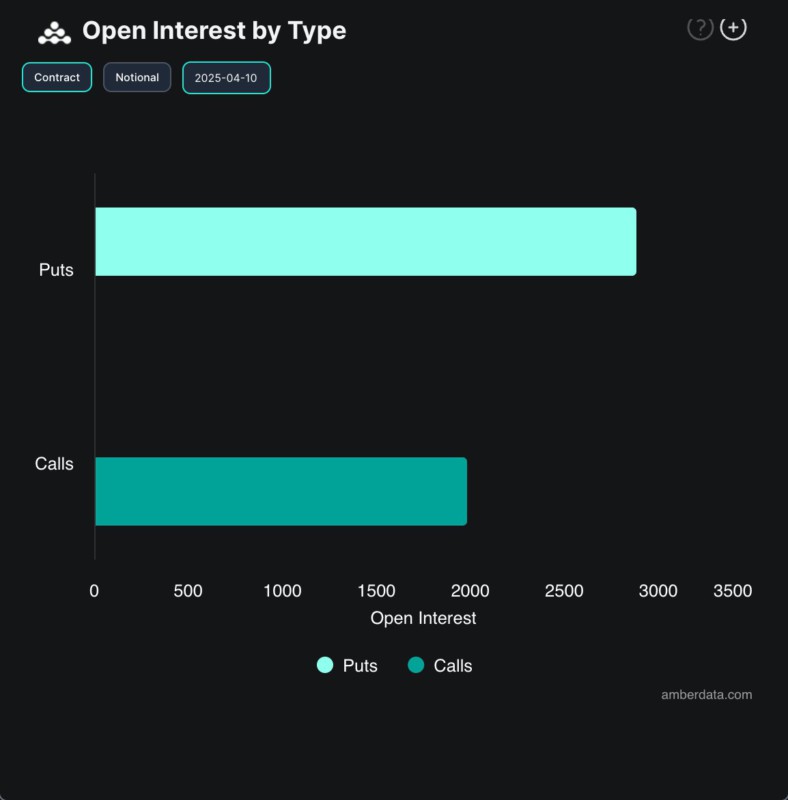

Despite the withdrawal of funds from Bitcoin (BTC) ETFs, the demand for call options suggests that traders are still preparing for a possible decline in Bitcoin (BTC) price. The opposing dynamics between ETF fund flows and Bitcoin (BTC) futures market activity create an interesting situation, where short-term caution coexists with long-term bullish speculation.

This situation suggests that the market may still be unstable and investors need to be cautious in making investment decisions. While there are signs of optimism in the derivatives market, investors should remain aware of potential risks.

Conclusion

With the various dynamics taking place in the Bitcoin (BTC) market, investors are faced with a difficult choice between participating in a long-term bullish trend or securing assets from short-term volatility. This decision must be made by considering all the risk factors and potential returns involved.

Read More: Solana Price Moves Up: Potential Strengthening or Correction in April 2025?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. BTC Spot ETFs See Outflows for Third Consecutive Week. Accessed on April 11, 2025

- Featured Image: Crypto Economy