Bitcoin Open Interest Surge: Increased Open Interest and its Implications on the Market April 2025

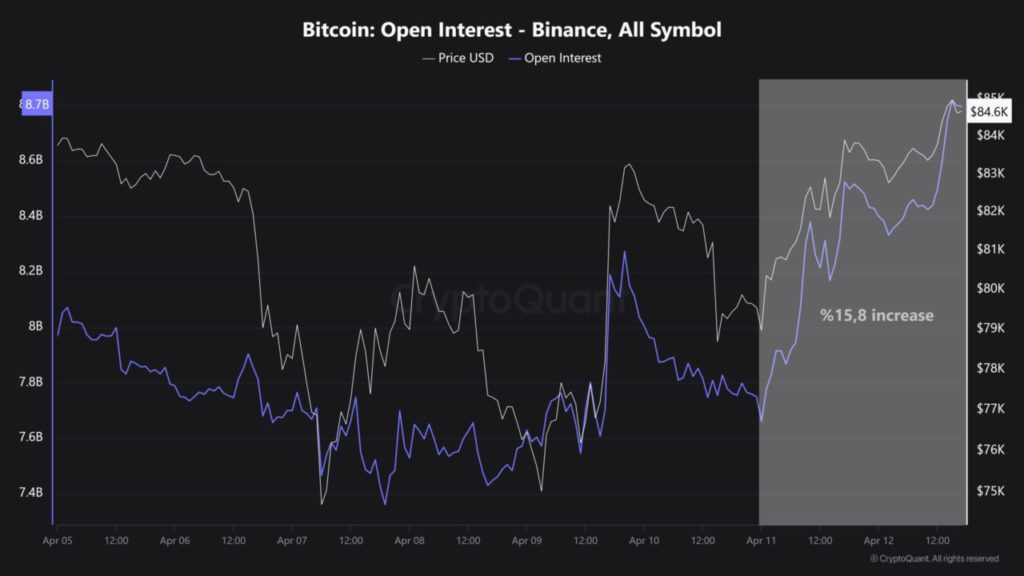

Jakarta, Pintu News – The Bitcoin market recently experienced a significant increase in Open Interest – OI, reaching $8.8 billion from $7.6 billion in a single day. This sharp rise signifies increased market and trader engagement, but also indicates the potential risk of high market volatility. In this context, it is important for investors to understand the dynamics at play and proceed with caution.

Increased Open Interest and its Implications

The rise in Open Interest on Binance, a crypto derivatives trading platform, reflects their dominance with a 31.4% share of the total $28 billion OI capital. This rapid increase not only indicates a growing bullish sentiment among investors, but may also trigger countervailing market movements or aggressive position unwinding.

Sharp increases in OI often result in short-term price fluctuations, which are generally triggered by a change in market sentiment or a failure to defend critical resistance levels. When OI increases, it often signals that more traders are using leverage to enlarge their positions.

This may increase the risk of massive liquidations that may affect excessive long and short positions. Therefore, it is important for investors to monitor changes in OI and prepare strategies to deal with potential market volatility.

Also Read: Ripple (XRP) Movement and Potential Correction: What Crypto Investors Need to Watch Out for?

Leverage Driven Pumps and Their Impact

Recently, the spot price of Bitcoin (BTC) reached $84K, which was driven by the excessive use of leverage. While this indicates a strong uptrend, it also brings risks to short-term market traders due to the potential for rapid forced selling. This phenomenon is not new and often occurs when crypto markets experience a surge in leverage.

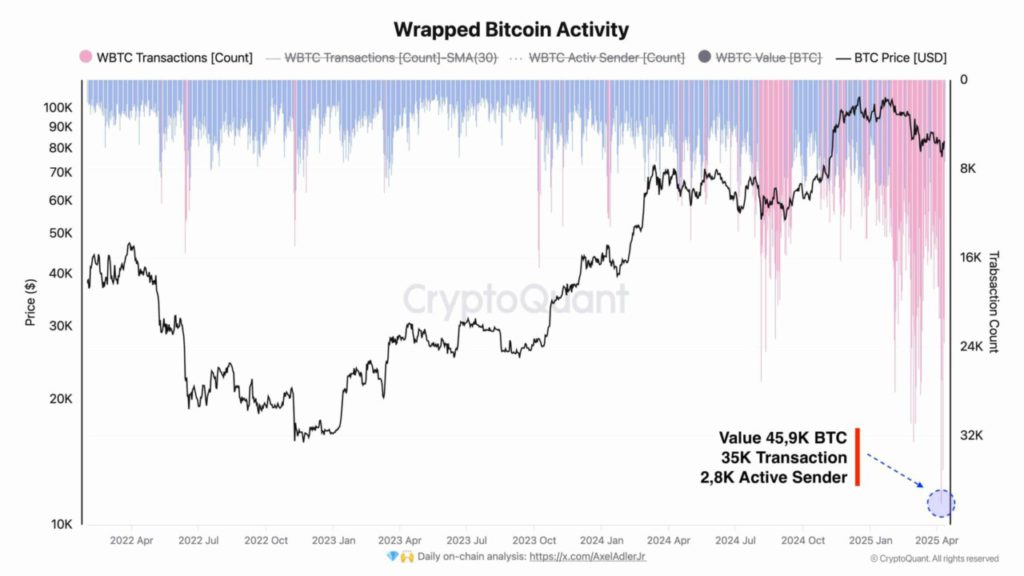

On the other hand, Wrapped Bitcoin activity hit a record high, with 35,000 transactions made through 2,800 active wallets, showing the resilience of WBTC users despite high market volatility. The drastic rise in the OI percentage change in 24 hours indicates extreme long sentiment, which could be risky if the market reverses. Investors should be wary of potential sudden changes in price that could be triggered by leverage adjustments or major shifts in market sentiment.

Bitcoin Price Movement Potential

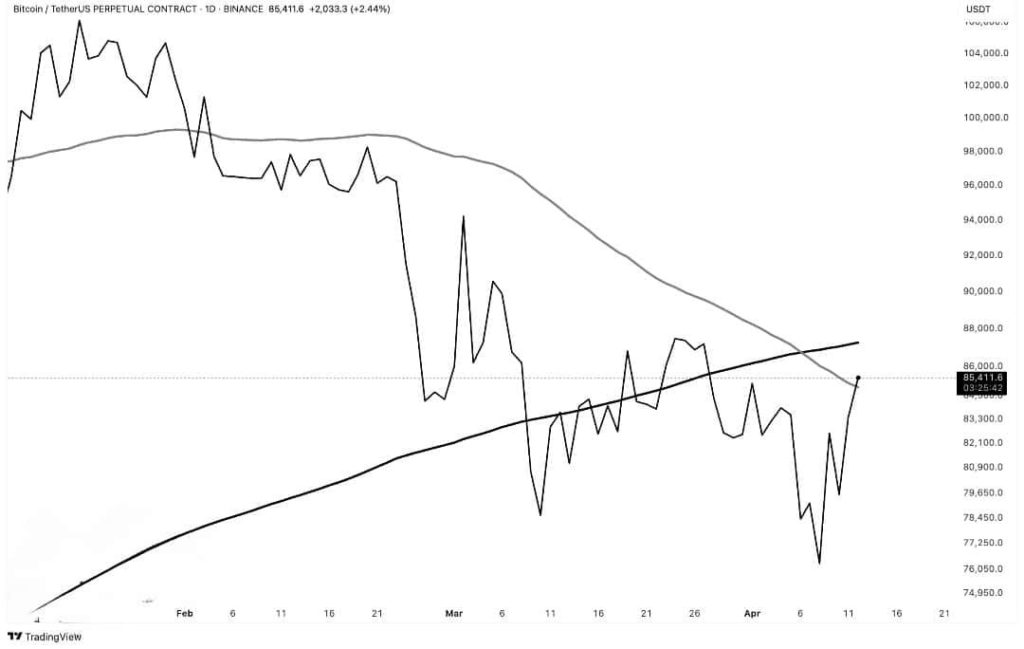

Bitcoin (BTC) recently broke out of the 50-day Simple Moving Average (SMA) and approached resistance at the 200-day SMA. If the price can hold above $87K, it might confirm a continued bullish trend with a potential target of reaching $94K. However, seller intervention is possible near the level, which could trigger a price drop.

Conversely, if the price remains below $87K, it could confirm the warning associated with the leverage-based pump action. This could cause the price to drop to the $79K level or even $76K if the price falls below $84K, indicating further bearish momentum. Investors need to observe significant price movements on both sides to determine the future direction of Bitcoin (BTC).

Conclusion

In the face of high market volatility and fast-changing dynamics, investors must consider all the risk factors involved. Understanding the implications of changes in Open Interest and the influence of leverage is key to successful market navigation. By remaining vigilant and responsive to market signals, investors can make more informed decisions and avoid potential large losses.

Read More: Pepe Coin (PEPE) Price Movement and Potential Golden Cross: What Does It Mean for the Crypto Market?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Here’s why Bitcoin’s 15% spike in open interest signals caution. Accessed on April 14, 2025

- Featured Image: The image created by AI