Floki’s Fate is on the Line: Can it Escape the $0.00006 Snare? Here’s What Analysts Say!

Jakarta, Pintu News – Floki recently recorded a 7.89% gain in a week’s time, following similar price dynamics with a bullish run-up to 2022.

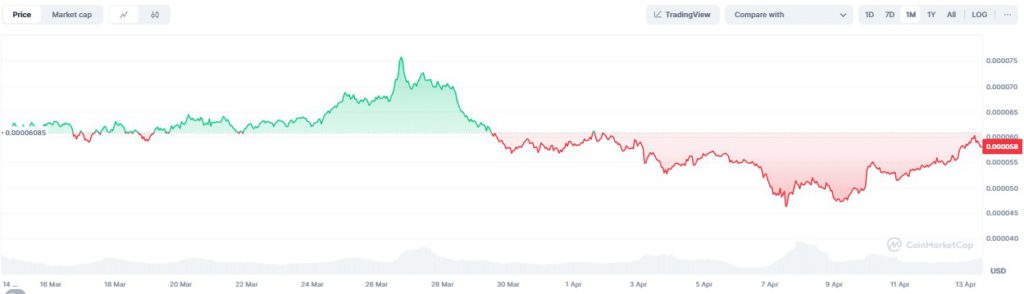

This rise was supported by a bullish divergence on the Relative Strength Index (RSI), which increased speculation about a possible re-rally. However, Floki is now facing a $0.00006 supply zone which is a critical resistance level and has repeatedly been an area of high volume distribution in the past.

Critical resistance challenges the Bull’s resolve

In the past two months, Floki has been stuck in a price range of $0.000047 to $0.00008, indicating consolidation conditions. On April 6, there was a sharp drop of 11.82% in a day, which dragged the RSI into oversold territory, signaling potential exhaustion on the selling side.

Meanwhile, the Moving Average Convergence Divergence (MACD) histogram shows compression near the zero line with a bullish crossover looking imminent. This technical condition could be the basis for a breakout from the price range.

However, this is still subject to confirmation from volume expansion and sustained buying pressure. On the monthly time frame, the $0.00006 level continues to act as a key supply zone and critical resistance. Since March 29, Floki has experienced rejection three times at this level, each time followed by a quick retracement.

Also Read: Ripple (XRP) Movement and Potential Correction: What Crypto Investors Need to Watch Out for?

Critical Moment: Can Floki Break Out of the Range Trap?

Floki’s sharp retracement to $0.00005 on April 7 was met with aggressive buying, with spot volume surging to 190.74 million, signaling strong reactive demand. This surge in buying pressure prompted a quick recovery of 20%, with the price returning to $0.000058.

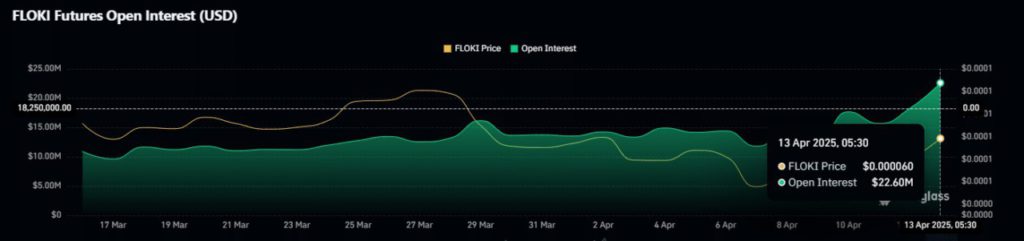

More importantly, Open Interest (OI) increased from $11 million to $22.07 million in the past week, indicating a significant increase in capital into leveraged positions. On Binance, Floki/Tether perpetual trading shows over 60% of positions leaning towards longs, reflecting a strong bullish delta.

However, in a volatile market, a heavy long position on Floki carries a double risk. As mentioned earlier, Floki’s recent intraday gain of 7.89% further resembles liquidity-taking.

Pullback Potential: Risks and Opportunities

Currently, with $11 million of new positions on the table, the risk of liquidation remains high. Plus, spot volume has declined to 104.13 million, a significant drop from the surge on April 7.

Without sustained volume input, the chances of a breakout above the $0.00006 supply zone appear unlikely. As a result, another pullback from this overhead resistance looks increasingly likely. Traders are advised to exercise caution in their decision making.

Conclusion

With the ever-changing market conditions and challenges faced by Floki, investors and traders should consider all technical and market factors before making an investment decision. Closely monitoring price and volume movements can provide important insights into the potential future direction of Floki.

Read More: Pepe Coin (PEPE) Price Movement and Potential Golden Cross: What Does It Mean for the Crypto Market?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Floki: Analyzing why the memecoin’s fate hinges on $0.0006. Accessed on April 14, 2025

- Featured Image: Asia Crypto Today