Is Bitcoin (BTC) about to experience a resurgence? This indicator could be the decider!

Jakarta, Pintu News – Bitcoin is currently at an important crossroads, where long-term metrics and market sentiment are starting to indicate the likely direction of future price movements.

Long-term Data Analysis

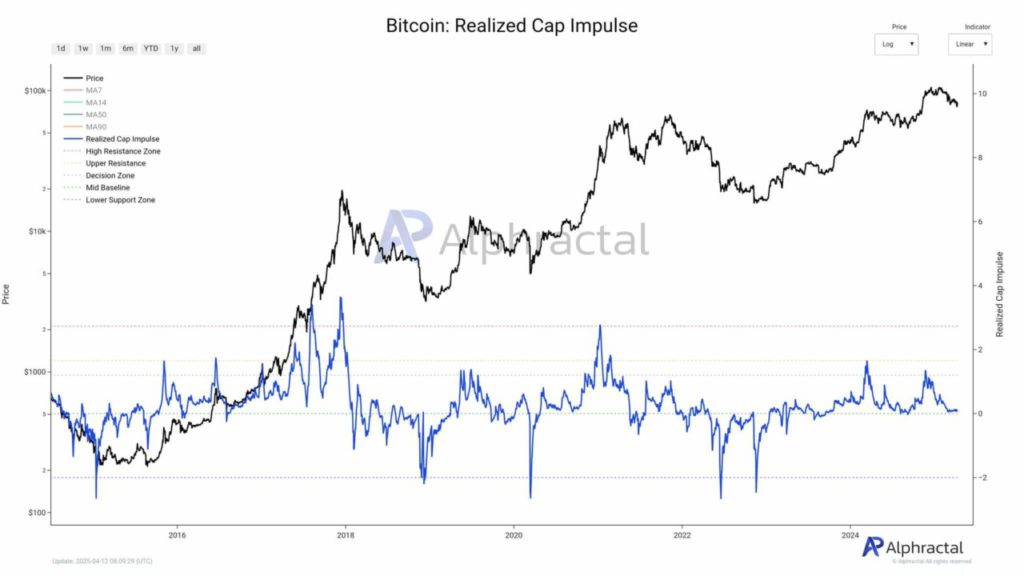

One important metric often used to gauge long-term Bitcoin (BTC) holder confidence is the realized capitalization impulse. Currently, that impulse is at levels that have previously preceded significant market recoveries in 2019 and late 2022.

This pattern suggests that long-term holders of Bitcoin (BTC) are in a critical decision window. If Bitcoin (BTC) manages to bounce positively from this support zone, it could signal that long-term holders are keeping their positions. This would be the basis for new accumulation and renewed upside momentum.

Also Read: Ripple (XRP) Movement and Potential Correction: What Crypto Investors Need to Watch Out for?

Structural Support or Collapse?

The current situation offers two possible outcomes. A positive bounce off the support zone could indicate that long-term holders of Bitcoin (BTC) are still defending their positions, which would be the basis for new accumulation and renewed upward momentum.

However, if Bitcoin (BTC) fails to bounce off or even breaks through this support, it could be an indication of a structural collapse. This would greatly affect market sentiment and could trigger a deeper price drop.

Market Sentiment: On the Brink

The Fear and greed index currently stands at 45, indicating a neutral sentiment tilted towards fear, but not yet at the point of capitulation. This reflects a market that is fraught with uncertainty yet remains responsive to potential catalysts.

History shows that sentiment often follows structural metrics, suggesting that the current calm may precede a significant directional shift. Whether this shift will turn bullish or bearish largely depends on the behavior of long-term holders during this critical moment.

Conclusion

Taking all these factors into consideration, the future of Bitcoin (BTC) seems to be heavily influenced by the decisions of long-term holders in the near future. Observation of these metrics and sentiment will be key to predicting the next direction of the Bitcoin (BTC) market.

Read More: Pepe Coin (PEPE) Price Movement and Potential Golden Cross: What Does It Mean for the Crypto Market?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin’s pivotal phase: What this metric reveals about BTC’s next move. Accessed on April 14, 2025

- Featured Image: Generated by Ai